Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Everyone’s pinning their hopes on this new year to bring good fortune, and for Bitcoin traders, it couldn’t be a better beginning. January saw BTC soar to dizzying new heights of up to $40,000 per coin. While the market has seen some price activity since then, it looks like BTC will hold the high ground. After the economic turmoil of 2020 and increased adoption of Bitcoin by mainstream financial institutions, the first cryptocurrency is close to living up to its nickname of ‘digital gold’.

How did we get here?

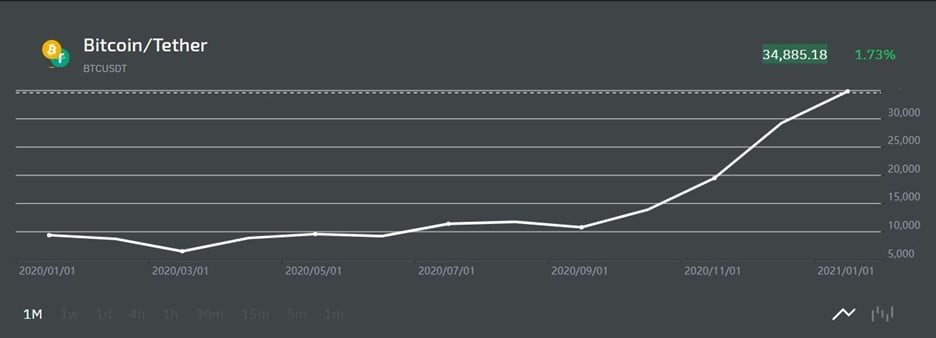

Bitcoin’s triumphant volatility may have surprised some market followers that saw Satoshi’s creation dip as low as $4,000 in the spring. But, as the global economy continued to suffer due to the COVID-19 pandemic, large-scale stimulus packages from state actors meant that traditional fiat currency was at risk of devaluation. On top of that, the 2020 halving event cut down rewards from miners, making the asset’s already limited supply even more scarce.

Investors took note, and the cryptocurrency became more and more attractive for speculators looking for a hedge against inflation, with Goldman Sachs identifying Bitcoin as ‘digital gold’ and Paul Tudor Jones endorsing it, as well. Grayscale, Fidelity, MassMutual and Microstrategy have all gained exposure to Bitcoin recently.

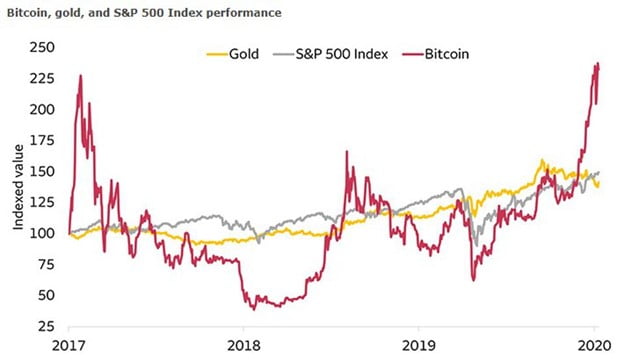

BTC outperformed gold and the S&P 500 in recent years, but with higher volatility. / Wells Fargo.

The institutional investment in BTC is still a relatively small percentage of the market, but individual investors have benefited from mainstream interest via higher value for their holdings. Square ($50 million invested in Bitcoin) and PayPal — which recently added BTC and other cryptocurrencies to its service — are delving into the Bitcoin world. As more platforms explore BTC, its value as a digital asset will be sure to reflect its use cases beyond that of a speculative asset.

The combined value of Bitcoin and the rest of the cryptocurrency market surged to over $1 trillion as prices rose across the board. But BTC’s recent climb couldn’t last forever.

BTC market right now

At the time of writing, Bitcoin (BTC) price slipped for the fourth day in a row. However, at $35,000, it bounced back from a recent drop to $30,000 and is still far above 2020’s low of $3,800. Savvy analysts have pointed out that both BTC’s trading volume and active address are at a new all-time high. Meanwhile, several firms have reported a dramatic rise in Bitcoin futures contracts, and online crypto exchanges have noted an influx of new users, with the StormGain crypto trading platform reporting a trading volume of $7.43 billion over the last month.

BTC’s recent performance: starting 2021 on a high note. / StormGain

More BTC is changing hands than ever, a sign of a healthy, liquid market. Bitcoin’ whales’, or accounts with more than 1,000 BTC, are also on the rise, potentially gobbling up the smallest retail investors (less than 0.1 BTC) who panicked and sold during the dip.

Outlook for Bitcoin in 2021: Should you invest?

Many analysts, institutional investors and crypto specialists alike predict sunny outlooks for Bitcoin over the next year. A leaked report from a senior Citibank’s analyst projected that Bitcoin could potentially hit a high of $318,000 by December 2021, calling it “21st-century gold”.

Strategists at JPMorgan have said that if Bitcoin beats its volatility, the original cryptocurrency could surge as high as $146,000 in the long-term as it overtakes gold as a safe-haven asset. Guggenheim’s predictions are even higher at $400,000.

Alex Althausen, CEO of crypto exchange StormGain, said on Wednesday that “BTC could easily hit $100,000 by the end of 2021. We’ve seen interest from new investors in Bitcoin like never before, which is also boosting the other cryptocurrencies on our platform.”

Bitcoin certainly presents opportunities for investors in 2021, but the risk for retail investors is that whales can suck up even more of an increasingly scarce asset and price smaller investors out. To maximise their profits, interested parties should look for a reliable crypto platform that offers the best returns on their investment and incentives for trading. Amid the Bitcoin feeding frenzy, other cryptocurrencies shouldn’t be overlooked, as BTC’s fortunes have historically lifted up other digital tokens, especially those which present interesting use cases for finance platforms.

How to buy BTC

Cryptocurrency is increasingly part of the mainstream, but specialist crypto platforms still offer the best conditions for traders. A good online exchange will offer trading options for BTC, XRP, ETH, and other coins that can be purchased with a regular bank card. The best crypto platforms also offer more advanced options, such as crypto indices and DeFi tokens.

When considering a crypto exchange for investment, be sure to research the commission rates and bonuses for the best deal, as well as unique perks from various platforms. For example, StormGain, one of the reputable crypto exchanges noted for its low commissions, also offers up to 12% APR interest on crypto holdings, which is especially attractive for long-term investors. The platform also includes free cloud mining software that can passively earn BTC for the user. Whatever exchange you choose, don’t miss your chance to stake your claim on the original cryptocurrency, as the momentum of digital assets can only accelerate.

About the Author: Anurag Gautam is an avid reader and Crypto Trader with a passion for creative writing for the past many years. By writing, he intends to help people flourish synchronously with pieces of his knowledge. His niche mainly includes blockchain, startups and business &technology. He has been working with startups, leaders, entrepreneurs and innovators.