Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Curve DAO (CRV) encountered notable obstacles in reestablishing its market equilibrium subsequent to a recent breach in its network security.

After a network intrusion that jeopardized a portion of Curve DAO’s (CRV) smart contracts and caused a monetary setback of $50 million, the value plummeted drastically.

This occurrence prompted numerous investors to bet against their CRV tokens, exacerbating the downward pressure on its valuation.

Based on a recent analysis of the price trends, the value of Curve DAO experienced a favorable support level close to the $0.56 threshold. On August 1st, there was an instance of rejection for the lower price, indicating that buyers are accumulating at this reduced price point.

Anticipated Curve DAO (CRV) Price Movement

In the face of ongoing security concerns, a separate analysis anticipates a substantial 42.1% surge in CRV’s price, propelling it to $0.81 once the security issues are effectively addressed and resolved.

Conversely, contrasting predictions foresee a potential 15.7% decline, bringing the value down to $0.48. This shift in sentiment is attributed to a significant number of investors diverting their attention toward competing options within the CRV ecosystem.

Examining the daily chart, a notable trend emerges as the CRV price experiences its second reversal from a horizontal support level, indicative of the emergence of a double bottom pattern. Presently, this bullish reversal has facilitated an 8% upsurge, driving the price to its current value of $0.614.

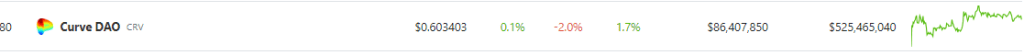

CRV market cap at $525 million on the daily chart: TradingView.com

Within the framework of the double bottom pattern, an expectation arises for buyers to steer the prices upwards by 20%, seeking to challenge the upper trendline of the channel pattern.

The true confirmation of a trend reversal lies in a bullish breakout from this resistance level, which would fortify the validity of the emerging pattern.

A Potential Trend Reversal

The double bottom pattern is a technical chart pattern observed in financial markets, characterized by two consecutive troughs forming near a common horizontal support level.

This pattern suggests a potential trend reversal from a downtrend to an uptrend, as the initial downtrend exhausts itself and buyers regain control, leading to a bullish breakout when the price surpasses the pattern’s resistance level.

Should the CRV breakout materialize, a subsequent rally could ensue, targeting an initial goal of approximately $0.08. Following this milestone, a subsequent price objective of $1.1 might come into play, underscoring the potential magnitude of the trend reversal that the double bottom pattern could potentially signify.

CRV price action. Source: Coingecko

With a CoinGecko listing of $0.603, the price of CRV demonstrated a 2% decline over the past 24 hours, while it managed a 1.7% increase over the last seven days.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from CCN.com