Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s bullish trend continues for another day, breaking the $73,000 barrier, as several market conditions seem to favor the world’s biggest cryptocurrency. According to data, Bitcoin jumped by 6% to hit $73,544 late Tuesday, its highest market price since March 14th. With this latest price surge, Bitcoin’s October gain is up by 13%, better than the top performers in the S&P with an average 1% increase.

Aside from Bitcoin, other top digital assets showed strengths, with Ethereum surging by 4% and the Binance Coin up by 2%. And with considerable inflows to Bitcoin ETFs in recent days and the US elections just days away, many expect a bigger price surge for Bitcoin.

A Bullish Bitcoin Ahead

Bitcoin’s jump to $73,500 during US trading hours Tuesday narrowly missed its all-time high set on March 14th. However, a few developments and favorable market conditions can help push Bitcoin to higher highs in the next few days.

Firstly, Bitcoin has finally snapped its seven-month downtrend. For weeks, the top crypto has consolidated at just above the $68,000 level, and this stability motivated traders and investors to push the price.

B I T C O I N $BTC

There are numerous ways to determine targets. One variable is whether semi-log or linear scale is used

Target of 94,000 is measured move of triangle projected from breakout level on semi-log

⬇️ 🧵 1/3 pic.twitter.com/VI0n7OAvia— Peter Brandt (@PeterLBrandt) October 29, 2024

Just this Monday, Bitcoin topped the psychological $70,000 support before getting a bigger push from inflows from ETFs and trades by whales. Many market analysts, including experienced trader Peter Brandt, set an even bolder target: Bitcoin will reach $94,00 to $160,000 soon.

Second, the price movement has liquidated plenty of short positions and effectively passed sell walls between $65,000 and $71,000. This development established a positive mood by leaving short traders on the edge. Thirdly, its industry domination is now at 60%, its highest since March 2021.

Institutional Interest In Bitcoin Rising

The ongoing large inflows into the Bitcoin exchange-traded funds approved in January also play a major role in the recent spike of the cryptocurrency. Based on Bernstein’s data, in the past few months the top BTC ETFs have drawn billions of inflows from businesses and institutional investors. These funds’ total assets under management as of October 28th already surpass $68 billion and are further likely to rise.

Then, with about $43 billion of interest, there is also increasing curiosity in crypto futures. This rise in trading volume points to positive attitude among traders and demonstrates increased interest of market players.

All Eyes On The US Elections

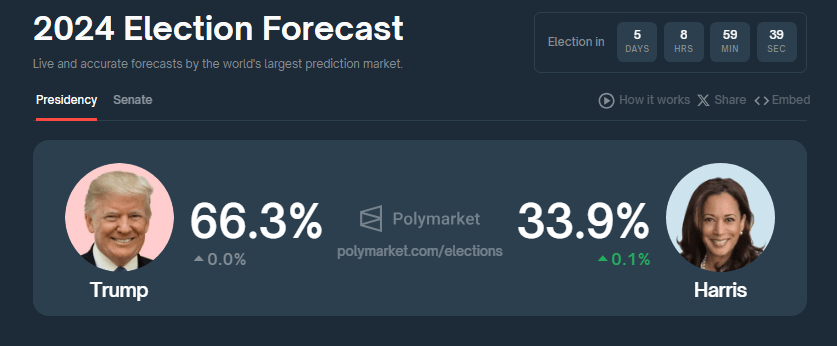

Perhaps the biggest driver of Bitcoin’s price is next Tuesday’s scheduled US elections. The rise in price has coincided with Trump’s increasing odds of winning the presidential elections.

Initially a “crypto skeptic,” Republican Trump has emerged as a pro-crypto and Bitcoin candidate, calling for a strategic stockpile of the token for the country.

All these factors helped Bitcoin’s recent price surge and can power the top crypto to a new all-time high.

Featured image from Dall-E, chart from TradingView