Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Polygon (MATIC), a blockchain scalability platform, finds itself in the grip of negative sentiment that casts a shadow over its prospects for a strong price recovery. The crypto market has been a volatile space, prone to sudden shifts in sentiment, and MATIC is no exception.

The recent downturn in the sentiment surrounding MATIC has left investors and traders cautiously observing the price charts.

Once considered a promising project in the crypto space, Polygon’s potential for growth has been impeded by the recent actions of the US Securities and Exchange Commission against altcoins.

Will the negative sentiment continue to hinder MATIC’s potential for a strong price recovery?

Polygon Whales Unfazed By US Regulatory Pressure?

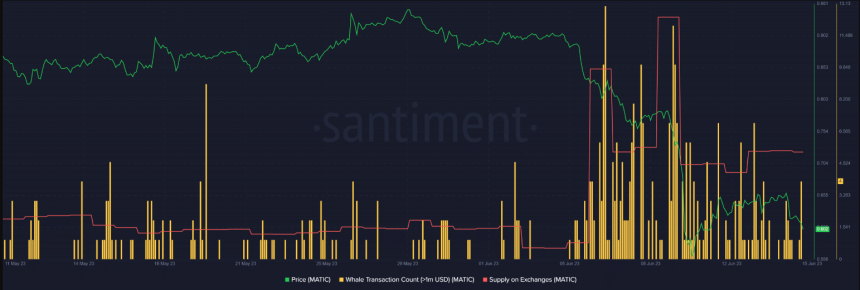

The latest data on MATIC reveals that the pressure from US regulators has not seemed to totally unsettle some prominent investors, as evidenced by a notable increase in whale transactions exceeding $1 million in recent days.

Source: Santiment

However, despite the increase in whale appetite, the cryptocurrency has failed to sustain a strong upward momentum at the time of writing.

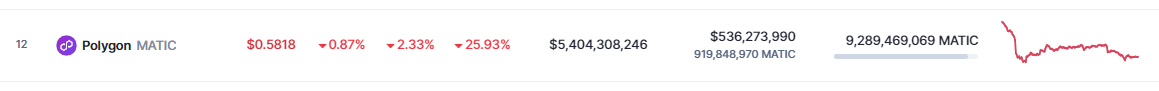

Source: CoinMarketCap

CoinMarketCap reports MATIC’s current price as $0.5818, reflecting a decline of 2.33% within the past 24 hours. Additionally, the cryptocurrency has witnessed a substantial slump of 25.93% over the past seven days.

In addition to the impact of regulatory pressure, the movements of MATIC’s supply on exchanges, which serves as an indicator of short-term selling pressure, have exhibited rapid fluctuations during the same period.

MATIC 24-hour price movement. Source: CoinMarketCap

It experienced a sharp increase, followed by a decline, and then another spike before eventually easing at the time of publication.

These developments indicate that the selling pressure on MATIC remains a significant concern, primarily due to the prevailing regulatory uncertainty.

MATIC market cap currently at $5.4 billion. Chart: TradingView.com

Fed’s Pause On Rate Hikes Fails To Stabilize Crypto Markets

On the whole, financial markets have continued to exhibit volatile movements, causing cryptocurrencies to decouple from the performance of traditional equities markets.

The recent downturn in the crypto market seems to be linked to the press conference held by Federal Reserve Chairman Jerome Powell on June 14, during which he announced that the central bank would temporarily halt rate hikes for the month of June.

While this decision aligned with investors’ expectations, it had an unexpected effect on the crypto market. Instead of stabilizing, the market experienced a reversal in its course and resumed the ongoing sell-off that has persisted for the past three weeks.

The presence of substantial macroeconomic challenges, coupled with the anticipation of future rate hikes and low trading volume, suggests that the volatility in the cryptocurrency market is likely to persist in the foreseeable future.

The prevailing headwinds, including economic factors on a larger scale, have contributed to the unpredictability and turbulence in the crypto market.

Featured image from Analytics Insight