Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

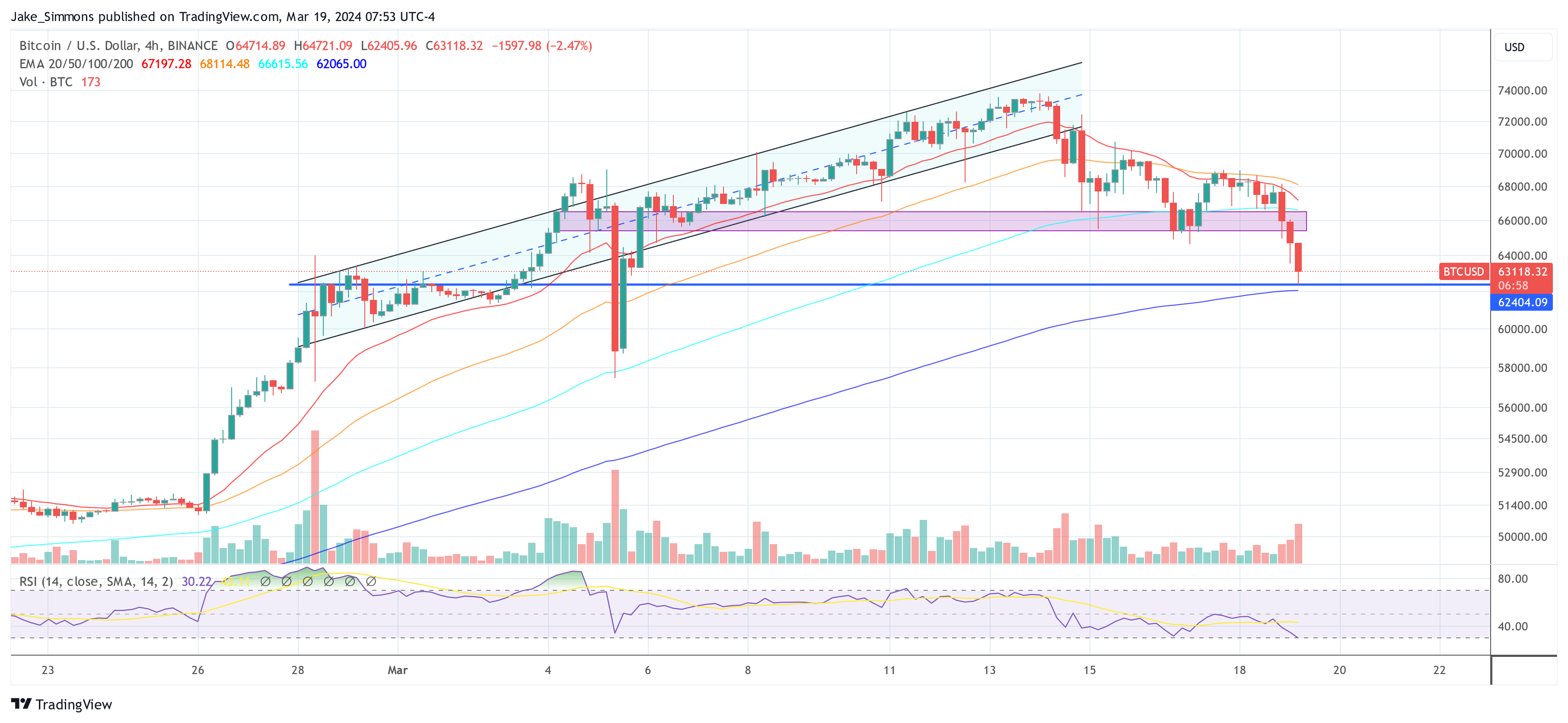

In the lead-up to the Federal Open Market Committee (FOMC) meeting scheduled for Wednesday, March 20, the Bitcoin and crypto market is experiencing a severe downtrend. BTC price has plunged roughly -10% in the past two days, and Ethereum (ETH) is down -12% in the same period.

The anticipation surrounding the Fed’s stance on interest rates has heightened in the wake of recent economic indicators, including unexpected spikes in the US Consumer Price Index (CPI) and Producer Price Index (PPI), stirring volatility across markets, including digital assets.

