Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

For longer than other altcoins, the Cardano (ADA) price was stuck in a deep bear trend. However, recent data shows that bullish sentiment is returning. But, the ADA price is facing one last key challenge to start a major rally.

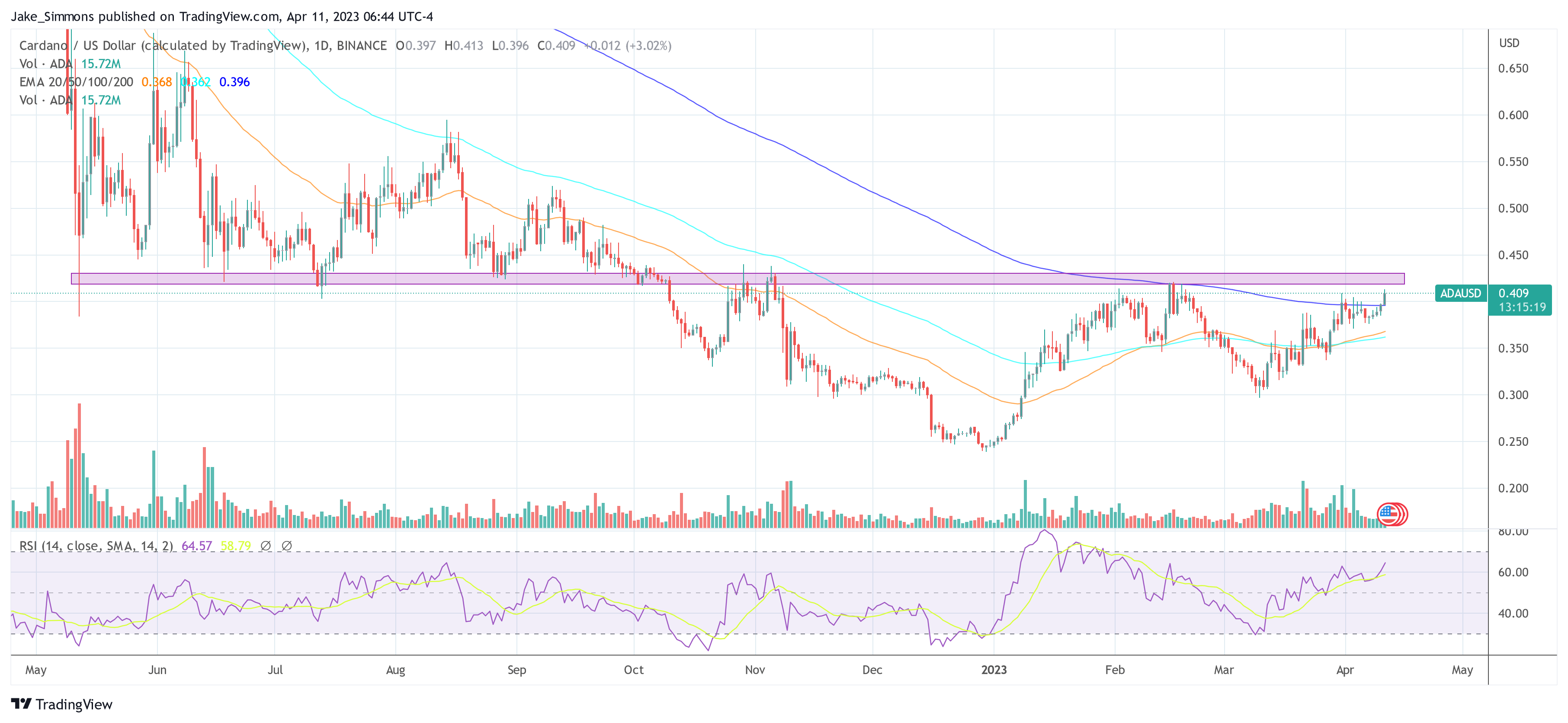

A look at the 1-day chart of ADA reveals that the price managed to break the 200-day exponential moving average (EMA) at $0.396 to the upside today. The 200 day EMA is traditionally used to indicate the long-term trend and is considered a bear/bull boundary line.

At the time of writing, ADA was trading at $0.408, but is still facing probably its biggest challenge in recent weeks: the resistance area between $0.42 and $0.43. This zone served as the strongest support from May to October 2022.

