Decentralized Finance (DeFi) lending and borrowing platform Maker (MKR) has been performing exceptionally well in the past seven days, as its native token price witnessed a 22% surge, despite the downward trend observed in other major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

The positive price action of MKR has come amidst news of the failure of Silvergate Capital, which has caused a slump in the prices of Bitcoin and Ethereum.

A look at the charts from crypto market trackers CoinMarketCap and Coingecko shows that most cryptocurrencies in the top 100 list are all painted in red. The Maker (MKR) token emerged as the top performing crypto from the roster.

Maker (MKR) Dominates Top 100 Crypto Ranking

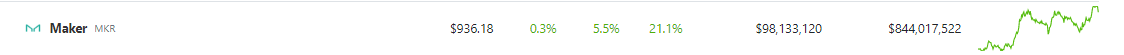

Source: Coingecko

At the time of writing, MKR was trading at $936, up 21% in the last seven days, and climbing 6% in the last 24 hours, data from crypto market tracker Coingecko shows.

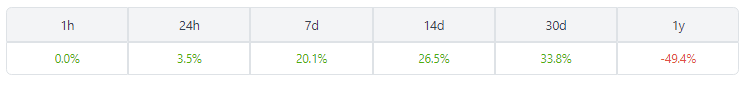

In the last 30 days, MKR has been consistently on the upside, maintaining a 34% increase and complementing its bi-weekly timeframe, which has been up 27%.

Source: Coingecko

After a brief reversal, MKR is attempting to restart its upward trend. This shows that traders continue to regard price declines as buying opportunities, indicating that mood remains optimistic.

Edul Patel, co-founder and CEO of Mudrex, told ABP Live:

“During the weekend, the broader crypto market stayed in the red as market participants digested the Silvergate situation.”

Maker (MKR) is a decentralized lending platform that allows users to borrow and lend cryptocurrencies without the need for a centralized intermediary.

The platform operates on the Ethereum blockchain and is considered one of the leading projects in the DeFi space.

The surge in the price of MKR indicates a growing interest in the platform, as investors seek to capitalize on the opportunities provided by decentralized finance.

Market Expansion For MKR

The price increase is a reaction to the revised executive vote poll results from Maker from the previous week. It contained a new pricing model with an annual charge schedule of 0.5%, as well as an increase in the debt limit from 5 million DAI to 10 million DAI, indicating a loosening of borrowing limitations.

The current year’s market expansion for MKR has resulted in a price increase for the crypto. A glance at its price history reveals that each increase in Bitcoin’s price has a favorable effect on MKR’s pricing.

The rise in Bitcoin’s price in 2018 and 2021 resulted in an immediate increase in Maker’s pricing.

Meanwhile, the current position of the market, which appears to be at a tipping point, is being keenly monitored by analysts.

Even if the crypto winter appears to be over, the broader market faces the challenge of offsetting Silvergate’s recent crypto setback.

SHIB total market cap at $6.5 billion on the daily chart | Chart: TradingView.com

Increased Demand For The Crypto

The MKR/USD pair has been trading between $832 and $963 for a while, but bulls are attempting to push the price above the range.

The fact that MKR has managed to buck the trend and record a significant increase in price is a testament to the strength of the project and its potential to deliver value to investors.

As more investors become aware of the benefits of decentralized finance, platforms like Maker are likely to see increased demand, which could further boost the price of MKR in the long run.

-Featured image from The Coin Republic