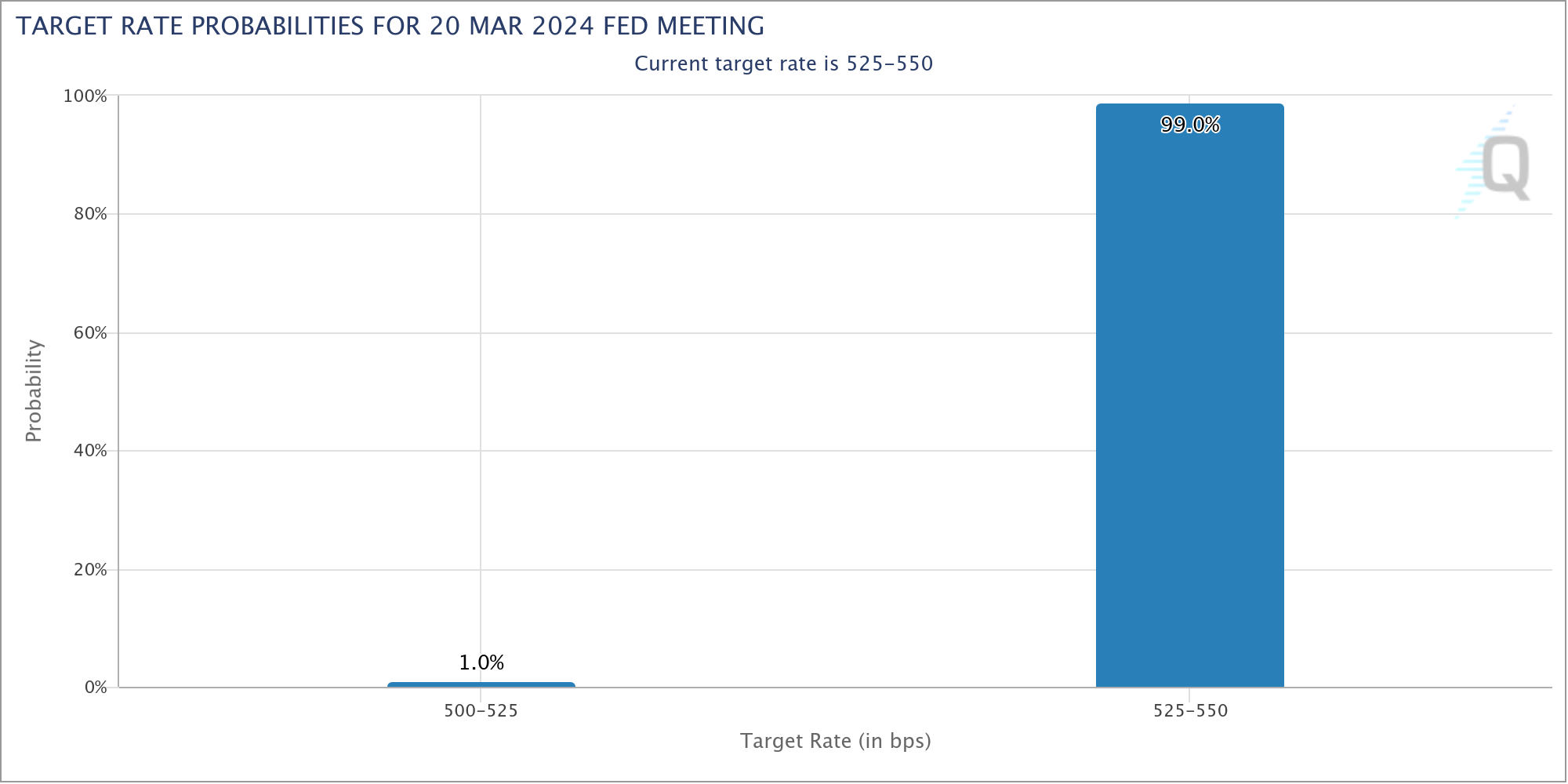

The consensus, with a 99% probability according to the CME FedWatch tool, suggests interest rates will hold steady. Nonetheless, the spotlight turns to the Fed’s dot plot, a graphical representation of the individual members’ expectations for future interest rates, which could provide crucial insights into the monetary policy outlook for the coming months and years.

