Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

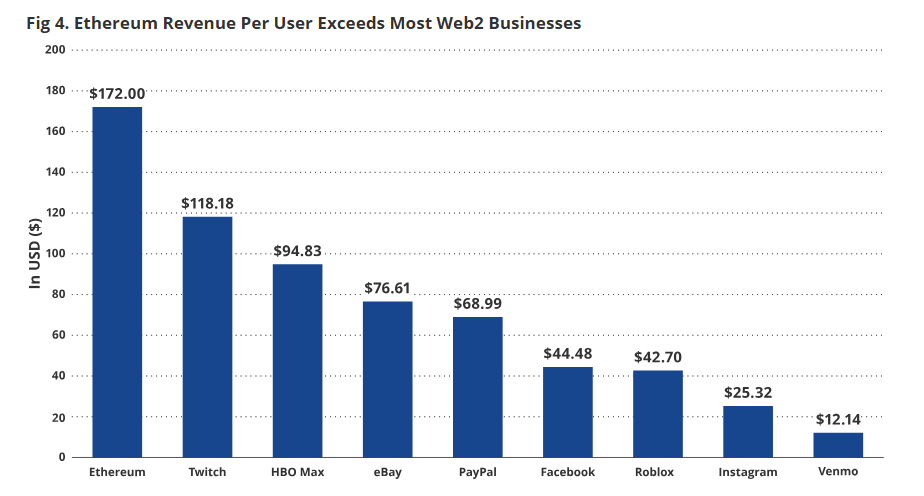

The second-largest cryptocurrency in the world, Ethereum, is headed for an explosive growth, says a new study by prominent asset management firm VanEck. According to the estimate, Ethereum‘s value might reach $2.2 trillion by 2030, which would put the coin’s price at almost $22,000. The success of Ethereum’s smart contracts and its ability to produce an unprecedented $66 billion in free cash flow by the decade’s end are crucial to this lofty forecast.

Traditional Finance Embraces Ethereum With ETF Approval

The latest green light for spot Ether ETFs on US stock exchanges is a major factor in VanEck’s optimistic prediction. By investing in these exchange-traded funds (ETFs), institutional investors and banks can get a taste of Ethereum without dealing with the hassle of actually owning the cryptocurrency.

Many more people, including financial advisors, institutional investors, and even large tech companies, are interested in Ethereum now that it is easier to access. The addition of these new stakeholders has strengthened Ethereum’s credibility and inspired faith in its future possibilities.

A Network Powerhouse With Room For Growth

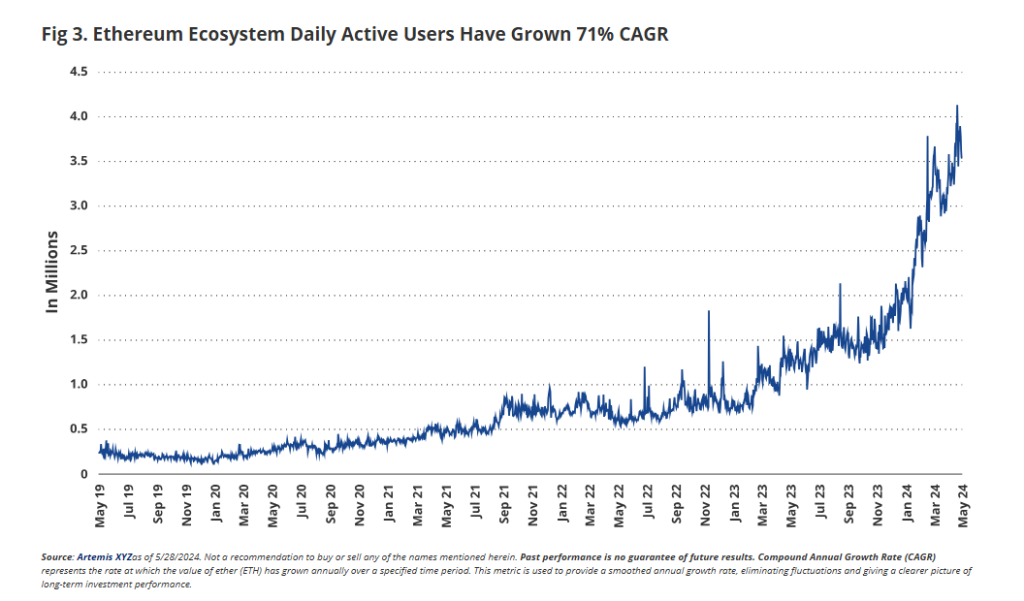

With its large user base, the Ethereum network has handled transactions totalling about $4 trillion and enabled stablecoin transfers worth $5.5 trillion in the last year. This remarkable event highlights Ethereum’s role as an essential part of the decentralised finance (DeFi) system.

Ethereum is always changing, and VanEck’s analysis takes that into account. This includes things like the growing number of apps that use Ethereum as a platform, the burning processes that make ETH tokens even more scarce, and Ethereum’s ability to take a bigger chunk of the growing blockchain market. A whopping $15 trillion is the total addressable market (TAM) for blockchain applications, according to the analysis, meaning Ethereum has a tonne of space to expand.

Will Ethereum Become The Silicon Valley Of Blockchain?

Ethereum might be the “Silicon Valley of Blockchain,” according to VanEck’s research, a place where new ideas can flourish and established markets be upended. With Ethereum’s smart contract capabilities, programmers may design and launch innovative apps and financial products that have the potential to transform industries as diverse as voting systems, identity verification, and supply chain management. With the growth of Ethereum’s ecosystem, the value of owning ETH tokens becomes more compelling, which could lead to the anticipated price increase.

Ether Price Prediction

At the same time, the most recent prediction is that Ether will increase in value by 2.13%, hitting $3,861 on July 6, 2024. Several technical indications that point to an uptrend at the moment lend credence to this forecast. An optimism-inducing Fear & Greed Index reading of 78 for Ethereum indicates “Extreme Greed.” A high reading on this index, which analyses market sentiment and emotions from a variety of sources, suggests that investors are getting too optimistic, which might lead to a market downturn.

With 17 “green” days out of the last 30, Ethereum’s daily performance has been positive 57% of the time. It seems like there’s been a steady increasing trend with increases. Ethereum, meanwhile, has demonstrated a volatility rate of 11.30% for the last 30 days. Although the price is anticipated to rise, it may encounter considerable variations due to the relatively high level of volatility.

Featured image from InvestorsObserver, chart from TradingView