Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

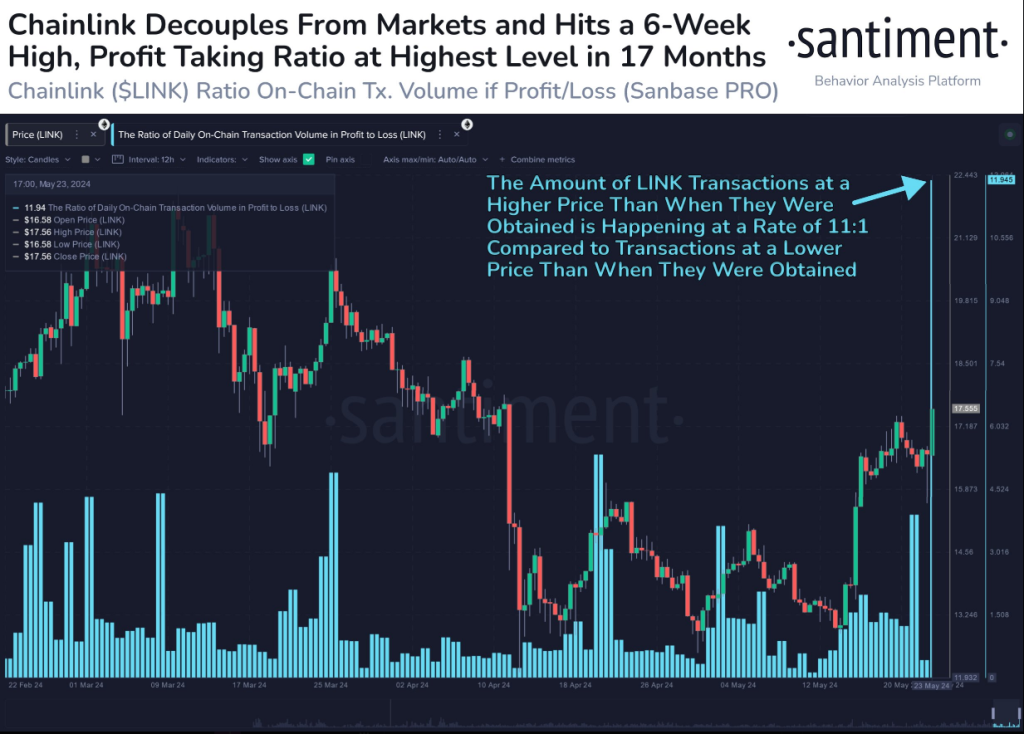

Rising steadily and surpassing a six-week high of $17.40, Chainlink (LINK), the oracle network driving distributed finance (DeFi), is seeing This spike coincides with a wave of hope driven by the approval of an Ethereum exchange-traded fund (ETF) and conjecture on a possible Chainlink ETF.

Transactions And DeFi Dominance Fuel Rally

With record 11 lucrative transactions for every one at a loss, on-chain data shows LINK to be in a strong purchasing mood. This increase in profitability comes together with the favourable response of the market to the Ethereum ETF. This clearance, according to analysts, points to an increasing institutional interest in cryptocurrencies, so opening the path for analogous vehicles targeted on certain initiatives like Chainlink.

🔗📈 #Chainlink has climbed well ahead of the #crypto pack, quickly surpassing $17.50 for the first time in 6 weeks. #Onchain today, there are 11 transactions in profit for every 1 $LINK transaction at a loss. This is the highest ratio since Dec. 8, 2022. https://t.co/nILlWsXWNh pic.twitter.com/joMV55V5x7

— Santiment (@santimentfeed) May 24, 2024

Tomi Point, a renowned crypto analyst, took to social media to express his belief that Chainlink could be the next beneficiary of the ETF boom.

Chainlink is a top candidate for an ETF since it closes the distance between DeFi and conventional finance. Key in increasing Chainlink’s institutional attractiveness is its strong DeFi ecosystem, which features dependable data connections to more than 20 blockchains.

Technicals Flash Green

The general attitude of the present market about Chainlink is quite positive. Though the dread & Greed Index stays in “extreme fear” area, most technical indicators show a consistent advance. Most technical analysis techniques verified as of May 24, 2024, a favourable future for LINK.

Many analysts have responded with optimistic pricing forecasts. Digitcoinprice forecasts LINK to rise to $37.35 by the end of May, a startling 117% increase. LINK’s outstanding success in the past month, with a price increase of nearly 16%, adds to the general hopeful view.

Chainlink Whales Pour In $16 Million More

The positive swings in whale activity on Chainlink this week also provide another crucial indication of the popularity among investors of LINK and other Ethereum-hosted cryptocurrency ventures.

The positive swings in whale activity on Chainlink this week also provide another crucial indication of the popularity among investors of LINK and other Ethereum-hosted cryptocurrency ventures.

Changes in the LINK token balances maintained by the top 100 largest wallets are shown on the Santiment chart above in real time.