Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana has fallen on its chart over the last 24 hours by 2%. Over the last 24 hours, there has been strong bearish influence on SOL’s price. Currently the coin has found support on the $34 level.

The market also has been taken over by the bears, Bitcoin has been hovering around the $20,000 mark for the last 24 hours. Other market movers have also retraced in their respective charts.

Technical outlook of the coin continues to point towards negative price action suggesting that price of Solana can fall further. Selling pressure in the market has started to mount indicating that price of SOL could again take a dip.

The global cryptocurrency market cap today is $977 Billion with a fall of 0.2% over the last 24 hours. Since, Solana has now fallen beneath the $40 mark, SOL could now be prone to further fall.

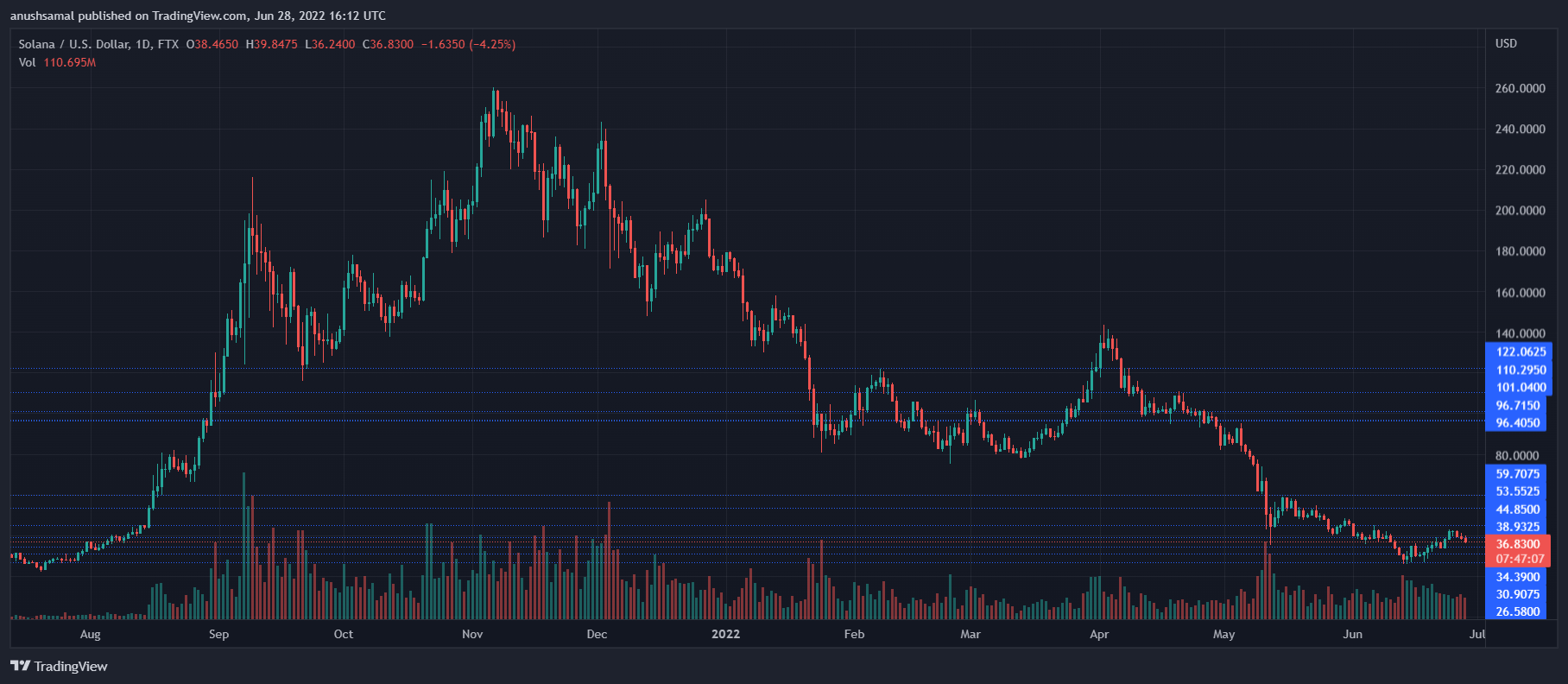

Solana Price Analysis: One Day Chart

SOL was trading at $36 on the 24 hour chart. Further retrace from the current price level will push the coin to $34. Overhead resistance for the coin stood at $38, if buying strength returns then SOL could attempt to revisit the $38 price level.

