Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Stellar Development Foundation (SDF) has issued its Q1 report. In an official post, the SDF reiterated the importance of its main strategic pillar around Stellar’s blockchain: usability, trust, adoption, and sustainable use cases.

In the past months, Stellar’s ecosystem has started growing on top of this vision according to the SDF. Data provided by the report indicates that the platform has seen a YoY increase in its total accounts standing at 11%.

The total number of operations processed on the network has increased by 100%. Similarly, payments have incremented and 160% with an 84% rise in “relevant assets” with a 29x number of on-network transaction volume made with them, according to the report.

Therefore, Stellar Network’s registered a grown in the number of “real financial instruments” using its platform as a solution. These assets are tethered to fiat currency or stocks in the traditional market.

Stellar enables bull-run in the crypto market

In addition, the Stellar Development Foundation managed to invest a total of $6,5 million in companies like Wyre, Cowrie Integrated System, and DSTOQ via the Enterprise Fund. Every new cooperation put Stellar closer to consolidate its pillar and it’s a new step towards mainstream adoption.

SDF’s Marketing team developed a new case study featuring DSTOQ, Stellar’s latest Enterprise Fund recipient. This case study highlights DSTOQ’s latest business results and features several customers speaking to how DSTOQ empowers them to attain financial freedom.

SDF and Circle’s partnership to launch stablecoin USD Coin (USDC) on Stellar marked an important milestone for this blockchain. As consortium CENTRE, the organization created by Circle and Coinbase to support USDC, seeks to be more independent from Ethereum, Stellar took a key role.

(…) pairing the world’s fastest-growing USD stablecoin with the world’s fastest-moving network. Businesses and individual users are now able to leverage USDC while taking advantage of Stellar’s low cost, speed, and security features.

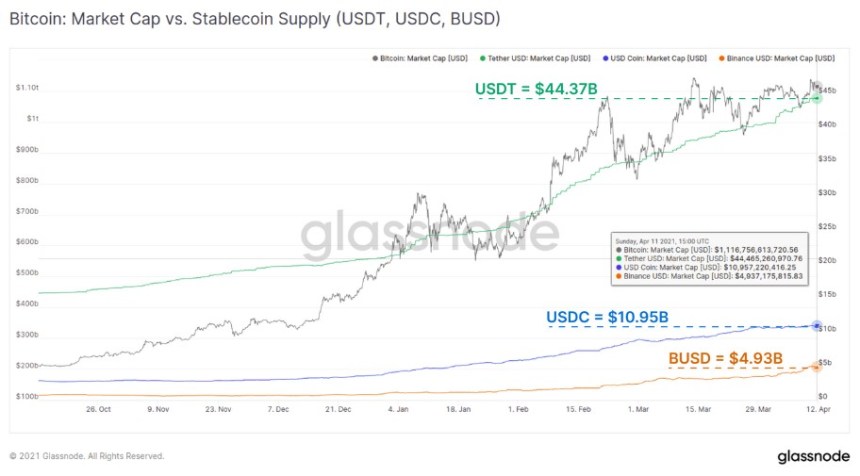

As shown by recent data from Glassnode, stablecoins and their market cap increase are apparently correlated with cryptocurrencies’ performance. The more demand for these assets, the more institutions, and retail investors need them to enter the market, as seen below.

XLM is trading at $0,60 with an 8.6% correction in the daily chart. In the weekly chart and monthly chart, XLM has good performance with 12.2% and 53% profits respectively.