Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

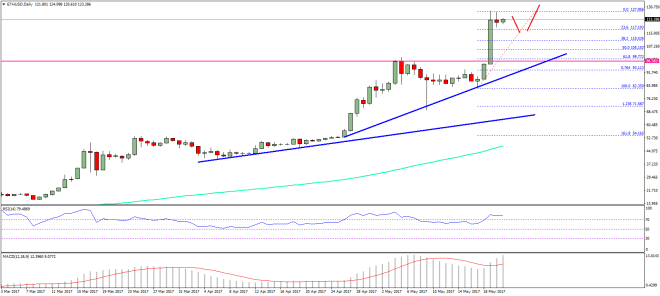

- ETH price surged higher during the past few days and moved above $120 against the US Dollar.

- There are two bullish trend lines formed with support at $99 and $65 on the daily chart of ETH/USD (data feed via SimpleFX).

- The pair may soon break the recent high of $127.95 and trade above $130.

Ethereum price gained heavily against the US Dollar and Bitcoin, and now ETH/USD may soon break $130 for further gains in the near term.

Ethereum Price Buy Dips

In the last weekly analysis, we analyzed a crucial bearish trend line with resistance near $88 on the 4-hours chart of ETH/USD. We were waiting for a break above $90 in ETH price against the US Dollar for further gains. The price did break the 61.8% Fibonacci retracement level of the last decline from the $100.80 high to $70.00 low to ignite an upside move. There were sharp gains, as the price climbed above the $100, $110 and $120 levels.

A new all-time high was formed near $127.95 (data feed via SimpleFX). The price is currently trading near $124 and consolidating. An initial support on the downside is around $117. It also coincides with the 23.6% Fib retracement level of the last wave from the $82.35 low to $127.95 high. If the pair dips from the current levels, it may find support near $120 or $117.

One may consider buying dips near $120 in the near term. The overall trend is bullish, as there are two bullish trend lines formed with support at $99 and $65 on the daily chart of ETH/USD. The pair may soon break higher and climb above $128. If buyers remain in action, there can be a break above $130 for a move towards $135-138 soon.

Daily MACD – The MACD is placed strongly in the bullish zone.

Daily RSI – The RSI is in the overbought levels.

Major Support Level – $117.00

Major Resistance Level – $130.00

Charts courtesy – SimpleFX