With a rise in trading activity and almost 20% price increase in the previous week, Floki Inu (FLOKI), the Shiba Inu-inspired memecoin, has shot to prominence. Experts warn, meantime, that this “pup-ularity” could be fleeting and driven more by buzz than by solid underpinnings.

Open Interest Takes Off: Newcomers Flock To FLOKI

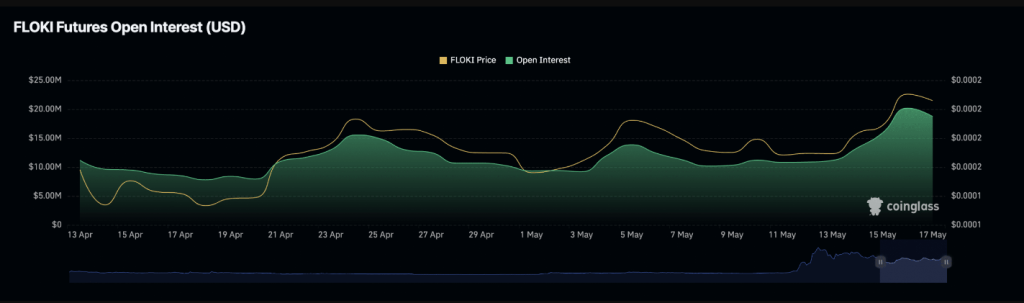

The rising Futures Open Interest for FLOKI is the main indicator inspiring enthusiasm. Reflecting the amount of existing futures contracts, Coinglass claims that this number has skyrocketed a startling 110% since May 1st, attaining a 30-day high almost $20 million. This implies a flood of fresh market players filling FLOKI slots, maybe expecting more price rises.

The notable increase in daily trading volume of FLOKI indicates fueling of the fire. Santiment reported daily volume on May 15th that exceeded $1 billion, the highest level FLOKI had seen since late March. This strong buying behaviour points to a rise in investor interest, which drives price increases.

Momentum Indicators Point To A Bullish Charge

Moreover supporting a positive FLOKI is the behaviour of its main momentum indicators. Currently comfortably above their neutral levels, at 62.68 and 65.37 respectively, both the Relative Strength Index (RSI) and the Money Flow Index (MFI). Said another way, these indicators imply that, near term, the price momentum favours more gains.

Benevolent on the surface, yet, there may be grounds for worry. An indication of the buying and selling pressure of an asset, the Chaikin Money Flow (CMF) presents a somewhat negative image.

Still In Negative Zone

Though price appreciation exists, FLOKI’s CMF is solidly in negative territory and right now ranges around -0.11. This implies that the buying pressure can be declining even if the price is rising.

Many times, this difference between price and buying pressure is interpreted as evidence of a possible reversal—that is, a rally motivated more by short-term speculation than by long-term investor confidence.

Although FLOKI’s current success is definitely outstanding, the underlying causes point to a maybe explosive future. Although the increase in open interest and trade volume suggests a market frenzy, the negative CMF raises questions about the sustainability of the spike.

Featured image from Floki, chart from TradingView