Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

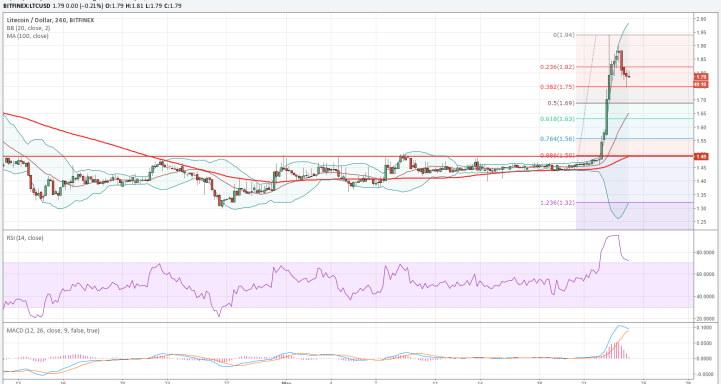

Litecoin has broken free from the hourly trading range on the downside, however, not before offering several highly lucrative trading opportunities to the market participants. I had mentioned in my previous analysis that Litecoin can be bought near $1.450 for a target of $1.459 by placing a stop-loss below $1.449. And there were plenty of such opportunities to trade in the past 24 hours.

After cracking below the crucial support level, Litecoin is trading at $1.441.

Image: https://www.tradingview.com/x/AnuRgOgU/

Image: https://www.tradingview.com/x/AnuRgOgU/

The latest collapse warrants a revision of the trading levels and the strategies. For this purpose, an analysis of the 120-minute LTC/USD price chart has been performed.

Litecoin Chart Structure – Litecoin has breached the support of $1.449 on the back of strong trading activity (marked in the chart). Technically, the market should experience strong supply pressure as it nears the zone of $1.450-1.452. The level of $1.460 continued to act as an extremely strong ceiling for the bulls.

Momentum – The 10-2h Momentum reading is significantly negative at -0.0179. Negative momentum readings indicate bearish bias.

Relative Strength Index – The RSI indicator reading of 42.2934 mirrors the weakness in the virtual currency. The strength reading must catch up to at least 50 if bulls are to force a trend reversal.

Moving Average Convergence Divergence – The MACD indicator relentlessly digs deeper into the negative territory along with the Signal Line. The latest MACD value is -0.0029 while the recent Signal Line value is -0.0013. The Histogram is managing to consolidate near -0.0015.

Conclusion

Even as Litecoin has broken the crucial floor of $1.449, it may make several attempts to head above $1.450. Short-term traders may consider building bearish positions on bounces up to $1.452-1.455 by placing a strict stop-loss above $1.459. The target on the downside should be revised to $1.442. Market participants are advised to not resort to impulse buying. The downtrend is not expected to reverse anytime soon.