Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

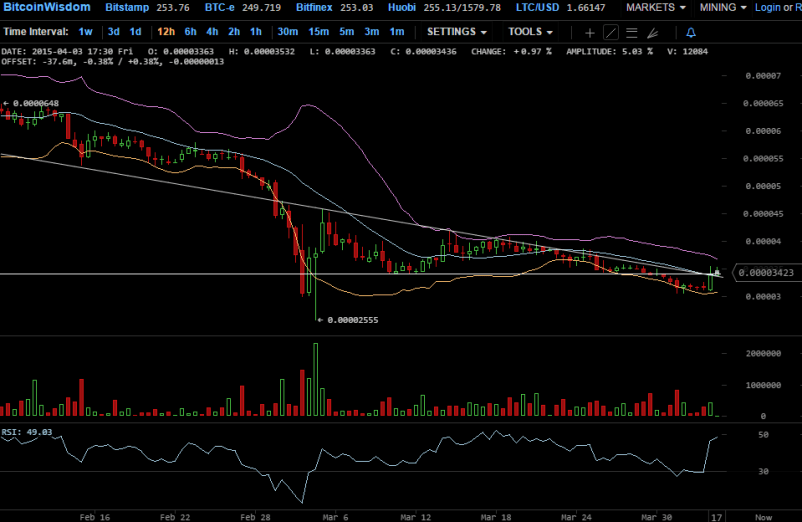

Ripple is trying hard to pare the hefty losses incurred in March when the cryptocurrency declined roughly 50% from 0.00005BTC to a low of 0.00002555BTC before closing the month at 0.00003150BTC. But April has been positive for Ripple until now, with the value gaining up to 0.00003423BTC.

But will the upmove sustain or are there major hurdles ahead? Let’s analyze the 12-hour XRP/BTC price chart to figure out key technical levels and the best trading strategy.

Chart Structure – As can be seen, Ripple had been making successive lower tops lending bears the strength to push the prices down even more. Due to extreme selling pressure, Ripple broke below the crucial support level (drawn as the horizontal line in the chart) of 0.000034BTC. The downward sloping resistance level also added to the pressure, making it incredibly tough for the cryptocurrency to head higher.

But, the bulls seem to be gaining control of the situation as Ripple has crossed above the previous support of 0.000034BTC and is threatening to take out the downward resistance line.

Relative Strength Index – The latest increment has been supported by strength as is evident from the jump in RSI value from 30 to 49.03. The current RSI is near the highs of March and of mid-Feb, and if RSI is able to touch new highs, then the price may as well advance much higher.

Bollinger Bands – Ripple has taken support from the lower range of the Bollinger Band. The 20-12h simple moving average had been acting as a strong resistance level but, if the price is able to float above this resistance of 0.00003363BTC, more gains may follow.

Conclusively, it can be said that bulls have indeed staged a solid comeback however, bullish momentum must be strengthened if the downtrend is to be reversed. Long positions should be built only after the price crosses above the resistance level.

Image: www.miningpool.co.uk

You did here about ripple and stellar in a million dollar lawsuit over the owner of stellar selling a million bucks worth of ripples on bitstamp because ripple doesn’t like ripple buyers reselling ripples only ripple is allowed to get rich selling ripples no one else. Ripple said he could only sell 10,000 a week and maybe more after a years time

Is there a chart somewhere where we can see the sale of 96,342,361.6 XRP going through? You’d have thought that would be quite a blip on the volume!

It’s a well known fact as it went through bitstamp plain as day that’s also we the ripple and stellar dipsticks are hashing out in court. You have to remember ripple was ultra mega premined before it was made available to the limited public, hundreds of billions of ripples are in the ripple staffs/ceo’s hands just waiting to dumped after the pump. Didn’t you read any of the above or googgle any of it to ya know verify?

The issues at Paybase, Paycoin and GAW Miners that have festered over the past month have now finally come to a head. Paybase will be ceasing operations on April 30th, 2015, in accordance with a SEC and DOJ investigation into the actions and business practices of one Josh Garza. Boom goes the dynamite!

