Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In the wake of Ripple’s announcement regarding the integration of an Automated Market Maker (AMM) into the XRP Ledger (XRPL), the community has been abuzz with speculation and debate. Central to this discourse is the potential transformation of XRP in light of this update, particularly in regard to its classification and function as a digital asset.

Ripple’s Chief Technology Officer, David Schwartz, previously hailed this update as the most significant for XRPL, raising expectations among stakeholders. Additionally, at the recent Swell conference, Ripple revealed plans to integrate its rebranded Ripple Payments product with the XRPL’s native decentralized exchange (DEX), further stirring discussions among community members.

The community’s response has been a mix of euphoria and confusion. Digital Perspectives, a key community influencer with over 150,000 followers on X, expressed concerns over the potential implications of this update: “Are we watching XRP become a stablecoin with the introduction of AMMs and the Prudential Treatment requirements from the Bank of International Settlement [BIS]? Cat 1 vs Cat 2, where would you classify XRP?”

He further questioned, “When XLS-30D passes and AMMs become an integral part of the XRPL, will it change the characteristics of XRP and qualify as a group 1b asset for BIS and other banks?”

XRP Price Volatility Is Necessary

Panos Mekras, the co-founder of crypto-focused company Anodos, quickly intervened to dispel the rumors and speculation about XRP morphing into a stablecoin to fit into the 1b asset class of the BIS with the advent of the AMM. Mekras, who has previously clashed with Digital Perspectives over misinformation, laid out a detailed refutation of the idea that XRP could become a stablecoin.

He emphasized, “The fundamental nature of XRP as the native coin of the XRP Ledger, a decentralized digital asset traded freely, is unchangeable. It’s technically impossible for XRP to transform into a stablecoin, a concept that completely contradicts its inherent design.”

He further delved into the dynamics of AMMs, noting that they are most effective in environments with high volatility. This volatility benefits liquidity providers (LPs) by attracting more traders and, consequently, increasing trading volume and fees. According to Mekras, the AMM is tailored to take advantage of such market conditions.

Mekras also highlighted the potential impact of the AMM on XRP’s market dynamics. He suggested that the AMM’s implementation might lead to an increase in buying pressure on XRP. A significant portion of the token is expected to be locked in the AMM, which would enhance its liquidity and attract more traders. This, in turn, would make the crypto token more versatile and efficient for various use cases.

In his concluding remarks, Mekras called for a more informed understanding within the community. He stressed the need to focus on the technical aspects of XRPL and the AMM, advising against following individuals who propagate misinformation.

“The community should stop following and paying attention to enablers of misinformation such as Digital Perspectives and learn more about the technicals of the XRPL and the AMM,” Mekras said.

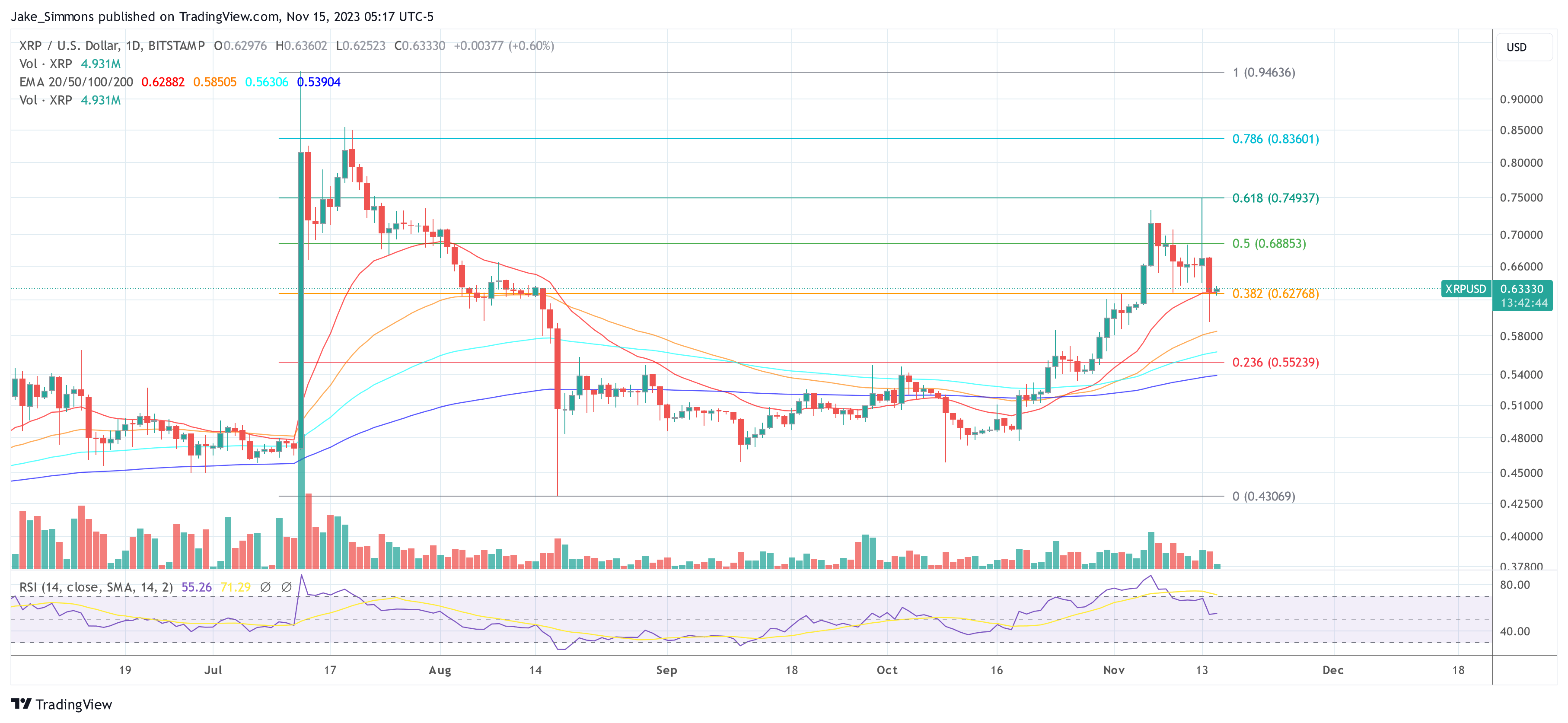

At press time, the XRP price found support at the 0.382 Fibonacci retracement level in the 1-day chart and traded at $0.6333.