Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

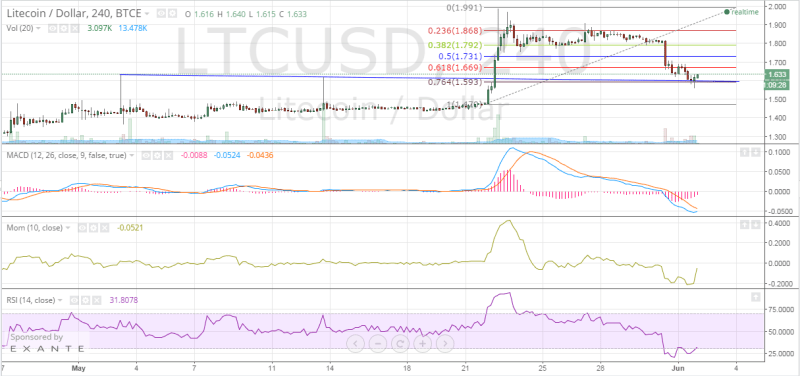

It only gets better for the short sellers! In my yesterday’s analysis, Fall from Grace, I had mentioned that the decline may worsen to $1.590, and Litecoin has touched $1.562 since the previous observation. The cryptocurrency has now dropped to a crucial level, below which I expect a rapid decline in the market cap.

Litecoin is currently trading down 2.2% at $1.633.

Image: https://www.tradingview.com/x/wZdeGBH9/

Image: https://www.tradingview.com/x/wZdeGBH9/

Things look extremely worrisome for the Litecoin bulls on the 240-minute LTC/USD price chart, conveying that market participants should consider it only as a sell on rise candidate.

Litecoin Chart Structure – Litecoin’s drop briefly pushed it below the trendline drawn from the previous two peaks (the horizontal blue line in the chart above) but closed above it. The near-term support level is now $1.594 while the level of $1.690 will prove to be a pressure point.

Fibonacci Retracement – Crucial Fibonacci support levels continue to get challenged and breached. After breaking the 61.8% Fibonacci retracement level, bulls tried to recoup the losses but instead, they failed miserably in even holding their ground. As a result, Litecoin fell to the 76.4% retracement level of $1.593.

Moving Average Convergence Divergence – The MACD and the Signal Line are unable to reverse their direction, following a continuous decline in the Litecoin price. The latest MACD and Signal Line values are -0.0524 and -0.0436, respectively.

Momentum – The Momentum indicator has retested the -0.2000 level, and jumped to -0.0521.

Relative Strength Index – The underlying strength indicator conveys that the cryptocurrency is currently out of the oversold region; the latest RSI reading is 31.8078.

Conclusion

I am expecting Litecoin to erase all the gains of this rally and head down to $1.470 this week. However, I will wait for a rise up to $1.670 to go short in this counter. Maintain a strict stop-loss above $1.690. Position your trades keeping the volatility in mind!