Bitstamp has initiated legal action over more than $1m in disputed funds related to the sale of nearly 100m XRP last month.

Bitstamp, which operates a Ripple gateway and bitcoin exchange, filed a complaint for interpleader on 1st April in the US District Court in the Northern District of California. Jed McCaleb, the founder of both Ripple Labs and Stellar, and two of McCaleb’s family members were named in the complaint.

The $1,038,172 in disputed funds were used by Ripple Labs to purchase 96,342,361.6 XRP put up for sale through an account allegedly controlled by McCaleb, according to the complaint.

The dispute represents the latest battle between Ripple Labs and McCaleb, who co-founded the company only to later depart and establish Stellar, a fork of the Ripple network. Since then, the two sides have fought over network issues and were later the subject of an in-depth report by the New York Observer.

Origin of dispute

The filing goes on to state that Ripple Labs told Bitstamp that the sale was in violation of an contract agreed upon between the company and McCaleb. That agreement, struck in August 2014, established that McCaleb was entitled to sell only $10,000 in XRP per week during the first year, an amount that will become gradually greater over a seven-year schedule.

Ripple Labs and Jacob Stephenson, McCaleb’s cousin, have since laid claim to the money, with Ripple Labs allegedly sending two letters to Bitstamp between 26th and 30th March demanding release of the funds.

Bitstamp has asked the court to settle the claims dispute, according to court documents obtained by CoinDesk. Bitstamp’s legal team wrote in the filing that “with respect to the disputed funds, Bitstamp is a disinterested stakeholder.”

Bitstamp counsel George Frost, who represented Ripple Labs in a dispute following the resignation of former board member Jesse Powell, said in a statement:

“Bitstamp was unable to resolve this demand with Ripple Labs. Given our inability to ourselves determine the facts underlying the ownership dispute, we decided that an Interpleader filing was the proper approach. Indeed, it is only method to resolve disputes in these difficult circumstances.”

When reached for comment, Ripple Labs spokesperson Michael Azzano characterized the process as “pretty routine”.

“This is Ripple Labs looking at some transactions that might run counter to their agreement with Jed,” he told CoinDesk.

McCaleb, in turn, alleges that the XRP were gifted to family members prior to the finalization of his agreement with Ripple Labs, and therefore, were not subject to this agreement.

“I am 100% sure I am not in breach of any agreement with Ripple Labs and all evidence will support that,” he said.

Alleged effort to boost sale

According to the complaint, Ripple Labs told Bitstamp that McCaleb intended to sell the XRP in order to use those funds to underpin a failed effort to sell 650 million stellars, the proceeds of which would then be used to support the development of the Stellar network.

Identified in the complaint are two Ripple addresses, each of which are claimed to be under the control of McCaleb and his family – rUf6pynZ8ucVj1jC9bKExQ7mb9sQFooTPK (cited in the complaint as “rUf6”) and r3Q3B6A2giHDMef83AztzBStBm1JBmxUKX (“r3Q”).

The filing reads:

“On or around March 20, 2015, r3Q offered to sell 98,846,600 XRP on the Bitstamp USD order book, which included the 89,999,900 XRP it received from rUf6 on or around that date and an additional 8,846,700 XRP of the 10m XRP that r3Q had previously received from rUf6 on or around January 6, 2015. On information and belief, this offer was made at McCaleb’s direction and for McCaleb’s and Stellar’s benefit, with the intent to use the funds to purchase STR from the auction STR.”

The same day, the complaint states, Ripple Labs moved to purchase 96,342,361.6 XRP at a cost of $1,038,172. Ripple Labs later told Bitstamp it bought the XRP “in order to avoid and mitigate irreparable harm and damages”.

The filing continues:

“Ripple Labs’ agent sent the $1,038,172 in purchase funds to r3Q on the Bitstamp gateway. Ripple Labs is demanding the purchase funds back, upon which it has agreed it will return the purchased XRP to rUf6.”

