Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Recent days’ Ethereum market has been a swirl of activity. Following a severe price fall last week, the second-largest cryptocurrency by market capitalisation has shown a mini-rebound, leaving investors wondering whether this marks the beginning of a long-term bull run or a brief flutter before yet another decline.

Ethereum Rallies, But Questions Linger

Driven by a widespread rise in the crypto market, Ethereum (ETH) jumped 3.7% in the last 24 hours. Following a huge price decline whereby ETH dropped to $2,850, this favourable trend follows. With popular crypto personality Ali advocating a possible “one to four candlestick rebound” depending on a buy signal on ETH’s chart, several experts have been hopeful about the recent surge.

The TD Sequential presents a buy signal on the #Ethereum daily chart! It anticipates that $ETH could see a rebound of one to four candlesticks. pic.twitter.com/Vg7FTl9X2a

— Ali (@ali_charts) May 15, 2024

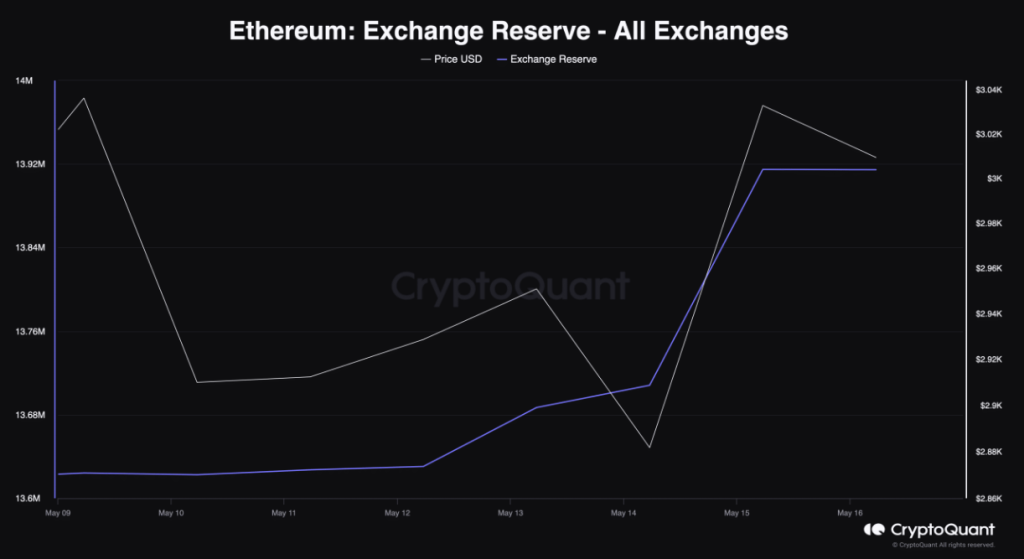

Still, not everyone holds. Analysing on-chain data closer reveals several contradictory indicators. Statistics from CryptoQuant show that ETH’s exchange reserves have skyrocketed over the past few days, suggesting that rather than building, investors could be selling their holdings.

Santiment’s statistics, which shows ETH’s supply on exchanges rising over the past week, supports this even more.

Often referred to as “whales,” the behaviour of significant investors also leaves a mixed picture. Although top addresses of Ethereum’s supply stayed the same, implying whales haven’t moved significantly, this might be seen two ways.

Some say it shows whales’ wait-and-see strategy, expecting a possible market top before re-entering.

Undervaluation Hints At Potential Growth

Some measures, in spite of the conflicting signals, suggest ETH’s possible price increase. Glassnode’s analysis of the token’s Network To Value (NVT) ratio shows that it has dropped noticeably within the previous week.

Market Sentiment, Technical Indicators Send Conflicting Messages

The present market attitude about ETH adds still another level of complication to the forecast challenge. Technical indications show a less clear picture even if other analysts are becoming optimistic based on the change in ETH’s weighted sentiment on social media sites.

Recently declining relative strength index (RSI) and money flow index (MFI) could indicate a loss of momentum in the most recent upswing. But the moving average convergence divergence (MACD) indicator has shown a positive crossover, suggesting a possible rising continuation.

A Potential Bull Run For Ether

Although some on-chain data point to a possible bull run for Ethereum and the last price rise point to this, technical indications, whale behaviour, and exchange reserve signals contradict each other and make accurate prediction challenging.

Featured image from Popular Mechanics, chart from TradingView