If SOL manages to remain above the $38 mark for a substantial amount of time then $44 could be possible on the chart. If Solana fails to hold itself near its $34 support line, it could drag itself down to $26 in just a matter of sometime. The amount of the altcoin traded was in the red indicating bearishness and increased selling pressure.

Technical Analysis

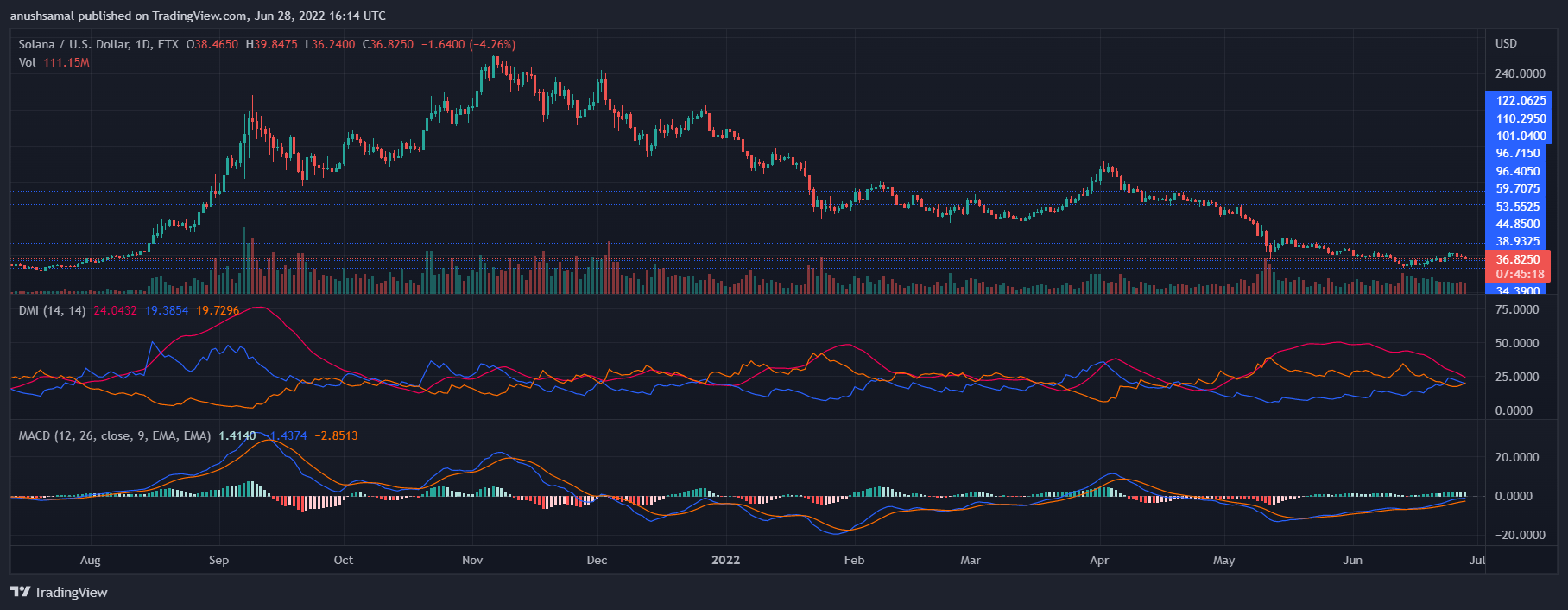

Technical outlook on the 24 hour chart for Solana has signalled at price falling further. As mentioned above, buyers fell in number.

The Relative Strength Index noted a decline and sunk below the half-line indicating that sellers outnumbered buyers in the market.

In accordance with rising selling pressure, Chaikin Money Flow also moved towards the zero-line. The indicator represents amount of capital inflows and outflows. This reading meant that capital inflows depreciated.

At the current price, Solana could witness demand from buyers if price remains at the same level. Although the bears have gained control, SOL has been flashing buy signal on the one day chart.

The Directional Movement Index (DMI) was negative which meant that the price direction shall remain bearish. On the DMI, the -DI line was above the +DI line.

Moving Average Convergence Divergence (MACD) depicts price trends and reversals. MACD flashed green histograms which are tied to a buy signal. For SOL to reclaim $44, strength from buyers shall prove to be crucial.

Featured image from Solana.com, chart from TradingView.com