For the Bitcoin community of Europe, it is the time to rejoice!

In a historic ruling, The European Union’s Court of Justice has said that the Bitcoin exchanges that transfer conventional currencies such as Euros or Swedish Krona into Bitcoin are exempt from value-added taxes.

The story behind the ruling is pretty interesting as well! A Swedish national David Hedqvist applied for operating his online Bitcoin exchange. However, the application ran into trouble after the Swedish Tax Authority declared that VAT (Value-Added Tax) will be imposed on Bitcoin even when The Swedish Revenue Law Commission had classified it as VAT-exempt.

The ruling effectively means that “Bitcoin is a currency, not a commodity.”

The court said,

“Transactions to exchange traditional currencies for units of the Bitcoin virtual currency (and vice versa) constitute the supply of services” under the bloc’s law “since they consist of the exchange of different means of payment. As such they are exempt from value-added taxes.”

The court also said that this was due to EU’s own regulations that bar such taxes on transfers of “currency, bank notes and coins used as legal tender.”

This ruling will certainly help in building a consensus in future over the treatment of Bitcoin.

Richard Asquith, Vice President at tax compliance firm Avalara who welcomed the ruling and called it “the first step in securing Bitcoin’s future as a genuine alternative to national currencies.”

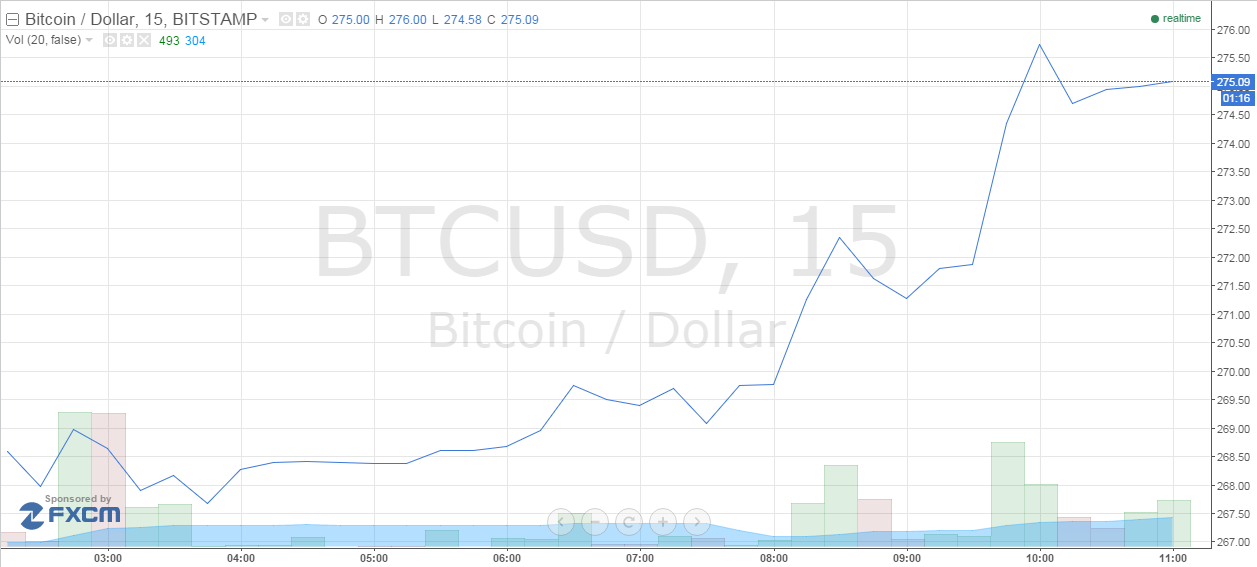

The good news has already taken the market by the storm and the bulls are on rampage mode, crushing the bears and catapulting the price to a fresh 10-week high of $276 (at the time of writing this report). See the chart below:

And the momentum is only going strong by the minute! We may even see Bitcoin scaling $280-290 on the back of this positive development.

Negative interest rates can solve national debt problem!

The federal government is the boss over the interest rates

they will pay on the federal government debt. You may think that the bankers or

the market call the shots but the boss is the federal government over their own

debt. They do not have to price to market, they can just print or issue

computer money to pay interest or redeem debt at maturity. Instead of

borrowing, they can issue money.

The current federal debt is structured with rates and due

dates that will be valid and paid at maturity.

The existing debt as it matures can be paid by either newly

printed cash or new zero or negative interest instruments. This change will be

structured over time but the end result will be the end of the federal debt

interest cost and the end of federal borrowing.

The rest of the credit market is free to make their own

deals at any rate of interest.

The official money of the United States is legal tender for

all debts public and private. All other money forms, Bit Coin types and money

issued by other countries or banks would have to be changed into US dollars to

compute and pay federal and state taxes and fees. Tax income would have to be

tied to expenditures to prevent inflation. It is not the business of taxpayers

to insure investors get a nice income on invested dollars.

The existence of the current huge federal debt, and the

implied interest costs that will have to be paid on that debt is largely

unknown by the general public. If the above changes were made the public and

investors would feel the pain of inflation earlier and place the blame on the

politicians that forgot that there is no free lunch.

The banks are now dealing with a new reality and are soon going to

understand they can’t take the technology and make a new

blockchain that includes them…because of who they are. Worse still,

the 2008 housing crisis made them rich and unpopular but it and along

with all the other illegal activities will be logged and continuously

available to audits. Traditional Banking may only work if it is in the

dark, not on a blockchain….they have survived on deniability too many

time. Their time is up!

Global M2 ( measure of the money supply) is

$60 trillion…..just divide that by 21 million Bitcoin and that is the

potential value of Bitcoin if it does become a global currency. And that

currency aspect may be nothing compared to the demand boost it will

have from the thousands of other uses.

Banks could conceivable come up with their own blockchain model.

They can’t. …fundamentally. because that will make it impossible for them to hide their activities and remove deniability….these banks can’t operate honestly.

So, in other words, they can.

Can the Banks use Bitvoin….Sure anyone can…you and I can van run our own Cryptocurrency and blockchain….but will this benefit us or will enough people use it….the answer for the bank is the same for letting a child play with a loaded gun…just not in anyone’s best interest. …not even themselves. …

It would be hard to tward government and audits and impossible to manupulate the markets without clearly exposing their hands in it….deniability anduditslone has been the key ingredient in every one of the hundreds of federal crimes these bankers committed since 2008…..

I can’t argue with that. Mostly because it’s a bunch of vapid nebulous nonsensical generalizations that attempt to obfuscate your admission that banks could in fact make and use their own blockchain model.

Ironically I gave reasons for my nonsense. ..you simply left your remarks unsupported….

Do you understand how debates work?

What do you expect? For someone to simply believe you if you have a clever insult?

There’s no debate, you already admitted they could do it. There’s nothing left for me to support, we already agree I’m right.

You going on and saying that even though they could, they really couldn’t because, and I’m paraphrasing, ‘all banks are liars and blockchain is a public ledger’ is, as I said, a nebulous generalization with no real meaning.

Pointing out the weakness of your argument wasn’t an insult, it was a matter-of-fact statement that you’ve already backtracked and admitted you were incorrect, but are trying to somehow make it seem like you really were right.

The only point of contention would then be “is every bank out there trying to commit and hide illegal activity?”. I think it’s pretty clear that, no, not every single one is. Hence, they could conceivably use a blockchain solution. What else is left to debate?