Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

There is a fresh gold rush in the cryptocurrency industry, this time on a messaging app. Rising 400% during the previous week, Notcoin (NOT), a Telegram-based asset, has hit its all-time high of $0.027. This huge increase has left experts trying to figure out the motivating factor behind this social media-fueled frenzy.

From Humble Beginnings To Meteoric Rise

Starting simply as an in-game currency for a Telegram clicker game introduced in late 2023, Notcoin’s path started small. By tapping a virtual gold coin—a basic but compelling mechanism that drew a lot of users on the popular chat platform—players could win NOT tokens.

This first achievement opened the path for a more extensive connection with Telegram in May 2024 so that users could earn tokens by completing different “earning missions” and chores. Notcoin’s recent increase seems to be driven by this play-to-earning concept in tandem with Telegram’s enormous user base.

Additionally driving the token’s explosive price is a notable increase in daily transaction volume. Now ranking among the top four most traded cryptocurrencies, Notcoin claims daily trade volume more than $4.5 billion. This increase in activity points to investors and possible new users ready to seize Notcoin’s play-to- earn possibilities.

Whales And FOMO: A Recipe For Volatility?

Unquestionably remarkable, the Notcoin surge is accompanied with voices of concern among the crypto world. The market for cryptocurrencies is well known for its volatility, hence such fast price rises can cause worries about possible bubble formation.

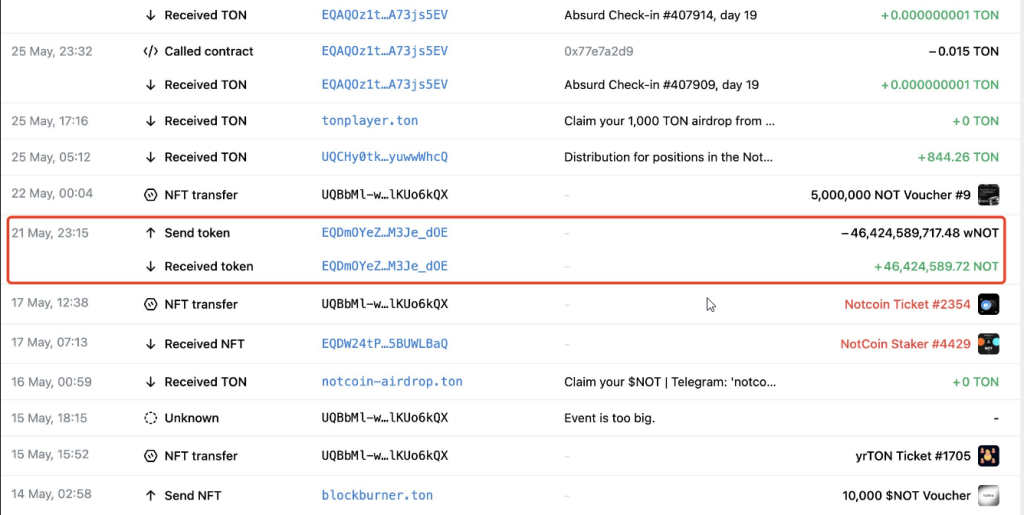

Reports from on-chain data source Lookonchain help to magnify this more. Lookonchain claims that the recent price increase greatly benefited a big investment (“whale”). Before the NOT official listing, this whale apparently bought a lot of wrapped Notcoin (wNOT).

The price of #Notcoin( $NOT) has risen by more than 400% in the past 7 days.

We noticed that a whale has an unrealized profit of $862K on $NOT.

He spent 50,550 $TON($278K) to buy 46.4B $wNOT before $NOT was listed.

1000 $wNOT can be exchanged for 1 $NOT.

On May 21, he… pic.twitter.com/Da29qniVzg

— Lookonchain (@lookonchain) June 3, 2024

Lookonchain notes that the whale turned their whole wNOT position into NOT upon listing, therefore producing an unrealised profit of over $862,000. The large possessions of the whale and possible future behaviour could greatly affect the price stability of the token.

The fear of missing out (FOMO) pushing the market now is another element to take under account. Attracted by the promise of large returns, new investors may be hurrying into Notcoin without properly appreciating the underlying technology or the hazards involved. This could cause the price to rise beyond the actual value of the token, therefore preparing the ground for a possible future corrections.

The Road Ahead For Notcoin

Notcoin’s success emphasises the increasing possibilities of including cryptocurrencies with well-known social media platforms despite their associated risks. Notcoin’s play-to–earning approach’s simplicity of access and user-friendly interface could be a guide for next blockchain integration in social media.

Long-term survival of the platform depends on its capacity to keep a good user base and show the actual value of the NOT token outside of its present gaming and task-based uses, though.

Featured image from Coben Executive & Corporate Advisory, chart from TradingView