Anna Wong, Chief US Economist for Bloomberg, remarked via X (formerly Twitter), “Another reason why FOMC [is] not ready to cut: members not yet of broad agreement of that need. Here’s visualizing the dispersion of FOMC views with the help of our new weekly NLP Fed spectrometer. “

Another reason why FOMC not ready to cut: members not yet of broad agreement of that need. Here’s visualizing the dispersion of FOMC views with the help of our new weekly NLP Fed spectrometer. (Interactive version at @TheTerminal BECO models —> Fedspeak —> spectrometer) pic.twitter.com/Kney89BERM

— Anna Wong (@AnnaEconomist) March 19, 2024

How Will Bitcoin And Crypto React?

Macro analyst Ted, expressing his perspective on X, underscores the nuanced relationship between macroeconomic trends and the crypto market at the moment. Ted elucidated that spot Bitcoin ETF flows have taken the backseat while macro factors came to the foreground.

He stated via X, “If BTC is to be considered digital gold, it’s expected to mirror gold’s market movements, albeit with a higher degree of volatility. In the current climate, with the market bracing for the Fed’s upcoming meeting, macroeconomic factors momentarily take precedence, driven by recent developments in PPI and CPI figures.”

He further speculates that “Despite the eventual remarks from [Fed Chair] Powell, the market has already adopted a hawkish stance in anticipation of a ‘higher for longer’ interest rate scenario.”

Michaël van de Poppe, a noted figure in the crypto analysis domain, provided his insights on the recent downward price movement of Bitcoin via X, citing a mix of factors including the anticipation of the FOMC meeting and significant capital outflows from Grayscale‘s Bitcoin Trust. Van de Poppe advises, “It’s typically in these pre-FOMC periods, perceived as risk-off intervals, that the savvy investor finds opportunities to ‘buy the dip’.”

In a reflection of market sentiment adjustments, analyst @10delta on X pointed out the strategic positioning of investors in anticipation of the Fed’s rate decisions. “The market is currently pricing in a reversal to the November ’23 interest rate levels, a clear indication that investors are adjusting their expectations based on the Fed’s potential pivot signaled in the previous dot plot,” he noted.

Accordingly, he argues that the FOMC & dot plot will be a “buy the news” event as the market expectations are being properly adjusted. “The macro worries […] should dissipate & crypto idiosyncratic bullish factors, such as the ETF inflows […] as well as the BTC halving take hold. All considered I think there’s a good R/R for ‘buying the dip’ heading into the March 20 event,” the analyst added.

Goldman Sachs Predicts (Only) 3 Rate Cuts This Year

Goldman Sachs Research recently provided a detailed analysis in their March FOMC Preview. The report highlights the nuanced balance the Fed seeks to achieve between controlling inflation and supporting economic growth.

“Our revised forecast now anticipates three rate cuts in 2024, a slight adjustment from our previous prediction, primarily due to a modest uptick in the inflation trajectory,” Goldman Sachs analysts elucidated. They further speculate, “While the immediate focus is on maintaining current rate levels, the trajectory for rate cuts will hinge on inflation dynamics and economic performance indicators.”

Goldman Sachs further predicts that the Fed will still target a first cut in June. “This combined with a default pace of one cut per quarter implies that the most natural outcome for the median dot is to remain unchanged at 3 cuts or 4.625% for 2024,” the banking giant remarked.

Goldman: Inflation has been firmer in recent months, but we think it is still on track to fall enough by the June FOMC meeting for a first cut. pic.twitter.com/0I1BPYiU8W

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 17, 2024

As the crypto market and broader financial ecosystems await the outcomes of the FOMC meeting, the prevailing sentiment is one of cautious anticipation. Market participants are closely monitoring the Fed’s commentary for indications of future monetary policy directions via the dot plot.

The question for the Bitcoin and crypto market is whether there will be an unpleasant surprise or whether market participants were right with their “higher for longer” policy assumption.

At press time, BTC found support at the $62,400 price level, trading at $63,118.