Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The world of memecoins continues to be a rollercoaster ride, and Pepe (PEPE) is no exception. Recent on-chain data reveals a surge in tokens moving out of exchanges, potentially signaling a bullish sentiment among investors. However, conflicting indicators cast a shadow of doubt on the sustainability of this upward trend.

Pepe Soars Out Of Exchanges, Suggesting Investor Confidence

A significant development for PEPE is the movement of a large number of tokens away from exchanges. According to Santiment, a blockchain analytics platform, the supply of PEPE outside exchanges reached a staggering 243 trillion on April 7th. This sharp rise compared to March 12th indicates a potential decrease in selling pressure.

Source: Santiment

Price Recovery, Rising Volume Hint At Potential Upswing

Further bolstering the bullish case for PEPE is the recent price increase. Over the last 24 hours, the memecoin has experienced a nearly 10% surge, suggesting a potential recovery from a recent slump.

In addition to the observed price fluctuations and projected price range for Pepe, it’s worth noting the significant increase in trading volume surrounding the cryptocurrency. This surge in trading activity not only reflects a heightened level of engagement within the Pepe community but also suggests growing interest from external investors and traders.

Bitcoin is now trading at $71.879. Chart: TradingView

The uptick in trading volume serves as a key indicator of market sentiment and could potentially serve as a catalyst for further price gains. Historically, increased trading activity has been associated with periods of price appreciation, as it signals a greater level of market participation and liquidity. In turn, this heightened liquidity can attract new buyers to the market, further bolstering demand and potentially driving prices higher.

Investor Sentiment Tells A Different Narrative

However, not all signs point towards a clear path to success for PEPE. While the token movements suggest some bullishness, a crucial metric paints a contrasting picture. The Weighted Sentiment, which reflects investor sentiment towards PEPE, has recently declined.

This could indicate a weakening of investor confidence and potentially foreshadow a decrease in demand for the memecoin. If this metric continues to fall, it could invalidate the current bullish bias surrounding PEPE, making a significant price hike less likely.

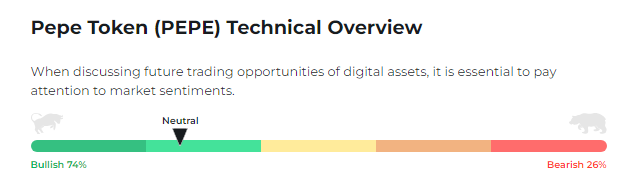

Quick Technical Overview

On a brighter note, PEPE shows strong bullish momentum with a 74/26 split favoring positive sentiment. This aligns with the recent price increase and suggests continued investor optimism.

However, it’s crucial to monitor social media chatter and news articles for any potential shifts in sentiment that could impact price movement. While the current outlook is positive, remaining vigilant is key in this volatile market.

Source: Changelly

PEPE Price Prediction

Meanwhile, amidst the volatility of the cryptocurrency market, Pepe’s price fluctuations have captured the attention of crypto experts, prompting projections for its trajectory in April 2024. Analyses indicate an anticipated average PEPE rate of $0.0000140 during this period, reflecting both the potential for growth and the inherent uncertainty within the market.

While these projections offer insights into the expected average price, it’s essential to acknowledge the range of possibilities. Experts suggest that Pepe’s minimum and maximum prices in April 2024 could vary significantly, with estimates ranging from 0.00000745 to .

Featured image from Pexels, chart from TradingView