Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Riding a wave of hope lately is the meme-inspired cryptocurrency known as Dogecoin (DOGE), which boasts a devoted fanbase. Its price jumped almost 8% over the week, much to investors’ pleasure. But a recent action by a major DOGE holder clouds the future price path of this energetic dog.

Dogecoin Fueled By Market Bulls And Short Squeeze

DOGE has been contentedly waving its tail as the general attitude towards cryptocurrencies has been positive lately. The price rose significantly last week; the good times seemed to be rolling with a 3% increase over the past 24 hours alone.

This drove DOGE’s price to a happy $0.152, so lighting many investors who have been patiently waiting for a continuous ascent smiles back on their cheeks.

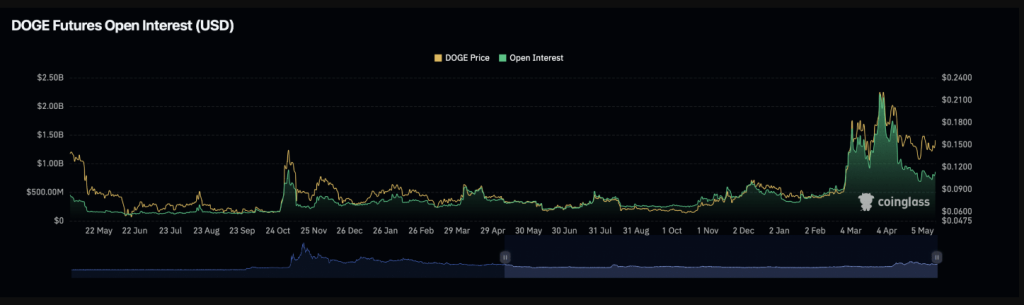

The party didn’t only occupy the spot market. With Dogecoin Futures open interest at a reasonable 9%, the derivatives market also saw a noteworthy increase in activity.

This points to traders, especially those trying to profit from possible price swings using futures contracts, showing a fresh curiosity.

Short sellers have been feeling the heat lately, fueling the fire. Coinglass claims they had experienced liquidations of a whopping $2.27 million.

This might set off a short squeeze, in which case short sellers have to purchase back DOGE to cover their positions, therefore driving the price higher. Still, this encouraging trend depends on whether it can overwhelm the possible selling pressure resulting from a recent whale movement.

Whale Alert: Big Transfer Sparks Speculation

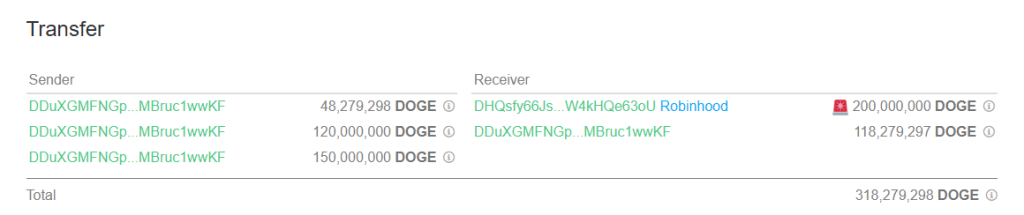

A deal involving a whale sent ripples of worry across the Dogecoin community, just as things were looking good for DOGE. Whale Alert’s data showed that the trading platform Robinhood received a shockingly 200 million DOGE, worth around $30.86 million.

This large action has drawn criticism since many believe the whale might be getting ready to pay out a sizable percentage of their ownership. A big sell-off could bring notable selling pressure, hence possibly deraying DOGE’s present upward momentum.

Technical Analysis: Breaking Trends And Potential Pullbacks

Technically speaking, DOGE seems to be trying to buck its daily decline by peering behind the hood. For bulls, this is a favourable indicator of a possible change in market mood. Further investigation reveals that DOGE lately entered an order block, which has been driving continuous price rise.

Featured image from War History Online, chart from TradingView