Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

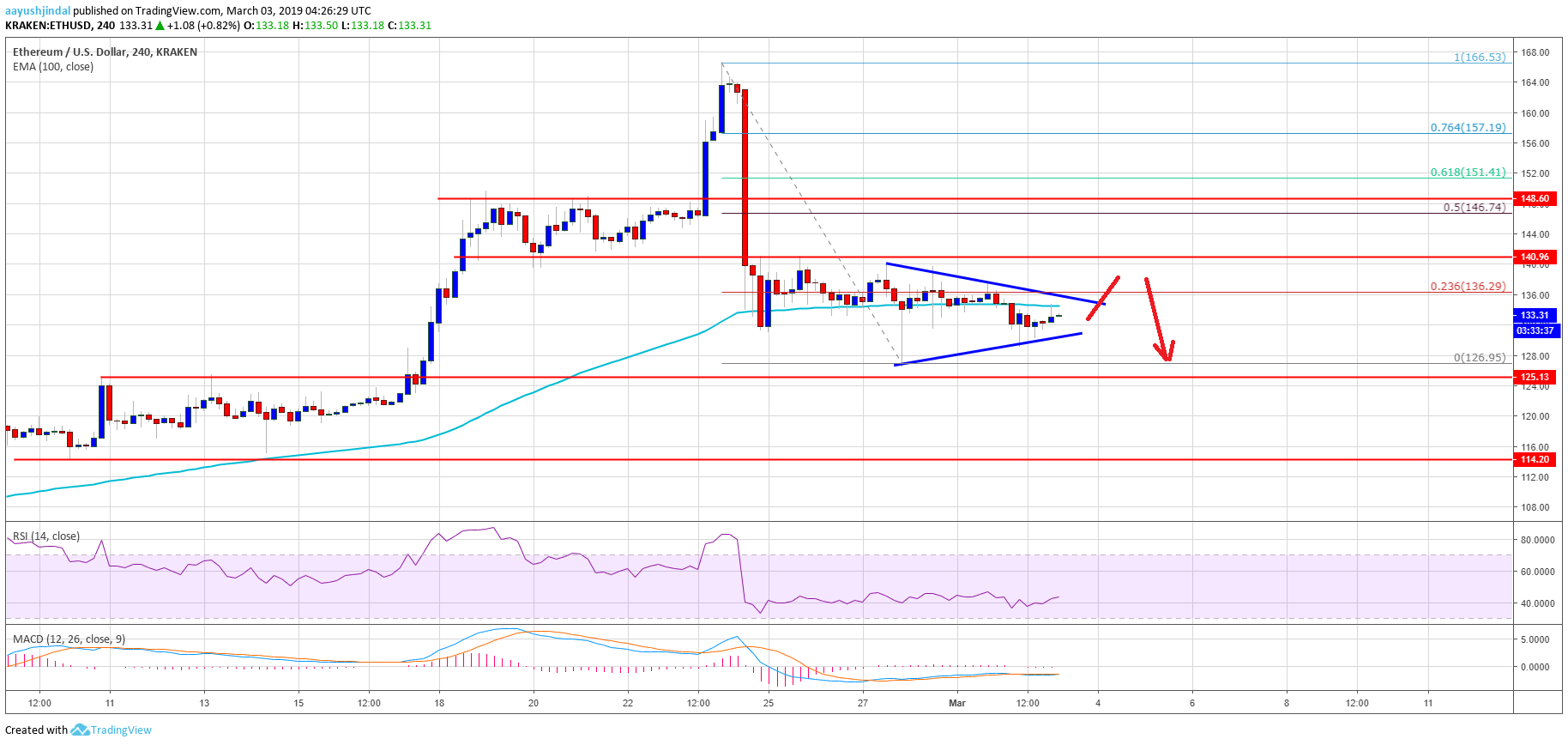

- ETH price traded below the key $139-140 resistance area for many sessions against the US Dollar.

- The price is trading with a bearish bias and there could be a few downward spikes towards $125.

- There is a key contracting triangle in place with resistance at $136 on the 4-hours chart of ETH/USD (data feed via Kraken).

- The pair could trade higher, but as long as it is below $140, it is likely to dip towards $125 or $124.

Ethereum price is struggling to gain bullish momentum versus the US Dollar and Bitcoin. ETH/USD could extend losses if it continues to trade below the $139-140 resistance area.

Ethereum Price Analysis

This past week, there were many attempts by ETH price to break the $139-140 resistance against the US Dollar. The ETH/USD pair failed to clear the $140 resistance and started trading in a range. However, most moves were bearish and the price declined below the $134 and $130 support levels. A new weekly low was formed at $127 and later the price recovered above the $130 level. There was even a break above the $135 level and the 100 simple moving average (4-hours).

Buyers pushed the price above the 23.6% Fib retracement level of the last decline from the $166 high to $127 low. However, the upside failed near the $137-138 zone. Later, the price dipped below the $135 level and the 100 simple moving average (4-hours). At the moment, there is a key contracting triangle in place with resistance at $136 on the 4-hours chart of ETH/USD. The pair could spike above the triangle resistance and revisit the $140 resistance area. Above $140, the next key resistance is near the $146 level. It represents the 50% Fib retracement level of the last decline from the $166 high to $127 low.

Having said that, a break above the $139 and $140 resistance levels won’t be easy. If there is a downside break, the price could decline below the last swing low at $127. The main support below $127 is near the $125 level, which acted as a solid resistance earlier. Below $125, the price could slide towards the $114 swing low in the near term.

The above chart indicates that ETH price is consolidating in a broad range below the $140 resistance. In the short term, there could be swing moves, but it seems like the price could revisit the $125 support level.

Technical Indicators

4 hours MACD – The MACD for ETH/USD is slowly gaining pace in the bearish zone.

4 hours RSI – The RSI for ETH/USD is currently moving higher towards the 50 level, with a positive angle.

Major Support Level – $125

Major Resistance Level – $139