Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

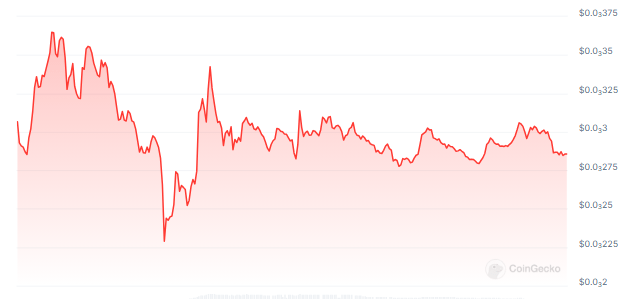

Currently trading at $$0.00026 and with a cloud of uncertainty hovering over the horizon, BEER is almost 40% below its pre-crash price. With the BEER crew throwing fingers at presale investors, the mystery of who started the sell-off still unresolved.

The depressing tale the Solana blockchain has exposed adds to the instability in the effervescent world of memecoins, like BEER. Rising questions over the inherent volatility and risks connected with these online-driven tokens, the currency gained popularity in recent weeks and underwent a significant price swings.

Whales And Rug Pulls: A Recipe For Disaster

The rollercoaster trip of BEER started with a classic memecoin scenario: a rise in popularity driven by internet enthusiasm and community buzz. But this euphoria concealed a hidden risk: the disproportionate impact of big token holders, sometimes known as “whales.”

Once numerous whales chose to cash out, their large sell orders set off a chain reaction. Within a few hours, the price of BEER dropped an amazing seventy-percent, dragging the value of the token from about $0.0003 to $0.0001 down.

Run rampant were worries of a “rug pull,” in which developers create a memecoin, raise its price through marketing, and then disappear with investor money. The event exposed the vulnerability of memecoins to manipulation by big holders, even while the BEER team fiercely denied any misbehaviour.

🚨 LATEST: Someone sold $10 million worth of Solana Memecoin $BEER (@beercoinmeme), causing its price to drop by 70%. pic.twitter.com/22H5cM5wFq

— SolanaFloor (@SolanaFloor) June 13, 2024

Unlike more established cryptocurrencies with different ownership structures, memecoins often include a high token concentration controlled by a small group of people. This makes a few whales able to have a major influence on the price, thereby causing great volatility.

BEER Weathers The Storm, But Questions Remain

Fortunately for some BEER holders, following the first selloff the token price showed some partial rebound. Nevertheless, the harm was done. The episode reminded me sharply of the inherent dangers involved with memecoin trading.

Currently trading at $$0.00026 and with a cloud of uncertainty hovering over the horizon, BEER is almost 40% below its pre-crash price. With the BEER crew throwing fingers at presale investors, the mystery of who started the sell-off still unresolved.

BEERUSDT trading at $0.00028 on the daily chart: TradingView.com

Solana’s Memecoin Boom: A Double-Edged Sword

The BEER episode also clarifies the two-edged blade of Solana’s developing memecoin scene. Memecoin creators have found Solana, famed for speedier transaction speeds than Ethereum, a haven.

The simplicity of starting tokens on Solana has drawn a flood of fresh ideas, but it may also cause the market to get overly saturated. This combined with the absence of inherent value for many memecoins fuels a speculative frenzy whereby price swings are driven more by excitement than by real worth.

Featured image from Pixabay, chart from TradingView