Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

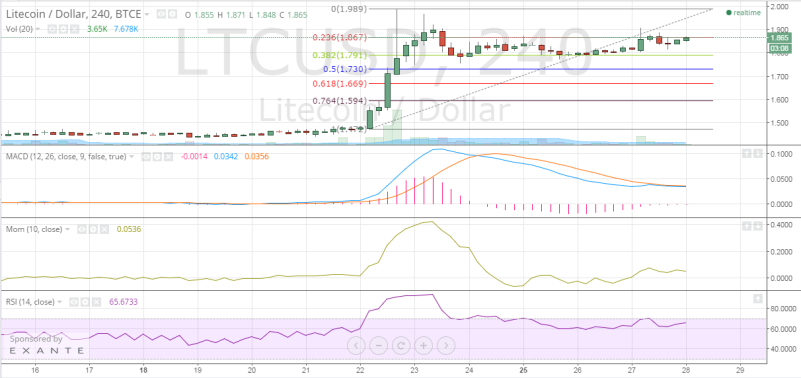

The mighty bulls are back! After taking adequate rest and catching enough breath, they have made a powerful comeback and exposed the frailty of the short-sellers. Backed by strong sentiments, Litecoin is now challenging a crucial resistance level.

Litecoin is currently trading up 2.8% at $1.865.

Image: https://www.tradingview.com/x/TNje1xzx/

Image: https://www.tradingview.com/x/TNje1xzx/

From a technical perspective, things look very positive for the virtual currency. An analysis of the 240-minute LTC-USD price chart tells that Litecoin should threaten previous tops unless bulls lose complete control of the situation.

Litecoin Chart Structure – A closer look at the chart reveals that post hitting the recent high of $1.989, Litecoin struggled to sustain above $1.865 on numerous occasions. The virtual currency is yet again attempting to break above this level and start a fresh leg of the rally.

Fibonacci Retracements – The cryptocurrency had been respecting the 38.2% Fibonacci retracement level of $1.791 as a support level while the 23.6% Fibonacci retracement level of $1.867 proved to be a tough hurdle to cross. If bulls manage to overcome the selling pressure at this juncture, upside targets of above $2.000 open up.

Momentum – The Momentum indicator has also given a positive confirmation to the price surge; the reading has advanced from -0.0003 to 0.0536.

Moving Average Convergence Divergence – The MACD indicator has drastically reduced the gap with the Signal Line, bringing the Histogram value even closer to the 0-mark. The current MACD and Signal Line readings are 0.0342 and 0.0356 respectively.

Relative Strength Index – The RSI reading has risen to 65.6733, but what’s highly remarkable is that it is going to be almost a week that Litecoin has sustained 60-plus values.

Conclusion

Riding high on optimism, Litecoin should aim for valuations up to $2.000. Employ a buy on dips strategy by placing a stop-loss just below the support level. Volatility is expected to remain muted as price rises. Expect a breakout by the end of this week!