Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In an era where crypto analysis is ever-evolving, some sentiments retain their significance. This was underscored when XRP influencer Crypto Eri delved into a statement from Ripple’s CTO, David Schwartz, that, although over five years old, still echoes pertinently within today’s cryptocurrency discourse.

When Crypto Eri shed light on this older response from Schwartz, she revisited a debate on XRP’s value dynamics. The query, which originated on Quora, surrounded the speculation that institutions might prefer XRP’s price to remain low for optimizing transaction processes. However, Schwartz’s comprehensive clarification brought forth an opposing perspective.

Ripple CTO Weighs In On XRP Price And Liquidity

Schwartz articulated that the presumption of banks or financial entities wanting a subdued XRP price is an overreach. He pointed out a fundamental relationship, stating, “Higher prices tend to correlate with higher liquidity, which means cheaper payments.” To elucidate further, he ventured into the intricacies of how XRP functions as a payment medium.

Drawing an analogy with Bitcoin, Schwartz offered a more vivid understanding. If one were to transact $1 million at a time when Bitcoin was valued at a mere $100, the liquidity constraints would induce significant price volatility. As Schwartz elaborated, “… trying to buy enough Bitcoin to buy the house, you’d push the price up significantly. And when the recipient tried to convert those bitcoins into their local currency, they’d push the price down significantly.”

However, as Bitcoin rose and crossed the $10,000 threshold (at the time of Schwartz’s contribution), its vulnerability to price fluctuations for larger transactions had decreased. Schwartz attributed this stability to the increased value, which requires a smaller share of total assets to facilitate significant transfers.

When drawing parallels, he emphasized that XRP behaves similarly. Therefore, a rising XRP price would undoubtedly make it a superior channel for high-value transactions for the Ripple payment solutions.

Schwartz Clarifies (More) Rumors

Beyond this age-old yet continually relevant perspective, Schwartz remains active in enlightening the community on diverse XRP-related queries. Addressing a recent Twitter proposition about XRP potentially bolstering the top 1%, Schwartz replied with a rebuttal, “I’m not sure I understand this claim. The top 1% of what exactly? XRP empowers anyone who wants to use the ledger to track the ownership and exchange of assets. What kind of control is he talking about exactly?”

On speculations of the Department of Homeland Security’s capability to ‘hack’ XRP, Schwartz demystified, “I’m not sure what a hack of XRP would even mean. The ledger contents are public. The rules are public… No such bug is known, of course. And any exploited bug would be fixed, so you couldn’t hack it the same way twice.”

Lastly, when probing the connection between an old patent of his and XRP’s architectural design, Schwartz elucidated, “I can’t see any real connection between my patent and XRPL design… the patent became mostly irrelevant.”

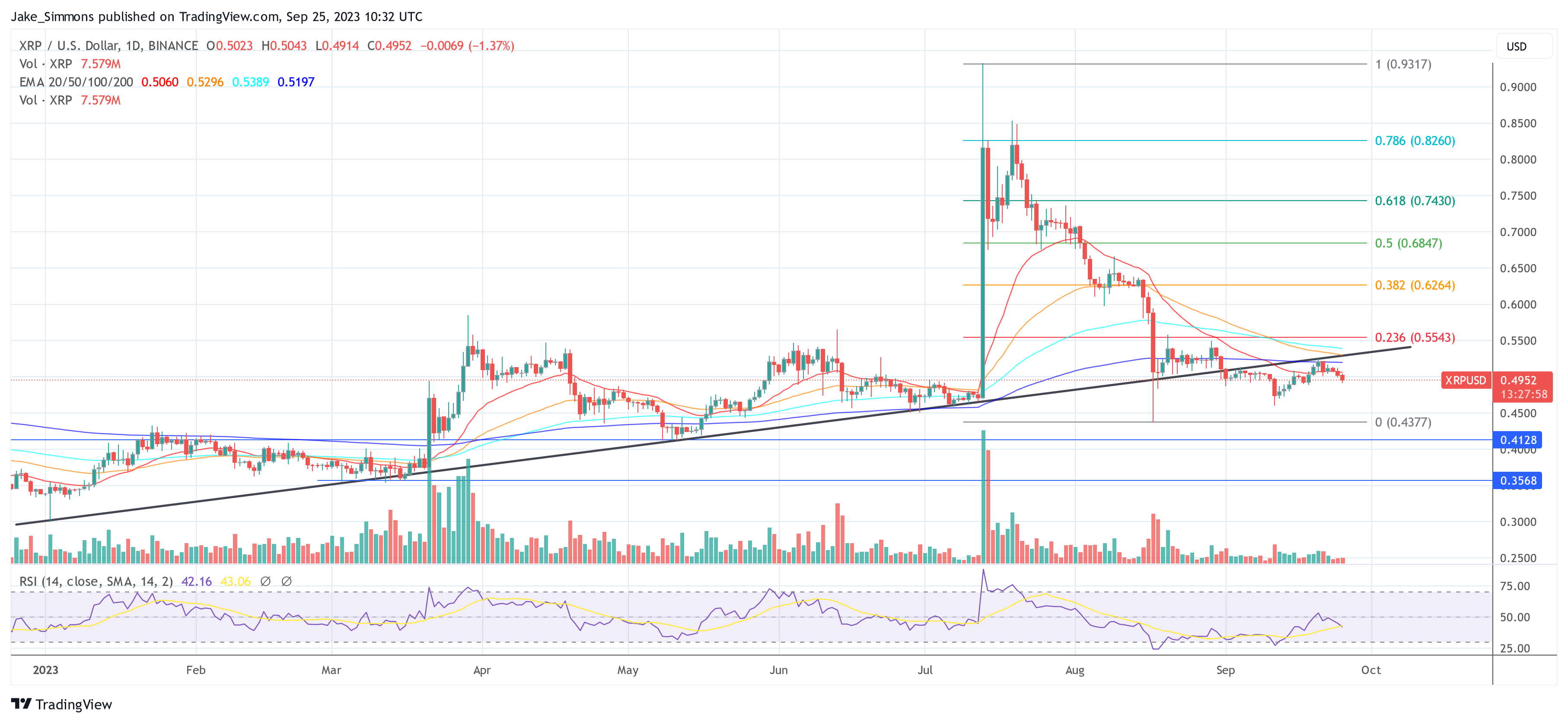

At press time, XRP traded at $0.4952.