Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Celsius Networks, currently undergoing bankruptcy proceedings, has engaged in significant Ethereum transactions that are causing ripples within the digital currency landscape.

In the past 10 hours, on-chain analysts at LookonChain detected noteworthy transfers, including a 13,000 ETH deposit ($30 million) on Coinbase and an additional 2,200 ETH ($5 million) on FalconX. These transactions suggest a proactive stance by Celsius in addressing its ongoing financial challenges.

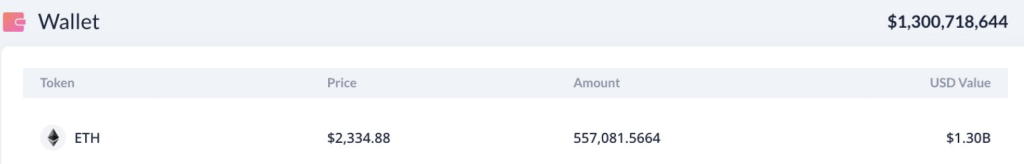

Celsius Sells $125M ETH, Maintains $1.3B Reserve

According to Arkham Intelligence, Celsius sold more than $125 million worth of Ethereum (ETH) coins between January 8 and January 12. The primary goal of this auction is to pay off creditors.

Dune Analytics also revealed a more widespread pattern of redemptions, with over $1.6 billion of staked Ethereum being redeemed during the same period. Since the Shanghai update last year, the amount of redemptions recorded is the highest.

The #Celsius wallet deposited 13K $ETH($30.34M) to #Coinbase and 2,200 $ETH($5.13M) to #FalconX again in the past 10 hours.

Currently, 2 staking wallets of #Celsius still hold 557,081 $ETH($1.3B).

Address:https://t.co/3gGOucC9gYhttps://t.co/zodN4gzVHKhttps://t.co/Jjt9fCN2Ej pic.twitter.com/E9DIZ9KDAH

— Lookonchain (@lookonchain) January 23, 2024

Despite facing financial constraints imposed by the court, Celsius still holds a substantial Ethereum reserve. This reserve amounts to over 557,000 coins in two staking wallets, with a total valuation of approximately $1.3 billion. The size of this reserve adds a layer of complexity to Celsius’ current financial situation and underscores the evolving narrative within the crypto space.

Source: LookOnChain

As part of its obligations to creditors, Celsius has been actively liquidating its Ethereum holdings. These auctions, aimed at paying off outstanding debts, are integral to Celsius’ bankruptcy proceedings.

Source: LookOnChain

The market has responded to these Ethereum transactions, resulting in a 4% decline in the price of ETH. The cryptocurrency slipped below the $2,350 mark, raising concerns among analysts, especially as ETH now wavers below its crucial demand zone ranging from $2,380 to $2,461.

Analysts predict that a failure to maintain this level could lead to a potential retreat towards the $2,000 mark.

Ethereum currently trading at $2,307.2 on the daily chart: TradingView.com

Wealthy Investors Trigger Ethereum Profit-Taking

Santiment’s historical data reveals that significant transactions by wealthy investors, commonly known as whales, often trigger profit-taking activities among regular ETH holders. This phenomenon intensifies selling pressure and contributes to price declines.

Meanwhile, decreasing funding rates suggest an underlying optimism in the market, hinting at a possible cooldown in previously overheated perpetual markets. This situation leaves room for ETH to rebound once the selling pressure subsides.

As the bankruptcy drama of Celsius unfolds, the scrutiny on its Ethereum transactions and the resulting market dynamics will persist. Investors and observers are closely monitoring the situation, eagerly awaiting further developments and anticipating the broader implications for both Celsius and the crypto ecosystem.

Featured image from Shutterstock