Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The world of cryptocurrencies is seeing a familiar sight: a meme coin ablaze. Rising in recent weeks, PEPE—a token with the internet’s preferred frog—has left investors questioning whether this marks the beginning of a new age or a passing craze.

PEPE On A Tear: New Highs And Whale Activity

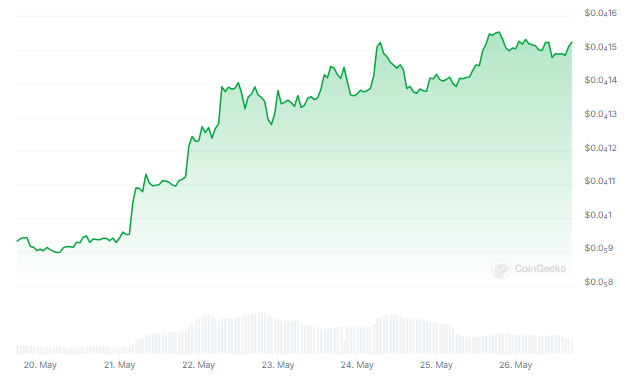

PEPE has been on a roller coaster over the last month, surpassing projections and leaving a path of green for investors. Rising nearly 100% in just 30 days, the price joyfully reached a fresh all-time high. Happy hodlers followed after this meteoric surge; according to IntoTheBlock data, a stunning 97% were seated nicely in profit.

Recovering its third-largest meme coin by market capitalisation from Dogwifhat, CoinGecko stats reveal Pepe has increased 56% in the previous week and 99% in the last month.

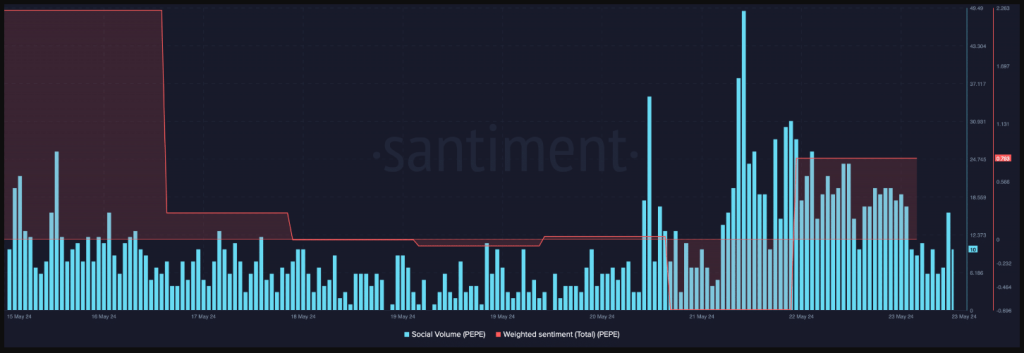

The positive momentum has not showed any slowing down tendencies. Another 3.7% increase over the past 24 hours helped PEPE reach its present highest point. Not only financially but also on social media, this outstanding performance has attracted lot of attention. The social volume of the coin has surged, suggesting an increase in interest and internet debate.

Fueling the flames, a whale—a word used to describe big investors with great buying power—has been causing stirs. Blockchain analytics tool Lookonchain has revealed a whale withdrawing an astounding 500 billion PEPE from Binance, a big bitcoin exchange. This huge build-up points to a vote of confidence in PEPE’s future spanning whale-sized proportions.

Buying Frenzy Or Overheated Engine?

Although the recent price rise and social media buzz are definitely encouraging indicators, some analysts are cautions. Technical indicators taken closer show possible warnings of an overheated market. Measuring purchasing and selling pressure, the Chaikin Money Flow (CMF) has slumped.

Likewise, the Relative Strength Index (RSI) and Money Flow Index (MFI) both linger in the overbought zone, implying PEPE’s price might be poised for a fall.

Selling pressure adds still another level of complexity to the picture. While some investors are loading in, others could be cashing out their gains. Last week, PEPE’s exchange outflow increased on a crypto analytics portal called Santiment, suggesting purchasing demand. They also saw a rise in supply on exchanges, though, which would indicate some investors might be using the high price to sell.

Potential Price Correction

News BTC examined PEPE’s daily chart to evaluate this possible selling pressure’s effect. According to their research, the price might initially drop below $0.0000122 before maybe finding support and starting yet another bull run. A more thorough correction might see PEPE drop below $0.000010 or even less, though.

The Most Traded Memecoin

Meanhwhile, Pepe was still among the most traded cryptocurrency assets over the previous day, according to data from Binance, with only BNB Coin (BNB), Bitcoin (BTC), and Ethereum (ETH) surpassing it.

Pepe still ranks highest among meme currencies traded, topping well-known coins as Shiba Inu (SHIB), Dogecoin (DOGE), and Floki (FLOKI).

Featured image from ART street, chart from TradingView