Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

We’ve heard from Goldman Sachs before on the topic of bitcoin. In late February, the multinational investment bank issued an early assessment of the digital currency in a document released to clients.

We’ve heard from Goldman Sachs before on the topic of bitcoin. In late February, the multinational investment bank issued an early assessment of the digital currency in a document released to clients.

The company has followed-up with a new 25-page report put together by their own Allison Nathan, and they aren’t exactly doing any sugarcoating, as pointed out by Business Insider this morning.

Goldman Sachs reportedly polled its own internal research groups to look into the beneficial uses bitcoin users say exist, and each group basically said the same thing: it’s too volatile.

Dominic Wilson and Jose Ursua, who work at Goldman’s markets research group said that bitcoin does not meet the criteria necessary to be considered a “viable” currency.

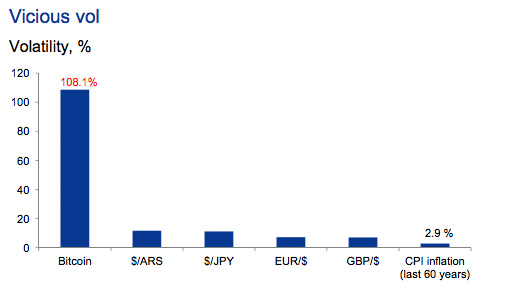

For most users what matters is not the comparison with other currencies, but a comparison with the volatility of the currency that they hold (dollars in the US for instance) in terms of the things that they need to buy. The volatility of consumer prices (in dollars) has been even lower than FX rates, even if measured over a period including the 1970s. Put simply, if you hold cash today in most developed countries, you know within a few percentage points what you will be able to buy with it a day, a week or a year from now.

The following graph illustrating bitcoin’s volatility compared to other currencies (and U.S. inflation) was included.

And while both Wilson and Ursua acknowledge that the bitcoin technology might change the art of transacting as we know it, bitcoin’s future is uncertain. They noted that “If a ledger-based technology is to succeed, the cyber-currency would very likely have to have some type of fixed exchange rate in order to overcome this obstacle.”

Jeff Currie, who leads the firm’s commodities research group also acknowledged bitcoin’s volatility, noting that “inconsistent demand” is a major factor in the wildly fluctuating value of the digital currency.

Roman Leal of Goldman’s IT services group said that bitcoin transactions have cost advantages over traditional methods like wire transfers, but there’s nothing stopping a “more established player” from adopting the advantages brought forth by bitcoin. He also added that regulation could also put a damper on some of the cost advantages bitcoin offers.

“Just as a flurry of new entrants – such as Square, Groupon, and PayPal – encouraged payment networks and payment processors to develop a mobile payments strategy, we expect traditional payment players to develop digital currency strategies,” he wrote.

The report also included an interview with law professor Eric Posner, who doesn’t quite feel comfortable with the way the network is controlled (bold emphasis ours):

The people who maintain the Bitcoin network can change the money supply through a majoritarian process. And that means that the supply of bitcoin is a function of what the majority of these people think at any given time. They are not economists or monetary experts, but technology and programming experts, and entrepreneurs. I find that unsettling and I think most people would feel the same way.

Goldman Sachs concludes that “bitcoin likely can’t work as a currency, but some sense that the ledger- based technology that underlies it could hold promise.”

What say you?

[source: Business Insider]

Well, they would say that wouldn’t they. Volatility will drop as liquidity increases. Liquidity will increase as acceptance increases – they’d just like to be in on the act, but they’re likely too late. A new cryptcy introduced by the banks would be shunned.

Their definition of currency is something that can be manipulated. So yeah, to them. not a currency. To everyone else.. yep, sure is.