Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

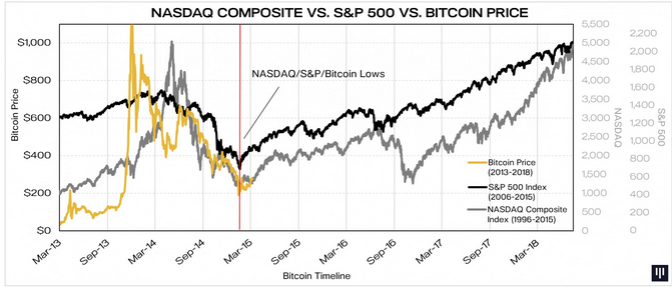

Forbes published an article today that compares bitcoin price movement to the price movements of S&P 500. The author believes that bitcoin price movements are similar to those of the US equities more than 6 years ago.

Last January, bitcoin dropped down below $170 to lose almost 75% of its value in approximately 7 months. Forbes’ author found many similarities between the bearish waves of the NASDAQ composite index in 2002 and the S&P 500 in 2009 with bitcoin price charts in 2015, as shown by the following graph:

The NASDAQ composite printed a high of over 5000 on the 2nd of March to increase 350% of its low in 2002. Moreover, the S&P 500 is currently 200% from its low printed in 2009. A relatively similar pattern is occurring on bitcoin price charts and at around $280 bitcoin is up 61% from its value two months ago. I agree with the author that bitcoin currently represents an even more promising investment opportunity that it was 16 months ago.

I also agree with the author that bitcoin price shouldn’t be used alone to evaluate bitcoin’s success; merchant adoption, investors’ interests and user adoption are better indicators of bitcoin’s success. On the other hand, a few governments have decided recently to jump onto the bitcoin wagon and regulate the world of cryptocurrencies which reflects bitcoin’s success too. During only the first 2 months of 2015, around $499 million has been invested in various bitcoin start-ups and thousands of jobs has been created.

Bitcoin price has definitely broken out of the bearish wave that has been ruling over the market for over 7 months. Although there are some similarities between the S&P 500 charts and those of bitcoin, increased venture capital, regulations of cryptocurrencies and utility increase can predict that bitcoin is a good investment option at the moment.

Short answer : NO

S&P 500 might be good to somehow predict btc price. But there is really no really strong correlation between S&P 500 and bitcoin price index. Bitcoin is not that dependent on US market, and will be only less dependent on it in future.

This is bitcoin “Bull”shit