Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum prepares for a major upgrade that is set to transform the crypto-economic incentives on the entire network. The underlying consensus mechanism will transition from a proof-of-work (PoW) algorithm to proof-of-stake (PoS).

Such an upgrade is expected to solve some of the scalability issues that the protocol has faced throughout the years and it will also introduce staking rewards for ETH holders.

As speculation mounts around the upcoming hard fork that is scheduled for Q3 2020, demand for Ether is expected to rise substantially.

However, multiple on-chain metrics suggest that a massive resistance barrier lies ahead of the smart contracts giant.

Strong Supply Wall Ahead of Ethereum

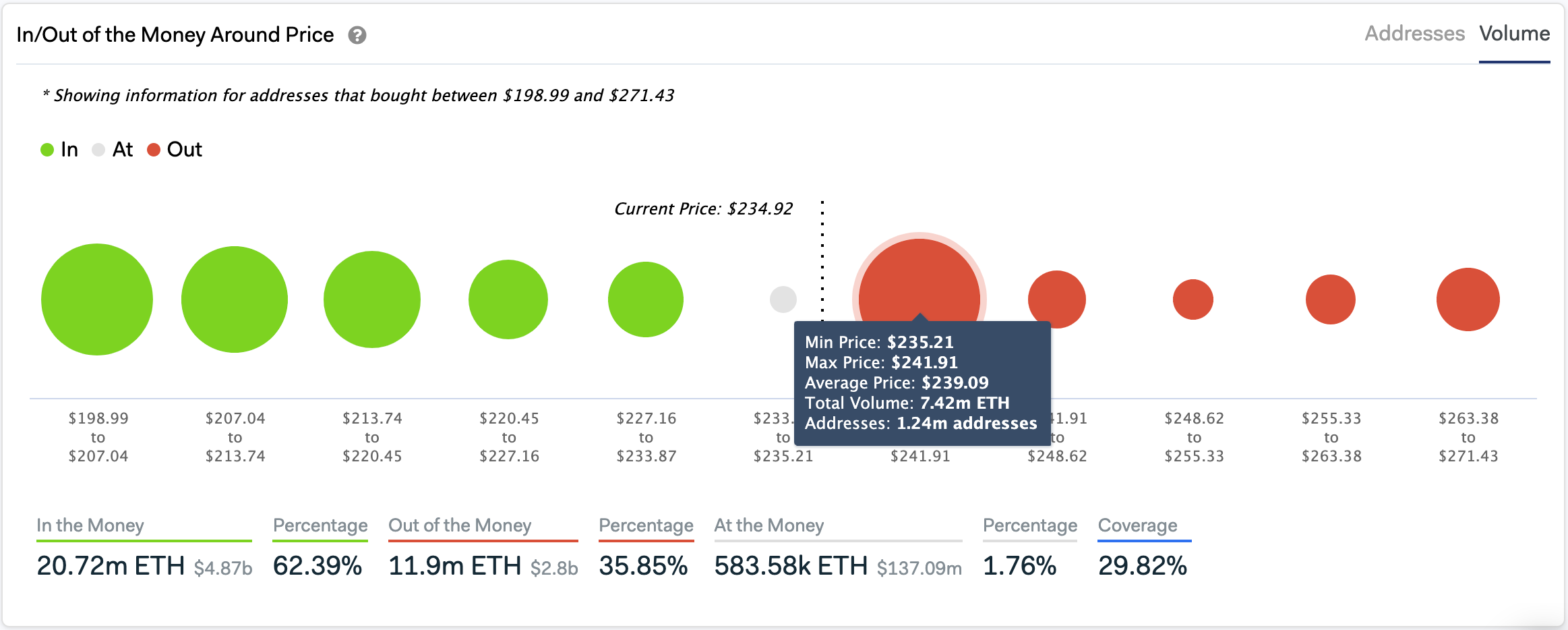

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals after the recent correction, bouncing off to higher highs will not be easy this time around.

Based on this on-chain metric, roughly 1.24 million addresses bought over 7.42 million ETH between $235 and $242. These price levels represent a significant barrier for the bulls to overcome since it may have the ability to absorb any upside pressure.

But, if demand for Ether shoots up allowing it to break above this supply wall, the outcome would amaze even the most skeptics.

Indeed, the IOMAP cohorts show that after this resistance level there isn’t any other major hurdle that will prevent a move towards $280.

Nonetheless, if the current support level fails to hold, the next significant barrier to watch out for sits around $204. Here, nearly 1.7 million addresses purchased more than 6 million ETH, according to the IOMAP.

Technical Indexes Call for a Rebound

From a technical perspective, Ethereum is contained within an ascending parallel channel that developed during the March market meltdown.

Since then, each time Ether rises to the upper boundary of the channel, it pulls down to hit the lower boundary, and from this point, it bounces back up again.

The recent bearish impulse that Ether went through allowed it to reach the bottom of the channel. If this support barrier continues to hold, ETH could surge to the middle or upper boundary of the channel like it has done it over the past three months.

Failing to do so, however, could jeopardize the bullish outlook and set it up for a steep decline.

Due to the ambiguous outlook that Ethereum presents, investors must take into consideration the support and resistance levels previously mentioned before entering any trade. Since on-chain metrics reveal strong resistance ahead while a technical pattern suggests that Ether has more room to go up, it is crucial to implement a robust risk management strategy.

The idea behind it is to avoid getting caught on the wrong side of the trend.