Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

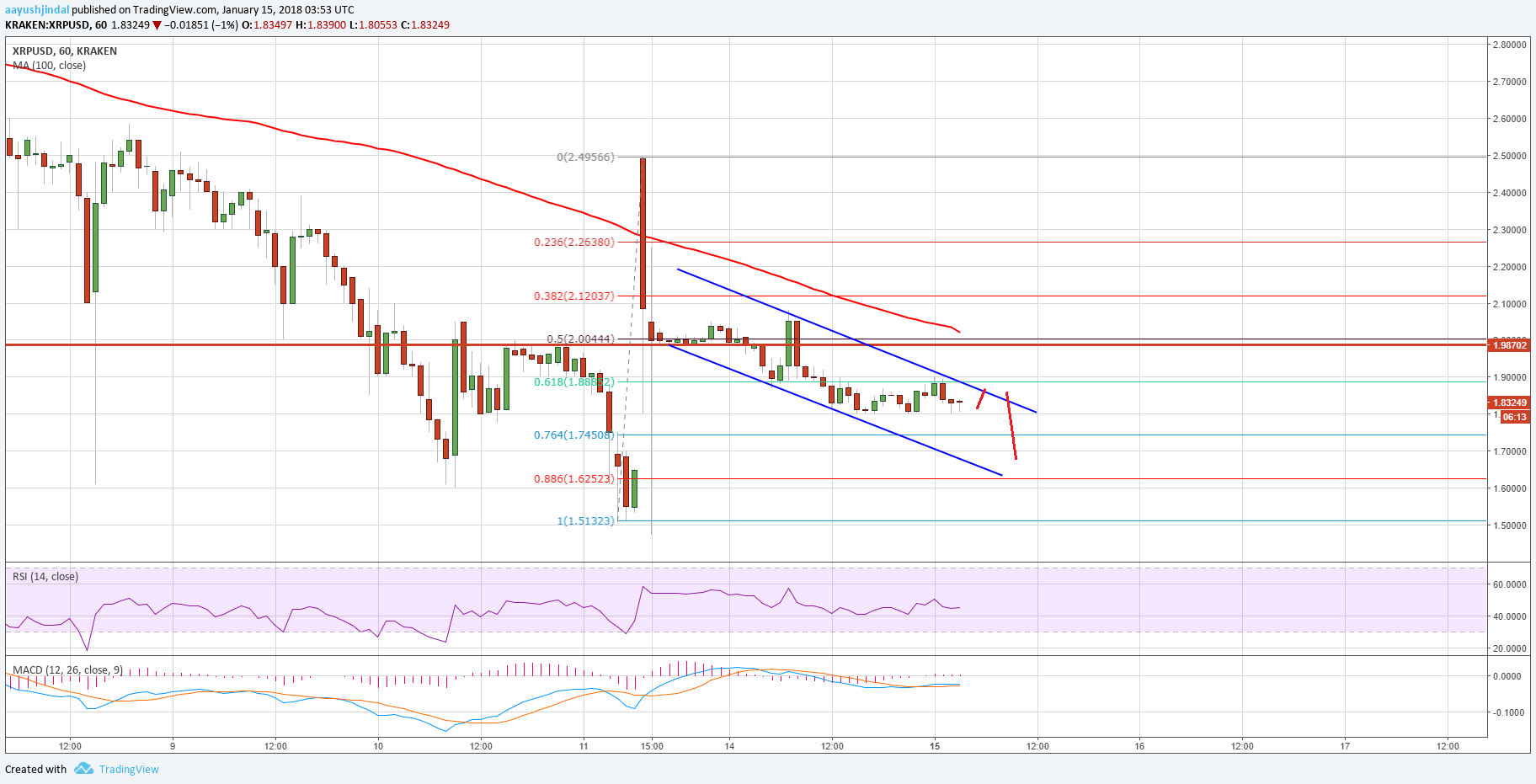

- Ripple price remains in a bearish trend below the $2.00 handle against the US Dollar.

- There is a declining channel forming with current resistance at $1.90 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is currently in a declining mode and it could test the $1.70 support area in the near term.

Ripple price is struggling to recover against the US Dollar and Bitcoin. XRP/USD has to move above the $2.00 level to overcome the current selling pressure.

