Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows Ethereum has just 66% of its holders in profit despite the 21% rally the cryptocurrency has seen over the past week.

Ethereum Holders In Profit Still At Relatively Low Level

According to data from the market intelligence platform IntoTheBlock, the recent downturn in Ethereum has significantly affected the profitability ratio of holders on the network.

In the drawdown, the ETH price had slipped from the $3,400 high near the end of July to the $2,100 level about a week ago. Since then, though, the coin has seen a sharp rebound to above the $2,700 mark.

The recovery should mean that some investors lost due to the crash would be back in profits now. Still, as IntoTheBlock notes, only 66% of the holders are currently carrying gains, implying that the profitability ratio is yet to see a notable improvement.

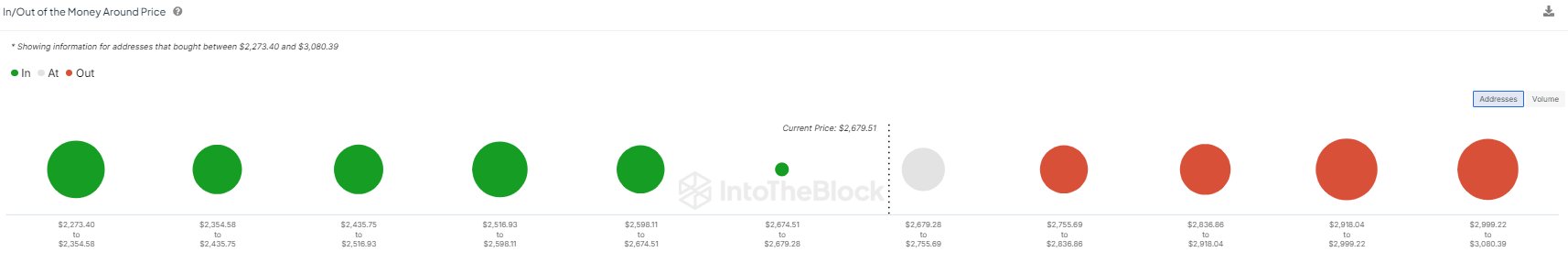

The analytics firm has shared a chart showing how the price ranges near the current one regarding the number of investors who bought at them.

In the graph, the size of the dot correlates to the number of holders whose cost basis is between the corresponding price range. It would appear that many investors bought between the $2,920 to $3,000 and 3,000 to $3,080 ranges.

Naturally, these investors would lose right now due to the asset’s spot price being below these ranges. Some holders like these who are at a loss look forward to the asset rising back to their cost basis to exit the market and get their money back. Such selling can provide resistance to the coin.

This selling is usually not of a scale that can impede Ethereum. Still, when many investors share their cost basis inside the same narrow range, the chances of a significant selloff rise. Thus, the aforementioned price ranges can obstruct ETH’s recovery should it proceed that far.

Another risk to any rally is profit-taking, but as just 66% of the investors are in profits right now, the risk of a selloff happening with this motive may not be high, especially given that the coin may have already washed out a lot of weak hands during the crash.

In some other news, as analyst Ali Martinez has explained in an X post, Ethereum has just seen a Tom Demark (TD) Sequential sell signal on its hourly chart.

Given this signal, it’s possible that Ethereum could end up witnessing a decline, although its scale may not be anything too large considering the short timeframe of the chart.

ETH Price

At the time of writing, Ethereum is trading at around $2,700, up more than 2% over the past 24 hours.