Bitstamp alleged that since the XRP was sold, there have been attempts to use the $1,038,172 to purchase stellars. The funds, according to the filing, have been dispersed to the r3q account as well as two other accounts – rvYAfWj5gh67oV6fW32ZzP3Aw4Eubs59B and rPQB4rgmwoaCjdX4BeoWikeshWL3fLMLD7 – since the sale took place.

Disputed funds frozen

Bitstamp said that on 31st March, it froze those accounts “due to the pending ownership controversy, regulatory and AML concerns and the size and circumstances of the transfers”.

Ripple Labs, the complaint states, is seeking to effectively reverse the transaction by having the $1,038,172 transferred back to its account in exchange for the XRP being transferred back to the rUf6 account.

The filing reads:

“Ripple Labs made a claim to the disputed funds that r3Q is attempting to remove from the Ripple Network and asked Bitstamp to transfer the disputed funds to Ripple Labs’ Ripple account in exchange for Ripple Labs transferring the XRP back to rUf6.”

According to Bitstamp, McCaleb and Nancy Harris – his aunt – have yet to make a formal claim on the funds but that they may opt to do so in the future. The filing added that other unknown parties could try and assert claims over the funds as well.

In addition to asking the court to settle the claims dispute between the different parties, Bitstamp has asked that it be allowed to continue holding the disputed funds until the court makes a judgment on the matter. The company also asked that it be absolved from any future litigation in relation to the disputed funds.

The New York Observer has published a near 15,000-word story that takes a detailed look at the alleged historical “bad blood” between decentralized payment network startups Ripple Labs and Stellar, and the impact of this relationship on events in the wider bitcoin ecosystem.

“The interpersonal story of Stellar and Ripple Labs is emblematic of the turmoil roiling the entire industry,” the article, penned by Michael Craig, reads. “It has everything: sex, huge money, fraud, genius, betrayal, international intrigue and government raids.”

Of particular note are the story’s main participants Jed McCaleb, the founder of now-defunct bitcoin exchange Mt Gox, Ripple Labs and Stellar, and Stellar executive director Joyce Kim who bear the brunt of the article’s barbs.

The Observer reports that McCaleb and Kim have long had a personal relationship that complicated McCaleb’s relationship with other senior executives and board members at Ripple Labs, and ultimately lead McCaleb to leave that company and found competitor Stellar.

Also included in the report are allegations that hit home far beyond the companies themselves, as it suggests the feud at the two companies has had implications for mobile payments startup Stripe and banking giant Wells Fargo, among others.

Wells Fargo bitcoin unit collapses

Of all the details included in the report, however, none perhaps has greater relevance than the revelation that US banking giant Wells Fargo had assembled a task force compromising 20 of its “top executives and advisors” that was aimed at finding ways it could become the first bank to embrace cryptocurrency.

The report argues that due to a combination of the Mt Gox collapse, the closure of Silk Road and McCaleb’s personal track record, the unit was disbanded in 2014.

“Predictably, Wells got cold feet,” Craig writes. “At the bank, the crypto blackout was so severe that it extended not only to shutting the accounts that cleared funds for crypto companies, but even those companies’ operating accounts … were shut down.”

This includes the account held by Ripple Labs, whose CEO Chris Larsen, the paper said, had a more than 20-year relationship with the bank prior to the decision.

“The problem is your connection to Mr McCaleb,” Larsen was told, according to the report. “The guy founded Mt Gox. You’ve got to get that guy out of there or we won’t bank you.”

At the time, McCaleb was no longer with the company, but the report suggests even his association as a board member was “enough to make Wells Fargo skittish” and move ahead with the dismantling of its nascent cryptocurrency initiative.

Turbulent times at Ripple

Speaking to the Observer, Kraken CEO and Ripple Labs investor Jesse Powell indicated that he first introduced McCaleb and Kim, and that, before long, Ripple had purchased Kim’s company SimpleHoney and brought her into the team.

