Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

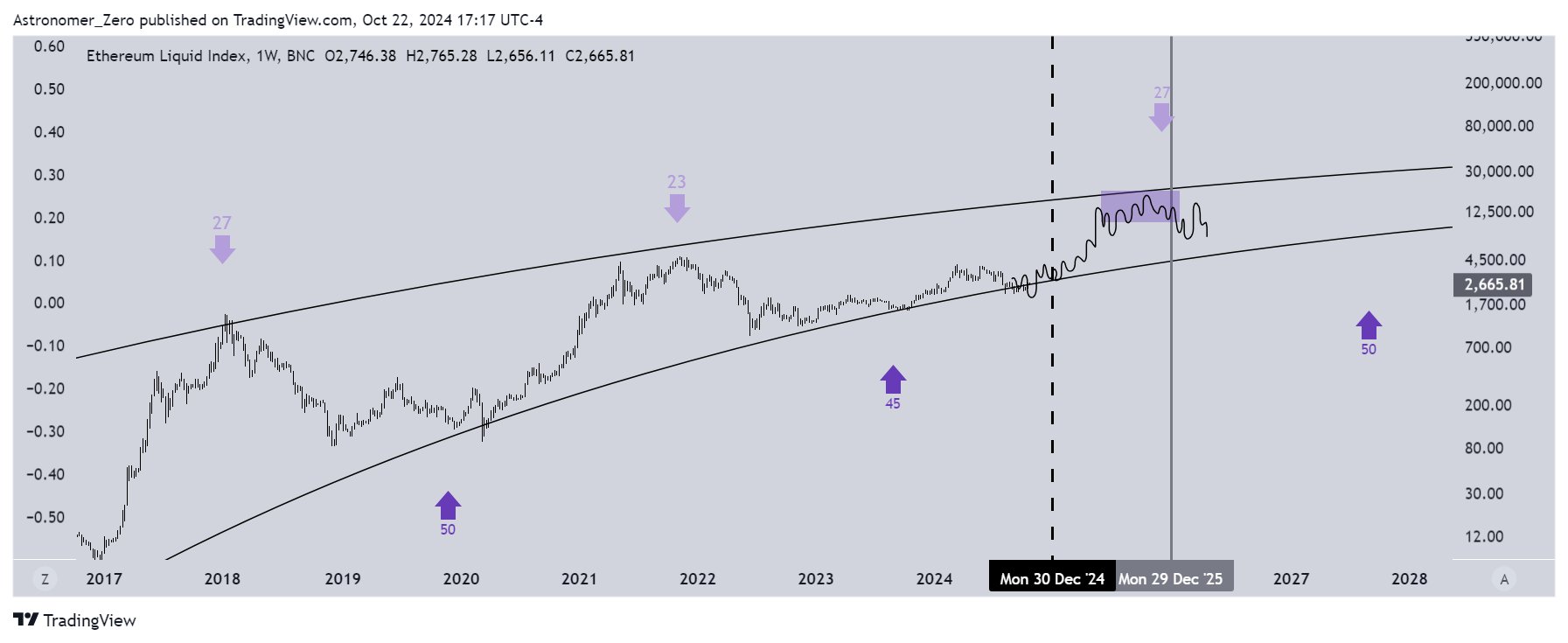

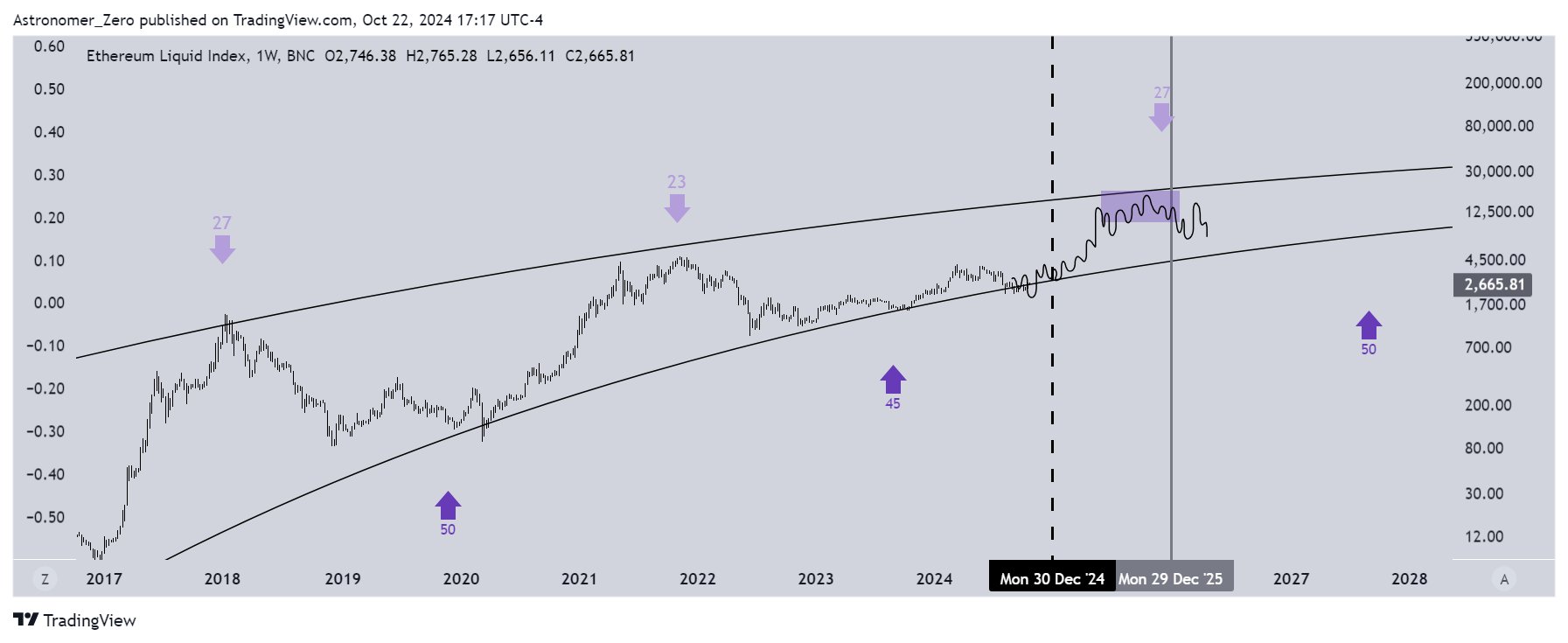

In an analysis shared on X, crypto analyst Astronomer (@astronomer_zero) has provided an in-depth macro outlook on Bitcoin (BTC) and Ethereum (ETH), suggesting that the next significant market peak—and potentially the ideal time to “sell it all”—may occur in the second half of 2025.

“Another month and a half has passed, and the full macro breakout thesis is really pushing many eyes onto the crypto charts now,” Astronomer states. Reflecting on his earlier predictions, he notes, “Last time we posted our plan of a Q4 upside breakout, BTC was at $58k and ETH was at $2.3k.” Since then, Bitcoin has risen by 20% and Ethereum by 13%, moves that occurred “against all the low timeframe technical analysis users’ belief, before the full breakout even happened.”

When Will This Crypto Bull Run End?

Astronomer emphasizes that traditional order flow and price action analysis are less effective on higher time frames, leading him to seek “edge elsewhere” through multiple data analyses. “We had our thesis in place, with multiple data analyses supporting not only that the low is in, but also that we likely would see a high timeframe breakout,” he explains.

Delving into Bitcoin’s macro perspective, Astronomer uses a combination of time, sentiment, and volume to identify weekly cycle lows. “The Middle East capitulation event [Israel-Iran tensions] clearly formed that, timed well 28 weeks after the previous weekly cycle low,” he observes. With the next weekly low not expected until late December, he sees “still room for upside” and anticipates that “price [will] accelerate here.”

Addressing market psychology, he cautions, “The market always finds a way to escape on the low timeframes as most traders (‘investors’) find themselves trapped into short term memory fallacy and simply forget the high timeframe picture.” Astronomer remains confident in his projection, stating, “Overall peak is still expected in the second half of 2025, where I think the true time to ‘sell it all’ may occur.”

