Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Via its Twitter handle Alpha Finance Lab has announced the relaunch of Alpha Homora in its second iteration. To be deployed on Ethereum, the team behind this DeFi protocol has called the event a “milestone towards our mission to build and incubate an innovative Alpha ecosystem”.

After the launch, Alpha Homora’s ecosystem could see an important rise in adoption and growth for the platform, as the official post claims. Also, there will be a new set of partnerships already in discussion, amongst them Polygon for integration with its second layer solution and multi-chain platform, more protocol fees for ALPHA holders.

Users of Alpha Homora will benefit immediately after the launch with new features. Yield farmers will be able to leverage more pools on decentralized exchanges (DEX) Uniswap and Sushiswap. As a bonus, protocols Curve and Balancer will offer more opportunities to maximize profits for yield farmers and liquidity providers. Both users will have leverage available, according to Alpha Finance Lab:

The scalable architecture of Alpha Homora V2 means the platform can accommodate more leveraged pools than Alpha Homora v1. Furthermore, these extra leveraged pools will include stablecoin-based pools and many more, meaning leveraged pools will no longer be just ETH-based.

In addition, Alpha Homora v2 will integrate more assets, besides ETH and stablecoins USDT and USDC, to yield farm, provide liquidity, and borrow. Alpha Finance Lab is yet to announce which assets specifically will be available. The team adds the following:

from the yield farming side, the relaunch of Alpha Homora V2 will allow leveraged yield farmers/liquidity providers to use LP tokens as collateral! The ‘Bring Your Own LP’ (BYOLP) tokens feature supports LP tokens from Uniswap V2, SushiSwap, Curve, and Balancer.

Alpha v2 will use base and derivatives tokens, offer lenders new opportunities to increase capital efficiency with ibTokensV2. The protocol will operate with an oracle aggregator contracts. Therefore, they will feed their platform with multiple trusted oracle providers. DeFiance Capital’s Wangarian said the following on Alpha Finance Lab new product and its benefits for the users:

Users can now maximize the potential that leveraged yield farming provides without obtaining unnecessary short exposure. I am confident that traction for Alpha’s products will regain momentum.

Alpha Homora’s Migration From v1 To v2

Upon its launch, the protocol’s second iteration will go through a migration process. In that way, the positions and liquidity in the first iteration will be moved to the new platform. Alpha Finance Lab claims there will be a “smooth” transition for users.

Finally, the new version of these products is expected to provide an “enhanced” experience, “improved” security, and other features. The products, according to the team, will capture the demand not met in the traditional financial system.

