Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

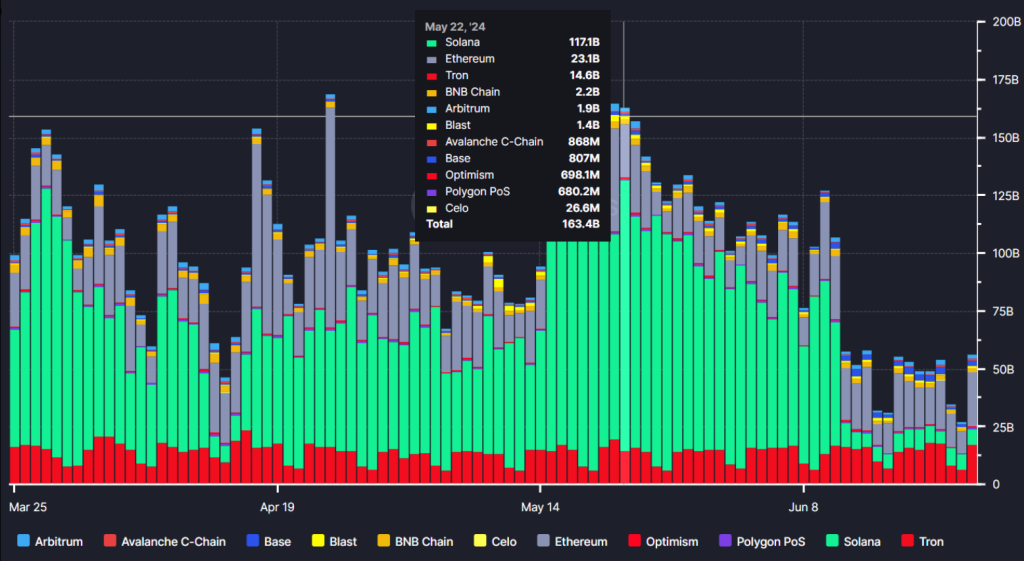

A startling discovery has sent Solana into complete disarray: it appears that the daily stablecoin volume may have been greatly overstated. According to reports, there was an incredible decline in just one day, going from an astounding $75-100 billion to a meagre $7 billion.

The cryptocurrency community is uneasy about this sudden change, since it calls into doubt the reliability of Solana’s historical performance and its ability to continue as a leading DeFi provider.

Wash Away The Hype: Inflated Figures Or Fabricated Reality?

Wash trading, a manipulative process where investors literally buy and sell cryptocurrency back and forth to each other, is being blamed by market sentinels for generating the appearance of heavy activity. By inflating trading volumes, this strategy may deceive investors about the platform’s actual adoption and liquidity levels.

Amazing how Solana went from $75-100 BILLION DAILY stablecoin volume to $7 BILLION daily in 1 day!!

Might it be because the data was totally fake??? Like how I’ve been talking about all these months??

And by the way even at $7 Billion 90% of the volume is still fake https://t.co/CnKWGAbjsM pic.twitter.com/ScfCgv5UhS

— Wazz (@WazzCrypto) June 25, 2024

A prominent instance of a well acknowledged stablecoin that elicits apprehension is USDC, which has a strong correlation with the US currency. Analysts propose that even with the adjusted valuation of $7 billion, around 90% of the quantity may still be overstated. This has the capacity to diminish investor trust by jeopardising Solana’s reputation as a pioneer in the realm of decentralised finance (DeFi).

In particular, USDC, a popular stablecoin linked to the US dollar, is the target of mistrust. Experts predict that a startling 90% of the volume may still be exaggerated even with the updated $7 billion estimate. This potentially undermines investor confidence by upending Solana’s narrative as a DeFi pioneer.

Investor Jitters And The Road To Redemption

The sudden drop in data has caused investors who made decisions based on previously disclosed information to feel apprehensive. A sell-off could cause short-term volatility in the Solana market. Moreover, the revelation comes just before the eagerly anticipated Ethereum ETF deadline, which some believe may have prompted Solana to step up her DeFi efforts.

This is a serious setback for Solana’s reputation. The data that investors rely on to make decisions must be reliable. It will take a prompt and open reaction from Solana’s development team to win back that trust.

SOL market cap currently at $63 billion. Chart: TradingView.com

Beyond The Hype: Does Solana Still Have DeFi Potential?

Although Solana’s recent success has been negatively impacted by the data scandal, the platform’s solid technological base remains unaffected. As one of the quickest and most scalable blockchains now in use, Solana is a sensible choice for DeFi applications from a technical standpoint.

The upcoming weeks will be crucial for Solana. The platform’s ability to address the data issue and implement adjustments to ensure transparency will decide its capacity to withstand this challenge and regain its position as a strong competitor to DeFi.

Featured image from YouTube, chart from TradingView