Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Litecoin (LTC), the “silver” to Bitcoin’s “gold,” has surged in recent weeks, buoyed by a combination of technical factors, strong investor interest, and strategic accumulation by miners.

The LTC price jumped 12% in the past 24 hours, reaching $106.40. This uptick follows a 40% year-to-date gain, with most of the growth concentrated in the last week. Daily trading volume has also skyrocketed by 175%, indicating a significant influx of investors into the Litecoin market.

Will April Be A Good Month For Litecoin?

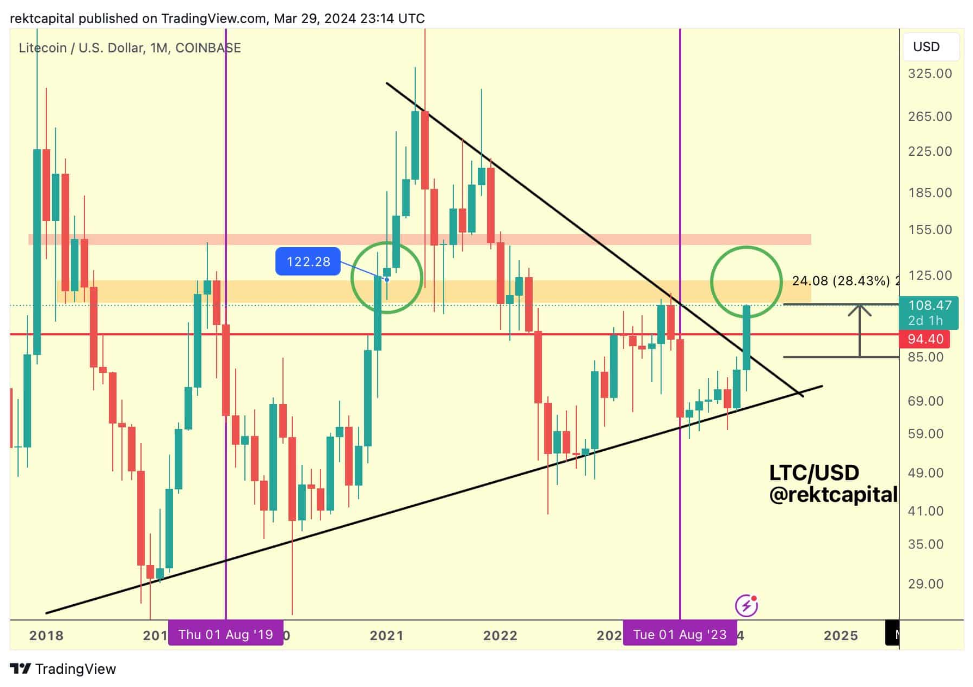

Analysts are particularly excited by a potential breakout from a multi-year downtrend. If LTC can maintain its position above $94, some believe it could usher in a new era of sustained growth.

A decisive break and hold above the $122 resistance level could trigger further gains, with some analysts predicting a surge towards $150 or even higher. This price pattern mirrors a successful breakout observed in 2020/2021, adding fuel to the bullish fire.

Popular crypto analyst Rekt Capital has also chimed in, noting the historical significance of similar price breakouts for LTC. He believes a successful retest of the downtrend and subsequent establishment of support could be indicative of a promising uptrend for the cryptocurrency.

Miners Fueling The Rally

One of the key drivers behind the recent surge is the behavior of Litecoin miners. Data from IntoTheBlock reveals that miners have been accumulating LTC at a healthy pace throughout March. They’ve added a whopping 150,000 LTC to their reserves, bringing their total holdings to 2.2 million.

This accumulation strategy reduces the selling pressure of newly minted coins and signals the miners’ confidence in the future price trajectory of LTC.

Total crypto market cap is currently at $2.573 trillion. Chart: TradingView

Open Interest On The Rise

The Road Ahead

Litecoin could be headed to a strong April performance, with strong technical indicators and bullish sentiment driving the current rally. However, responsible investors should always conduct their own research and exercise caution when navigating the ever-turbulent world of cryptocurrency.

Featured image from Pixabay, chart from TradingView