For Ethereum, Astronomer notes a similar but compressed cyclical pattern compared to Bitcoin. “ETH typically drops later near the 4-year cycle peaks (2014, 2018, 2022) and has its surge also later in the 4-year cycle (2016, 2020), making its moves seem more aggressive,” he explained.

He also addresses the current sentiment towards Ethereum and other layer-1 protocols: “It’s clear by now that ‘useful’ coins are deemed ‘useless’, typical things called for when price doesn’t move. Yet anyone who even remotely used ETH knows what it can do.” Astronomer attributes the stagnation in utility growth to cyclical and sentimental factors, noting, “We’ve seen massive hype around it in 2021 and that simply hasn’t been digested yet.”

While maintaining a bullish outlook, Astronomer acknowledges the possibility of unforeseen events that could disrupt the market. “Despite all the data, there still always is a small chance I’m wrong,” he admitted. Citing potential global crises like “World War 3 (WW3)” or “the end of a nation,” he warns that such events “can always pull down the market significantly,” potentially causing Bitcoin to drop “back below $50k.”

However, he remains steadfast in his strategy: “Cycles are powerful in nature, and we’ve shown why those events shouldn’t faze you. I will indeed hold on in that case, hedged with large shorts well timed and just continue to ride out the cycle as I do think price will recover from there.”

Overall, the analyst cautions traders against losing sight of the broader picture due to short-term market movements: “You’ll start to question why… But so far, so good.” When asked by a user, “Wow! You think BTC could hit $350k? That’s incredible!”, Astronomer clarified his position: “I don’t think so. Optical illusion on the chart. It’s more $150-200k I think we can reach.”

At press time, BTC traded at $66,475.