Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Former FTX CEO Sam Bankman-Fried (SBF) is facing a new slate of bank fraud charges this week, including the likes of conspiracy to operate an unlicensed money-transmitting business and conspiracy to commit bank fraud.

A newly-released indictment filed on Thursday likely confirms many outstanding suspicions that have existed in the crypto community over the past few months, and introduces a few new interesting pieces of detail as well.

Let’s take a look at the quick nuggets of information available to us from this 39-page document.

The Charges Against SBF Grow

The indictment, labeled a ‘superseding indictment,’ adds a total of four new charges from the Southern District of New York’s attorney’s office. The new indictment brings SBF’s total charges up to a dozen.

Much of what’s been chronicled in this saga to date has been reinforced, including the DoJ’s assessment around FTX’s co-mingling of funds with Alameda Research, details around SBF’s political donations, and more.

However, there’s also more fine details released around some of these elements that are worth reviewing.

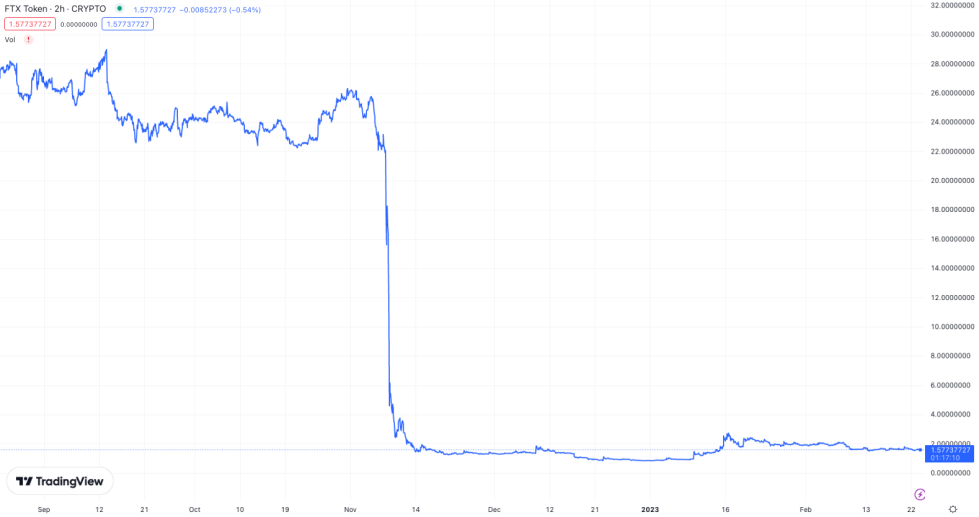

FTX's platform, FTT, went down with the ship when FTX collapsed in November. | Source: FTT-USD on TradingView.com

New Highlights

The 39-page indictment is jam packed with pieces of interesting information. Here’s some of the bits that we found especially interesting and insightful that haven’t generally been included in the major talking points over recent months:

- Political Donations: It’s been widely known that SBF donated north of $40M to Democratically-leaning political action committees (PACs). In a previous interview with reporter Tiffany Fong, SBF stated that he donated a similar amount to Republican-leaning PACs, but kept those donations under wraps as “dark” donations to avoid public scrutiny. The updated indictment provides more detail and insight, outlining how SBF utilized an unknown individual – labeled “CC-1” in the docket – to facilitate many of those donations. The indictment added, however, that in “dozens of instances… [SBF]’s use of straw donors allowed him to evade contribution limits on individual donations to candidates to whom he had already donated.”

- FTX was “not a legitimate business”: Early in the document, the court proclaims that SBF’s FTX was “not focused on investor or client protection, nor was it the legitimate business that [SBF] claimed it was.”

- Your tweets may be used against you: In a court of law, your tweet can be used against you. In the indictment, a tweet from SBF co-conspirator Caroline Ellison referencing financials stated that “… the balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there.” The indictment notates that the tweet was misleading and alludes to a misappropriation of funds.

- BTC & ETH referenced as securities: Interestingly, page 20 of the document states that SBF “caused significant negative price impact on the value of commodities in interstate commerce in the United States, including bitcoin and ether spot and future prices.”