The Observer described her tenure as one that was not only rocky, but saw her attempting to play up her importance and that of McCaleb. Eventually, the report argues that Larsen needed to intervene.

“Chris sat her down and was like, ‘Joyce you’re a CEO. It’s going to be hard fitting in. You’re obviously reporting to me. Two cultures coming together is always a hard thing. Let’s talk about everything before we do it just to make sure everything is good.’ And Joyce just of course wouldn’t hear of it,” an insider said.

Kim is alleged as having a “Yoko Ono” role at the company, according to those who spoke to the report.

“This is Jed’s thing, when you’re in a private conversation with him all of a sudden Joyce is CC’d on this private conversation, even when the conversation includes the person saying, ‘I don’t want you to share this with Joyce.’ So not only does he disregard that request but he’s letting you know she knows you don’t like her,” another source said.

Kim’s tenure lasted only six weeks. McCaleb, the report contends, soon “lost interest” in the project.

Stripe deal squashed

The end result of the ensuing turmoil is that a deal that would have seen Ripple Labs purchased by Stripe for $13m in cash never came to pass. The Observer indicated it was unable to uncover an exact reason for the deal’s demise.

Yet, another sticking point however, was that most of the leadership team at Ripple Labs held significant holdings of its altcoin, XRP. McCaleb and Larsen, for example, both owned 9bn XRP, a factor that discouraged many in the wider bitcoin market from trusting the company.

At the time, Powell also sought to intervene to fix what he described as the company’s ongoing PR problem.

All of the problems came together, the report said, in a meeting in which McCaleb attempted to have Larsen removed from the company for reasons not disclosed.

Larsen kept his role, however, by a 5-1 vote, with McCaleb providing the dissenting voice.

“Every single person begged Jed not to make us choose between him and Chris,” said Roger Ver, a VC investor in Ripple Labs. “In the end, the vote was unanimous that Chris should stay. The only person who disagreed was Jed.”

Attacks on Stellar

McCaleb would go on to found Stellar, taking a $3m investment from Stripe, though the article questions the nature of the relationship between the companies.

For example, Stellar’s former head of community told the publication that the two companies are quite close, with everything Stellar does having to go through Stripe.

Still, Stripe’s relationship with Wells Fargo, the report suggested, has put limits on how close the two companies can publicly appear.

The report quoted those close to co-founder Patrick Collison as describing him as privately dismissive of banks, while highlighting the reliance the San Francisco-based payments company has on institutions like Wells Fargo.

The article went on to question Stellar’s designation as a non-profit, arguing that tax experts believe this claim won’t hold up under regulatory scrutiny.

“Once the IRS pieces together how Stellar benefits McCaleb, Patrick Collison and any other insiders receiving STRs or fattening up in the initial distribution, it will likely find the venture inconsistent with the charitable purpose of the 501(c)(3) exemption,” the report reads.

Article’s accuracy questioned

Following the publication of the article, CoinDesk reached out to the parties involved for their take on the report and its implications.

Perhaps unsurprisingly, McCaleb indicated that the article failed to capture the facts of the story.

“Given the vast amount of inaccuracies and innuendo in the article, it is not worth commenting on. The bias in the article is so obvious, no one can take it seriously,” he said.

Yet another complaint was lodged by Frank, Rimerman + Co. LLP, which argued quotes from an interview with representative Lisa Henderson were taken out of context.

“We are deeply concerned comments of a general nature have been quoted without proper context, creating an impression that Ms. Henderson had access to relevant documents or was in a position to judge Stellar’s specific transactions or business model when this is not the case,” the agency said.

Additional criticism centered on the article’s portrayal of Kim, with co-founder of Freestyle Josh Felser weighing in with his experience as her colleague and hiring manager.

“[Kim] worked at Freestyle for over six months and departed on excellent terms. This information is quite easy to verify since she met with hundreds of entrepreneurs during that time period,” he said.

VC investor Jeremy Liew, managing director at Lightspeed Venture Partners, has also stated he has “no recollection” of the comments he made regarding Kim in the article.