Despite the recent downfall of the crypto market, the projection of Bitcoin (BTC) to cross the $100k threshold remains seen as a matter of time. Back in December, Bloomberg Intelligence indicated that the anticipated mark would happen eventually “due to the economic basics of increasing demand vs. decreasing supply,” and new data shed some light on that idea.

Bitcoin Vs. Crude Oil

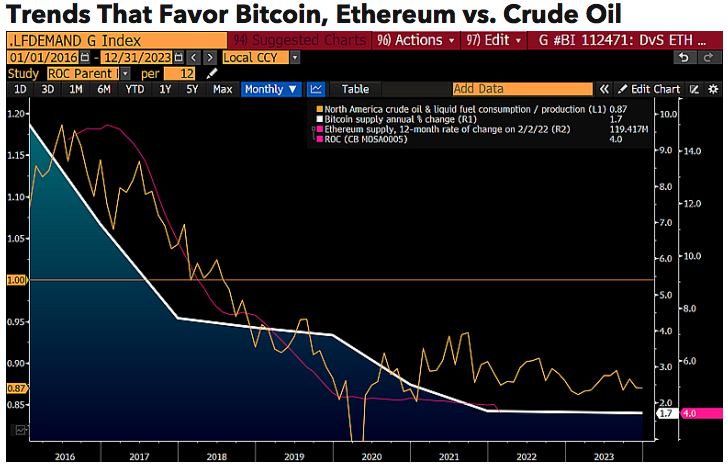

In a new Bloomberg Intelligence report, data shows trends that could favor Bitcoin and Ethereum prices.

The report noted that “Representing advancing technology, Bitcoin is gaining traction as a benchmark global digital asset, while oil is being replaced by decarbonization and electrification.”

Lack of supply elasticity is an attribute shared by Bitcoin and Ethereum that “sets them apart from commodities”.

For commodities, “rising prices thwart demand and increase supply”, but the top cryptocurrencies might tell a different story.

“Increasing Bitcoin and Ethereum demand, and adoption vs. diminishing supply, should follow the basic rule of economics and raise prices.”

In the following chart, Bloomberg shows a juxtaposition of the decreasing BTC and ETH supply along with the excess of crude oil and liquid-fuel production compared to consumption heading toward 13% in 2023, noting that the U.S. “has been a top headwind for commodity prices”.

Related Reading | Why The Bitcoin At $100K Discourse Remains Strong Despite Market Crashes

Mainstream Adoption

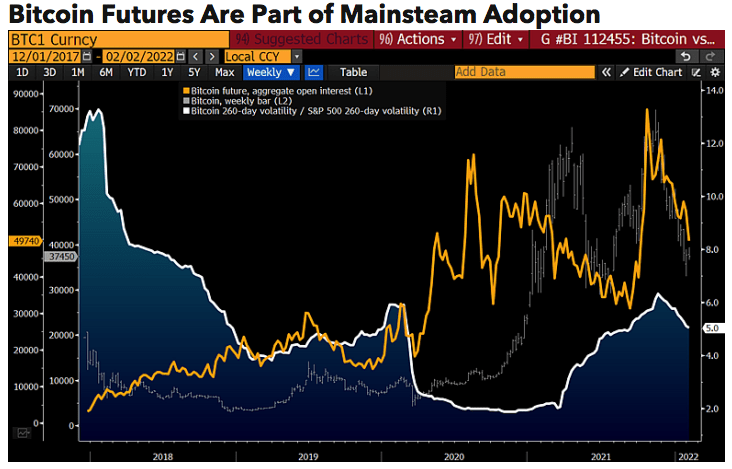

Experts think that BTC “is well on its way to becoming global digital collateral”, while its revolution in the “digitalization of finance” is in its early days. Future mainstream adoption will lead to increased demand for bitcoin.

The report predicts that the future developments in the macroeconomics and politics of the U.S. –dollar dominance, jobs, votes, taxes, and the aim to oppose China’s policies and find leverage against them– will lead U.S. policymakers into creating proper regulations for cryptocurrencies and ETFs.

Beyond El Salvador adopting BTC as legal tender, the proximity of the U.S. midterm elections has evidenced the American senators and politicians’ race to follow along. In Wyoming, Arizona, and Texas politicians are pushing to turn the digital coin into a legal tender, pointing at Bitcoin as a new defining factor to get well positioned in the polls.

A wider acceptance of bitcoin is expected to happen with more regulatory clarity because fear and misinformation could diminish, thus more investors would jump in meaning mainstream adoption.

The report also notes that this greater mainstream adoption of Bitcoin is looking unstoppable, which would likely benefit its price.

“The launch of U.S. futures-based exchange-traded funds in 2021 appears as a baby step by regulators that we think culminates with ETFs tracking actual cryptos via broad indexes.”

Bloomberg data shows that “Rising demand, adoption and depth of Bitcoin should leave few options for volatility but to decline.” For this reason, they think it’s going through a “price-discovery stage”.

The following chart shows “the upward trajectory of Bitcoin futures open interest vs. the downward slope in the crypto’s volatility vs. the stock market”, noting that Bitcoin’s 260-day volatility is 3x of the Nasdaq 100, which contrasts its volatility during the launch of futures in 2017, which was closer to 8x.

Regarding the Federal Reserve’s tightening measures, Bloomberg experts had previously predicted that “Bitcoin will face initial headwinds if the stock market drops, but to the extent that declining equity prices pressure bond yields and incentivize more central-bank liquidity, the crypto may come out a primary beneficiary.”

Related Reading | Bitcoin Leverage Ratio Suggests More Decline May Be Coming