Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

With its second-largest market capitalization among cryptocurrencies, Ethereum finds itself in an odd place. The pricing battles for direction; its underlying network is seeing a boom of activity.

Ethereum Network Sees Increase In New Users

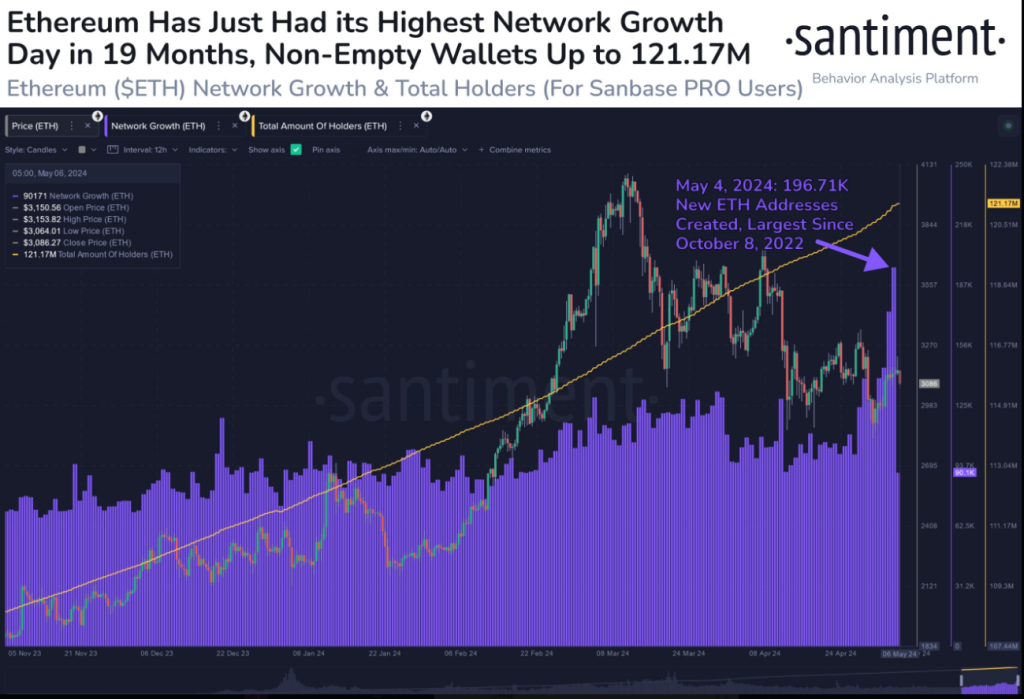

According to crypto data firm Santiment, May 4th saw a whopping 200,000 new Ethereum addresses created, marking the highest single-day growth in nearly two years.

Driven by elements like the expanding Decentralized Finance (DeFi) market and the always changing realm of Non-Fungible Tokens (NFTs), this spike points to a fresh curiosity in the Ethereum ecosystem.

📈 #Ethereum rebounded back above $3,200 this weekend, and saw massive network growth. 196.71K new addresses were created on the $ETH network on May 4, 2024, the largest single day of growth since October 8, 2022. This should be viewed as a #bullish sign. https://t.co/l9iFVWCJpE pic.twitter.com/MlHQTvKKN0

— Santiment (@santimentfeed) May 6, 2024

This network expansion is a positive indication of great and rising Ethereum interest, which could convert into large capital inflows whenever macroeconomic conditions turn more favorable.

Is The Price Dip A Buying Opportunity?

While the network is flourishing, Ethereum’s price right now is $2,995, a 1.8% drop in past 24 hours. This takes it very near to sliding below its 200-day Exponential Moving Average (EMA), a technical signal sometimes seen as indicating negative momentum.

On closer inspection, though, one finds a perhaps optimistic twist. Along with the price reduction, trade volume declines could suggest a declining selling pressure. Such a situation has occasionally preceded a price reversal, in which case buyers re-enter the market and drive prices higher.

Total crypto market cap currently at $2.2 trillion. chart: TradingView

Investor Optimism Buoyed By Potential Fed Pivot

A dismal jobs report highlights the ongoing US economic weakness, which has spurred rumors that the Federal Reserve would lower interest rates. This might provide new liquidity to the market, so helping risky assets like cryptocurrency.

Analysts believe that a dovish Federal Reserve turn might completely transform Ethereum. Generally speaking, lower interest rates make owning cryptocurrency more appealing than classic fixed-income assets.

Ether seven-day price action. Source: CoinMarketCap

Ethereum’s future road is yet unknown. The pricing presents immediate difficulties even if the principles of the network seem strong. Managing this complicated situation will call for investors to give great thought to the on-chain activity as well as the larger economic scene.

Regulation and Innovation: Key Factors to Watch

Attracting institutional investors, a possible driver of major price increase, would surely depend critically on regulatory certainty around cryptocurrencies.

Featured image from Book My Flight, chart from TradingView