Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

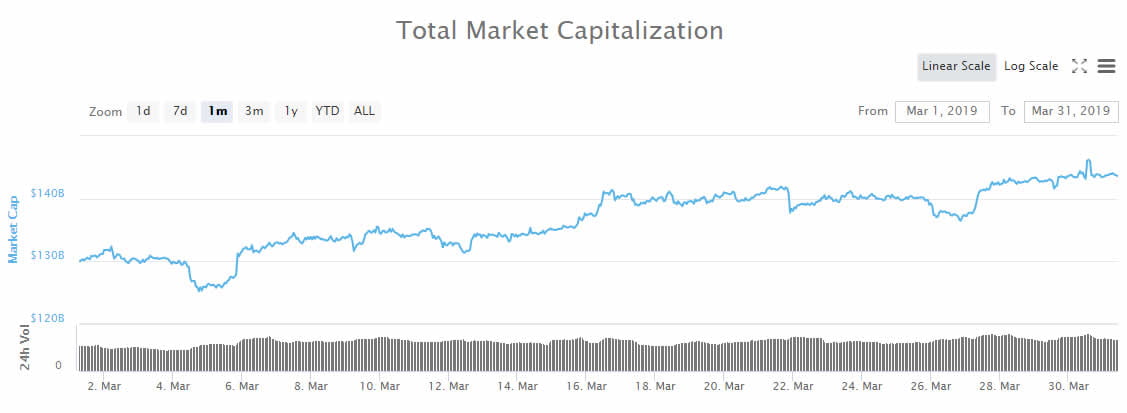

Following a gain of 14% during February crypto markets continued to make progress during March. Starting out the month at $130 billion markets had climbed 10% by the end of it to $143 billion with a gain of $13 billion. Altcoins had been largely responsible for the movement as Bitcoin dominance fell ever nearer to 50%, its lowest level for seven months. Daily volume had increased from below $25 billion to high thirties by the end of March and momentum was looking solid despite failure to break key resistance levels for many of the majors.

Over the course of the month Bitcoin has made steady progress from $3,860 to $4,100 registering a 6.2% climb. Major resistance still stands at $4,200 however and BTC failed to break this which has resulted in its market dominance declining as altcoins led momentum. Movement has been slow but since its 2018 low in December Bitcoin has recovered 28%.

March Crypto Winners

Ethereum has not done a great deal during March with only a 3% gain to end the month just over $140. ETH has managed to hold second place and increase the gap ahead of XRP to two billion however.

EOS has been flying in March, mostly over the past week where Coinbase Custody has given it a boost. Climbing from $3.55 to $4.10 the Ethereum competitor made 15.5% during the month and flipped Litecoin for fourth spot again.

Litecoin has done even better with a 30% surge from $46 to $60 during March. The move has taken LTC up the market cap charts as high as fourth before losing this to EOS a few days ago. Bitcoin Cash is another winner with a 26% pump from $132 to end the month around $167.

Binance Coin has literally been on fire recently and March was no exception with an epic pump of 68% for BNB over the 31 days. The coin appears to be acting as a stablecoin does when traders sell off altcoins and go back into BNB or USDT, it pumps when markets are dumping.

Stellar picked itself up in March also with a climb of 26% from $0.085 to $0.107 by month end as trade volume for XLM tripled. Cardano also had a rare good month with a pump of 63% to end March at around $0.070 and knock Tron out of the top ten.

Monero made around 8% on the month to end March trading at $53 from below $50 at the start of it. Dash did a lot better by breaking $100 from a start of around $84. The 22% climb saw the privacy based altcoin out perform its rival XMR.

IOTA made around 7% in March to end it over $0.30 but fell back in the market cap charts to fifteenth. Maker made even less at 6% but it was still a gain taking MKR over $700 by month end. Tezos has been one of the top performers in March with an epic 140% surge from $0.40 to just below a dollar. Ontology has also done well making 40% from around $0.90 to $1.27. NEO made around 7.5% but failed to break $10 by month end. Rounding out the top twenty in March is Ethereum Classic which made 11% over the month.

March Crypto Losers

Ripple’s XRP token has fallen back during March, losing just over 2% to finish at a weak $0.31. There have been no major partnerships or announcements to boost XRP which did not even react to last month’s Coinbase listing. As usual with the exchange there were accusations of insider trading and manipulated markets as the Ripple token fell for the second consecutive month.

Tron also fell back a couple of percent during the month and lost its top ten position to Cardano. TRX ended March trading down at $0.233. Bitcoin SV was another loser dropping over 4% on the month to end trading around the $64 level.

The majority of altcoins made strong gains during March with many of them getting double digit boosts. March has built on February’s gains but the bigger picture is still bearish as Bitcoin continues to stall at $4,000 resistance. In summary the top crypto performers in March were Binance Coin, Cardano, Tezos and Ontology with XRP, Tron and BSV falling back as the only three losers in the top twenty.

All figures from Coinmarketcap.com

Previous months: February 18 | March 18 | April 18 | May 18 | June 18 | July 18 | August 18 | September 18 | October 18 | November 18 | December 18 | January 19 | February 19