Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

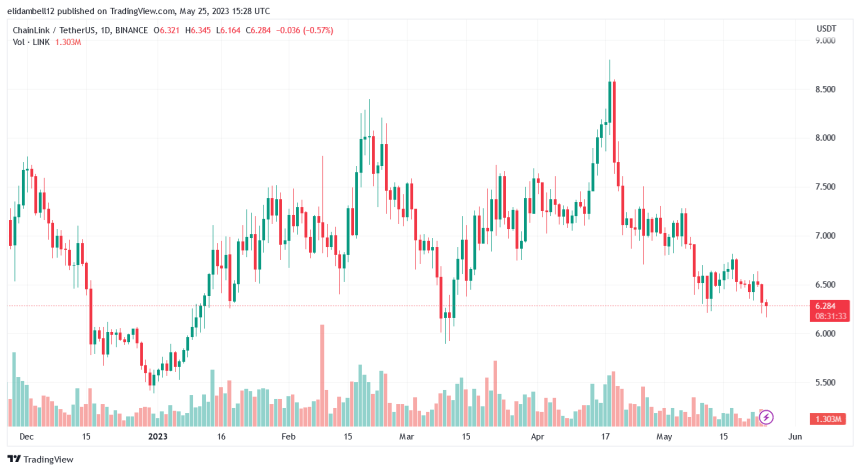

The bullish momentum in Chainlink (LINK), which spiked the asset to $6.75 on May 18, 2023, ended on May 19. From May 19 till date, LINK recorded a bearish pressure as the price gradually decreased each day till May 24, when it closed at $6.33.

Currently, on May 25, 2023, Chainlink’s price stands at $6.30 on CoinMarketCap, indicating a further decline over the past 24 hours.

LINK Bears Dominate Market With Strong Momentum

LINK is a prominent cryptocurrency that bridges the gap between smart contracts and real-world data. The native token of Chainlink, LINK, has exhibited negative performance within the last day’s trading session. Notably, the asset has been on a downtrend in the last seven days resulting in a loss of 6.25%.

These losses suggest sellers pressure buyers beyond their capacity to hold the price, leading to downward pressure on LINK’s price. Investor’s market confidence was reduced, resulting in a steady price decline over the last seven-day trading session.

Based on social sentiment indicators, CFG, Chainlink (LINK) displays a general negative sentiment with a reading of 17.5%. This implies negative social media conversations or a lack of enthusiasm among investors toward LINK.

Bearish Trendline Pattern

LINK has been on a bearish trendline chart pattern since April 18 till date, resulting in a constant price decline within the context of the downward trend.

This pattern is characterized by a series of lower highs and lower lows, indicating sustained selling pressure and a lack of bullish momentum. Traders and investors may interpret this pattern as a signal to anticipate further price declines and consider strategies that align with a bearish market outlook.

Due to increased selling pressure, LINK has broken through the first primary support level of $6.2 and is heading to the next support level of $5.9. With the current bearish momentum, the asset may soon hit this support in the short term.

LINK Technical Analysis Using Indicators

LINK’s trading chart for May 25 shows that the asset’s market trend is bearish. The asset trades below the 200-Day And 50-Day Simple Moving Averages (SMA), suggesting a bearish market sentiment.

This indicates that LINK will experience a bearish momentum both in the long and short-term trends. Investors may see this as an opportunity to take profits, which will cause a further price decline.

The Relative Strength Index (RSI) of LINK currently stands at 37.73, indicating a neutral market. However, the trend line is moving downwards, suggesting an increase in bearish momentum. It is worth noting that an RSI below 30 signifies strong selling pressure, indicating that bears control the market, whereas a level beyond 70 suggests bulls dominate.

Lastly, the Moving Average Convergence/Divergence (MACD) trading below the signal line confirms the bearish moves present in the market. This indicator suggests a high bearish momentum in the market, just like the RSI depicts.

Featured image from Pixabay and chart from Tradingview.com