Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

San Francisco-based Bitcoin exchange Coinbase has announced a volume-based rebate system for trades put on their platform. The offering, which will come into effect from next week, was announced today via an official blog-post.

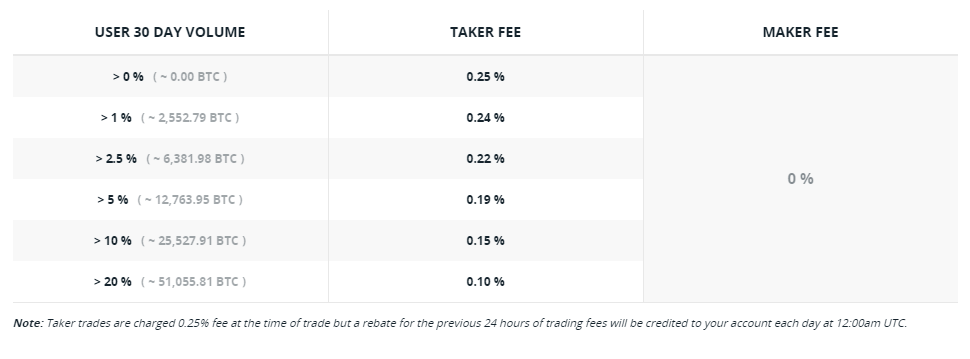

The company will continue to implement the maker-taker fee structure on the trades, but the traders will receive daily rebate benefits from trading more bitcoins on the Bitcoin exchange. A trader’s 30-day Bitcoin exchange volume relative to the total exchange volume will determine the amount of the daily rebate.

For example, suppose that 100 BTC were traded on the Bitcoin exchange over the last 30 days, and you traded 5 BTC during the same period – then you have accounted for 5% of the total volume. Based on this, Coinbase will calculate the (reduced) taker’s fee. Coinbase used to charge a 0.25% taker’s fee on each trade during the day.

The rebate will be credited to the account each day at 12:00 AM UTC. Take a look at the image below for a detailed breakdown of the fee structure.

Evident from the above description is that the taker’s fee ranges from 0.25%-0.10% while the maker’s fee has been kept at 0%. A taker is someone who aggressively prices his trades so that they get executed immediately, which reduces the liquidity in the exchange’s order book.

When a trade is not immediately executed, the order is put on the order book to be filled. If another trader trades using your order, then you are considered a “maker,” and charged a 0% fee, instead.

The Bitcoin exchange believes that offering volume-based rebates will encourage traders to actively participate in the Bitcoin market and foster fairness and competitiveness.

So, if you are still considering trading bitcoins and are looking for a great exchange with side-benefits, you can sign up here.