Ripple Price Resistance

After a minor correction above the $2.20 level, Ripple price struggled to move further higher against the US Dollar. The price failed to stay above the $2.00 support and made a downside move. It traded below the $1.9870 support as well key $1.9500 level. Moreover, there was a break below the 50% Fib retracement level of the last wave from the $1.5132 low to $2.4956 high.

There is clearly a lot of pressure on XRP and it seems like the price could decline further towards $1.70. At the moment, there is a declining channel forming with current resistance at $1.90 on the hourly chart of the XRP/USD pair. The pair is facing a lot of sellers and it could remain below $1.95-2.00 levels in the short term. On the downside, an initial support is around the 76.4% Fib retracement level of the last wave from the $1.5132 low to $2.4956 high.

It seems like the pair is poised to test the $1.70 level in the near term. On the upside, a break above the $2.00 level is must for more gains. Moreover, the 100 hourly simple moving average is at $2.05 to prevent upsides.

Looking at the technical indicators:

Hourly MACD – The MACD for XRP/USD is moving slowly in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is currently just below the 50 level.

Major Support Level – $1.70

Major Resistance Level – $2.00

Charts courtesy – Trading View, Kraken

hi aayush thanks for your analysis.

Your crystal ball is faulty

thanks captain bollywood

Not a word about Ripple the company or the viability of their business direction- were they part of this equation? And what about coinmarketwatch? Did you forget it was their incredibly reckless decision to remove the Korean prices from the XRP averages, with no warning whatsoever, which triggered the panic selling in the first place? This was the equivalent of yelling ‘Fire!’ in a crowded theater.

The loss of tens of billions in market cap due to the carelessness of a single web site will not go unanswered by government authorities. It is precisely this sort of market immaturity which guarantee the block chain space will be viewed at best as dangerous, and at worst criminal. Hardly the foundation upon which to build a serious alternative to the financial status quo. If this fiasco had happened with stocks like Apple or Google, people would be going to prision.

Understand “Technical Analysis” first, then ask this question again.

Patience. This is a 6 month to a 2 year hold on this coin. It solves real world problems and is in the test phase. With more companies picking it up for “testing” the outlook is only positive.

https://uploads.disquscdn.com/images/bb09cfe8886ff49d5031a2d8b5d865b539daa9c4f8674e015fc4293b10b026ff.png

I own and operate a multi-million dollar IT firm which specializes in cyber security. We work with publicly traded companies to improve security posture in their respective technological environments. We have a perfect record when it comes to cyber-security audits and assessments when aligned amongst the most respected ethical hacking firms in the United States. Goes to say, our team has some insight that some economists might not have. I would like to add, almost a dozen of our employees are invested in Ripple.

This day in age, there are firm expectations and requirements when it comes to digital conveyance of sensitive and or valuable assets. I have personally conducted extensive research on the most popular digital currencies and believe Ripple, unlike others, has clearly demonstrated a commitment to regulation and efficiency.

I have a few theories but prefer to share my modest viewpoint. The Ethereum blockchain and some related currencies will encounter several challenges this year, however, I expect Ethereum will be a significant player for years to come. From a technological standpoint, Ripple’s infrastructure outperforms that of any competitor by far. They have also demonstrated their ability to engage in significant business deals with some major players.

Many have questioned the large supply of escrowed XRP, calling it “shady”. Considering their potential hold, I think Ripple is conservative and selfless. I believe Ripple needs to stay committed to a “humble attitude”, as their success depends on it. Almost always, every new concept experiences a discovery phase prior to adoption. In this particular case, I believe the majority of Ripple’s entire supply will soon be committed to enterprise, at a negotiated price of course. This will leave investors with an extremely narrow window to buy in. To sum it up, the mysterious escrow supply will be consumed by banks, corps, and then the price will spontaneously skyrocket beyond anything we’ve experienced.

Supporting ideas-

-total cross border transfer of capital per year: (not including untapped regions where current solutions have no range yet XRP could have reach / low cost attainability).

-Deals have been signed but no change in supply….hmmm…

-Less than $100B XRP in supply.

-Volume: $156.6T+ per year in cross boarder transfers

Benefit: Security / Accountability / Cost / Regulatory / Efficiency

=potential???

Marco Leal Pres/CEO Loyal IT, Inc.