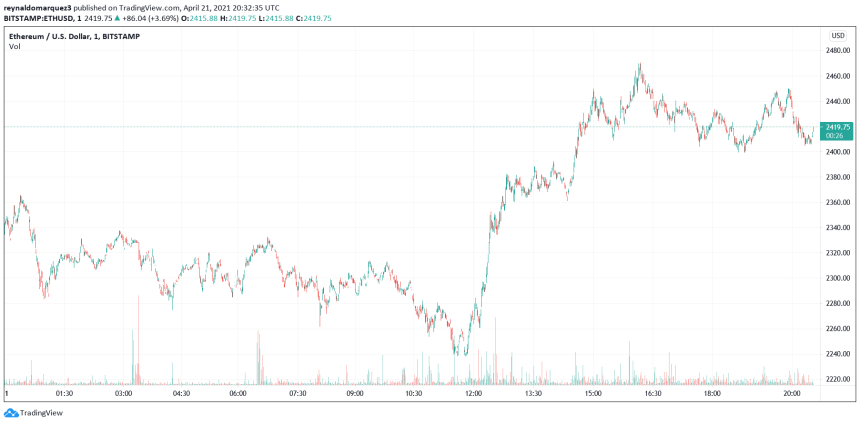

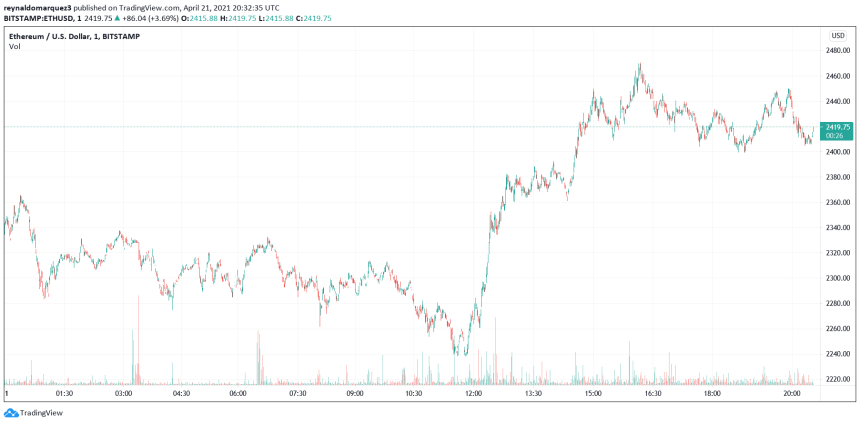

ETH is trading at $2.409,66 with a 3.6% profit in the daily chart. In the weekly chart, ETH has 4.6% profit and 34.6% in the past month.

Via its Twitter handle Alpha Finance Lab has announced the relaunch of Alpha Homora in its second iteration. To be deployed on Ethereum, the team behind this DeFi protocol has called the event a “milestone towards our mission to build and incubate an innovative Alpha ecosystem”.

After the launch, Alpha Homora’s ecosystem could see an important rise in adoption and growth for the platform, as the official post claims. Also, there will be a new set of partnerships already in discussion, amongst them Polygon for integration with its second layer solution and multi-chain platform, more protocol fees for ALPHA holders.

Users of Alpha Homora will benefit immediately after the launch with new features. Yield farmers will be able to leverage more pools on decentralized exchanges (DEX) Uniswap and Sushiswap. As a bonus, protocols Curve and Balancer will offer more opportunities to maximize profits for yield farmers and liquidity providers. Both users will have leverage available, according to Alpha Finance Lab:

The scalable architecture of Alpha Homora V2 means the platform can accommodate more leveraged pools than Alpha Homora v1. Furthermore, these extra leveraged pools will include stablecoin-based pools and many more, meaning leveraged pools will no longer be just ETH-based.

In addition, Alpha Homora v2 will integrate more assets, besides ETH and stablecoins USDT and USDC, to yield farm, provide liquidity, and borrow. Alpha Finance Lab is yet to announce which assets specifically will be available. The team adds the following:

from the yield farming side, the relaunch of Alpha Homora V2 will allow leveraged yield farmers/liquidity providers to use LP tokens as collateral! The ‘Bring Your Own LP’ (BYOLP) tokens feature supports LP tokens from Uniswap V2, SushiSwap, Curve, and Balancer.

Alpha v2 will use base and derivatives tokens, offer lenders new opportunities to increase capital efficiency with ibTokensV2. The protocol will operate with an oracle aggregator contracts. Therefore, they will feed their platform with multiple trusted oracle providers. DeFiance Capital’s Wangarian said the following on Alpha Finance Lab new product and its benefits for the users:

Users can now maximize the potential that leveraged yield farming provides without obtaining unnecessary short exposure. I am confident that traction for Alpha’s products will regain momentum.

Alpha Homora’s Migration From v1 To v2

Upon its launch, the protocol’s second iteration will go through a migration process. In that way, the positions and liquidity in the first iteration will be moved to the new platform. Alpha Finance Lab claims there will be a “smooth” transition for users.

Finally, the new version of these products is expected to provide an “enhanced” experience, “improved” security, and other features. The products, according to the team, will capture the demand not met in the traditional financial system.

ETH is trading at $2.409,66 with a 3.6% profit in the daily chart. In the weekly chart, ETH has 4.6% profit and 34.6% in the past month.