Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

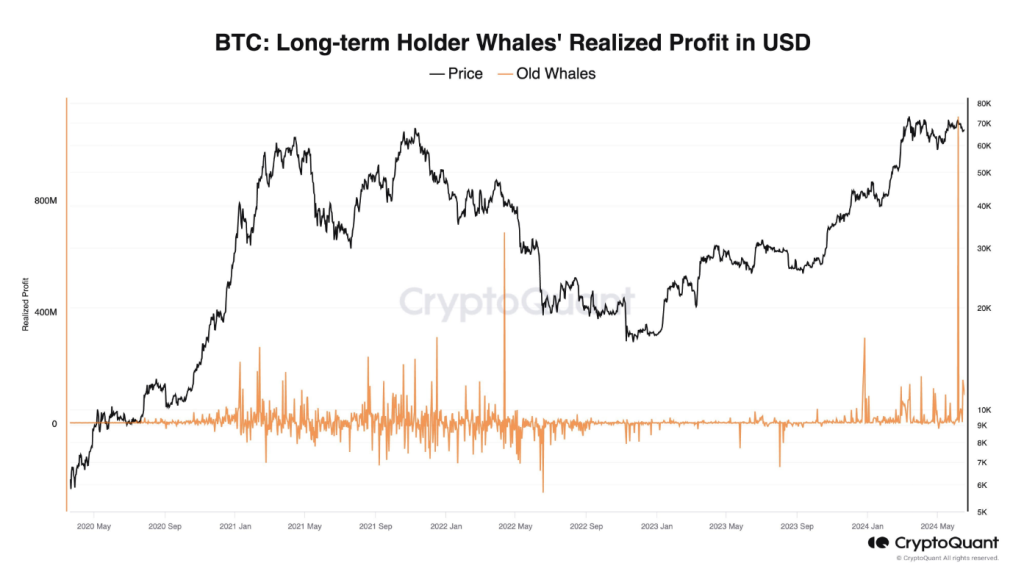

Bitcoin seems to be running across an air pocket. Whales have been largely discarding their digital possessions during the previous two weeks. For many landlocked investors, this exodus—which, according to CryptoQuant amounts to over $1.2 billion—has cause for anxiety.

Where The Whales Go, The Market May Follow

Although the causes of this unexpected sell-off are still unknown, experts note a convergence of elements. According to one idea, miners’ objectives change to include the brawny computers guarding the Bitcoin network and getting paid fresh coins.

#Bitcoin long-term holder whales sold $1.2B in the past 2 weeks, likely through brokers.

ETF netflows are negative with $460M outflows in the same period.

If this ~$1.6B in sell-side liquidity isn’t bought OTC, brokers may deposit $BTC to exchanges, impacting the market. pic.twitter.com/oYeKsRqKeF

— Ki Young Ju (@ki_young_ju) June 18, 2024

Miners could be cashing out their crypto profits to invest in the future of computing as the rapidly expanding artificial intelligence (AI) industry presents a perhaps more rich goldmine.

Unquestionably, artificial intelligence appeals to Lucy Hu, a senior analyst at Crypto Fund Metalpha. The basic processing capacity required for artificial intelligence development fits exactly the capacity of mining equipment. Miners seem to be purposefully spreading their income sources.

There could be a domino effect from this possible migration of miners off the Bitcoin ecosystem. The general supply of BTC in circulation rises when miners sell their prizes, thereby maybe lowering the price.

This fits the noted drop in “UTXO age,” a measure of purchasing and selling trends. A decline in UTXO age points to more selling activity, which is not encouraging for those wanting to ride the Bitcoin tsunami.

Traditional Markets Beckon, Leaving Bitcoin On The Beach

The larger market attitude is adding gasoline to the flames. Recent US dollar strength and a widespread rush towards “safer” assets like traditional stocks have dampened riskier investments like Bitcoin.

The net outflows of nearly $600 million from US-listed Bitcoin ETFs, the worst performance since late April, mirror this risk aversion.

Is This A Bitcoin Bust, Or A Temporary Hiccup?

These elements taken together have been a consistent downgrading of BTC’s value. From a high vantage point of $71,000 just a few weeks ago, Bitcoin has dropped to somewhat over $65,000. If the negative feeling keeps running, some analysts caution of a possible freefall to as low as $60,000.

Whales are pulling off a lot of Bitcoin offloading. Is this a warning indicator that things are about to get difficult for Bitcoin, a fire sale, or a large discount to purchase Bitcoin? Investors are waiting to decide whether this is the right moment to purchase or whether they should leave before the price declines considerably more.

Featured image from Getty Images, chart from TradingView