Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin, the Shiba Inu-themed bitcoin that erupted on the internet in 2021, has had a rocky ride recently. After a week of adjustments, DOGE seems to be clawing back; some analysts believe this could be getting ready for a repeat of past success.

Echoes Of Bull Runs Past

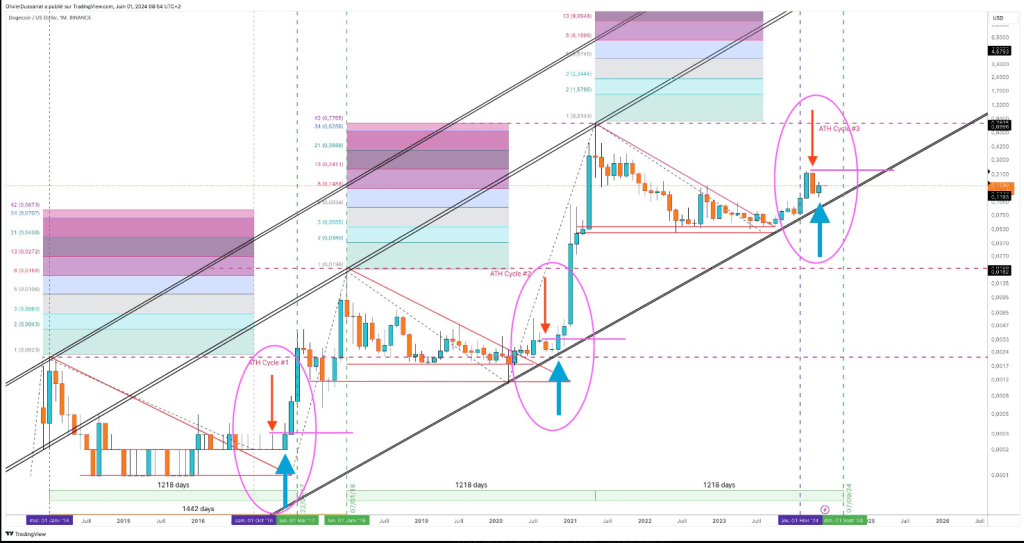

Hope for Dogecoin depends on a newly discovered trend reflecting its 2016 and 2020 behaviour. A similar pricing pattern existed back then before notable bull runs drove DOGE to unprecedented heights. For DOGE holders, this revelation has sparked a ray of hope; other analysts project a similar result in the next weeks or months.

#Doge monthly : it’s just a symphony !#dogecoin $DOGEUSD #XD #FTW #PeopleCurrency #ThisIsTheWay @xpayments 𝕏Ð pic.twitter.com/bPiPcNTH3l

— Olivier Ð 𝕏 (@Dark64) June 1, 2024

Technically, things seem to be in line for a possible explosion. Indicators of purchasing and selling pressure, the Chaikin Money Flow (CMF) and Relative Strength Index (RSI), show both positive trends that point to rising market confidence.

Technically, things seem to be in line for a possible explosion. Indicators of purchasing and selling pressure, the Chaikin Money Flow (CMF) and Relative Strength Index (RSI), show both positive trends that point to rising market confidence.

Short-Term Blues And Bearish Whispers

For Dogecoin, meanwhile, not all indicators lead towards sunlight and rainbows. Though prices have lately increased, the general attitude of the market on DOGE is still somewhat negative.

This hostility shows up in a notable drop in weighted sentiment, a gauge of the general tone of coin-related social media comments.

Tracking the number of references DOGE gets online, social volume has also declined recently, indicating declining community interest.

Moreover, short-term indicators such as trade volume and speed present alarming picture. Over the past week, trading volume—that is, the frequency of DOGE bought and sold—has dropped significantly.

Dogecoin Price Prediction

Technical indicators for Dogecoin are pointing bearish although a recent run with 43% positive days and rather low volatility is under progress. By July 4th, the present projection is for a price decline of more than 13%, landing at $0.135.

This suggests a possible gap between market psychology and objective technical analysis since the great “Greed” feeling of 73 on the Fear & Greed Index points against this.

Featured image from Carrie Glenn, chart from TradingView