Is that time of the year again, Bitcoin seems stuck in a never ending range while Layer-1 coins and other cryptocurrencies rally. The crypto market ended 2021 with important profits, but not with the bang everyone seemed to have been expecting.

Related Reading | TA: Why Ethereum Bulls Aim Fresh Rally Above $4K

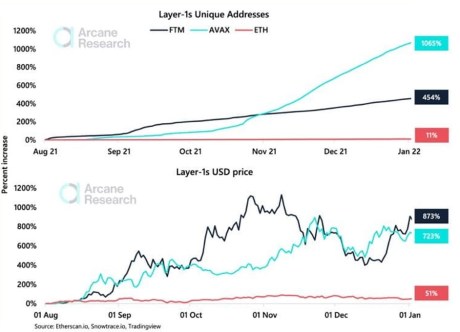

Arcane Research recorded important growth in Layer-1 coins, such as Fantom (FTM), and Avalanche (AVAX) as a result of a 2021 full of adoption. These cryptocurrencies experienced rallies over 15x against Ethereum (ETH) and took a portion of its market share.

Arcane Research claims the growing popularity in decentralized finances (DeFi), non-fungible tokens (NFTs), and the transaction fee increase on the Ethereum network. The latter phenomenon started in 2020 with the “Summer of DeFi”, the period that saw the biggest boom in DeFi users leading to an increase in network usage.

The proliferation of NFTs contributed with that issue and let layer-1 coins such as Binance Smart Chain (BSC), Solana (SOL), and others to onboard those users that were priced out of Ethereum. The same seems to be happening with Fantom and Avalanche. Arcane Research claimed the following:

As illustrated on the charts, the greater the number of users of a particular protocol, the more value it tends to attain. In other words, the hypothesis that a multi-year bear is lurking because altcoins have gone up too much requires some nuance.

The explosive growth in these layer-1 coins could followed a similar path as those cryptocurrencies that benefited for a short term only to see their use base decimated, or users could form communities and become permanent contributors with their expansion. In that sense, the implementation of second layer scalability solutions for Ethereum could become a threat for those projects.

A Multi-Chain Industry Supported By Layer-1 Cryptos

A separate report by Delphi Digital records a major growth in other layer-1 projects during 2021. Terra (LUNA) was one of the most important on those terms alongside Polygon (MATIC), a scalability platform for the Ethereum ecosystem.

In terms of total value lock (TVL), Terra saw a 356x increase while Polygon experienced a 17,100x increase in its TVL. As seen below, Fantom and Avalanche entered the top 10 blockchains by TVL but with a smaller increase that the aforementioned cryptocurrencies.

Despite its high transaction fees, and congestion issues Ethereum remained the largest network in terms of TVL during 2021 and preserved its dominance, for the time being. When analyzing the biggest protocols by TVL, it is interesting to find Lido Finance and Multichain, as Delphi Digital claimed, two platforms with interoperable and cross-chain capabilities.

This could hint at a future where Ethereum and layer-1 coins find themselves in an equal field as users turn to the latter in search of a more cost-efficient ecosystem, and cross-chain features.

Related Reading | TA: Ethereum Plunges After Rejection: Technicals Remain Bullish

As of press time, ETH trades at $3,811 with a 1% loss in the past day.