Since the area was breached to the downside on October 11, 2022, ADA price has failed to close above this area on the 1-day chart. Several attempts in October 2022 and February 2023 failed. A recapture of this price level would be of major importance and could trigger a rally towards $0.60.

Cardano (ADA) Fundamentals Look Impressive

The fundamentals confirm the bullish trend for Cardano. Analyst Ali Martinez reported in a tweet yesterday that ADA whales are on a shopping spree. In the last 2 weeks, they have purchased 560 million ADA tokens worth $218.4 million.

This suggests that ADA has become more attractive to larger investors again after the price started showing signs of recovery. A notable success has also been pointed out by ADA community member Darren.

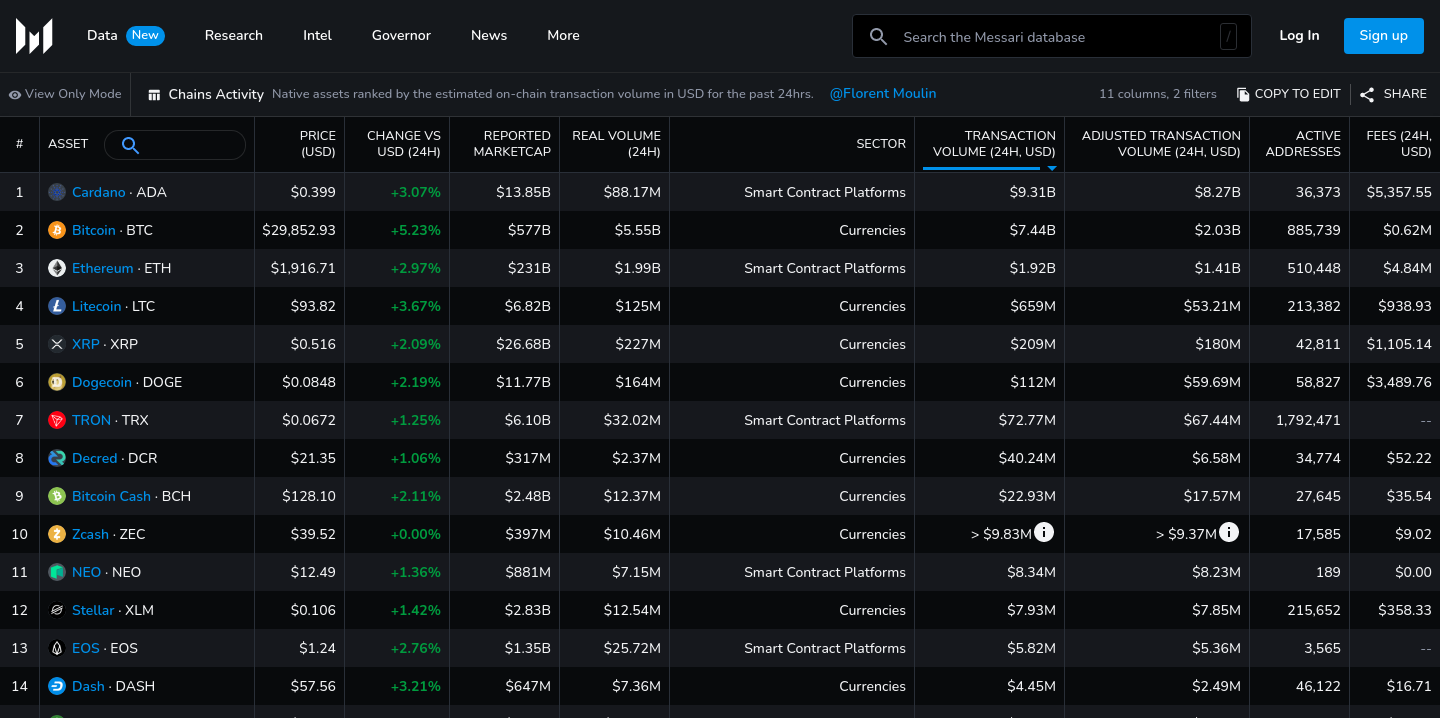

According to Messari’s data, Cardano has the highest transaction volume of any blockchain in the last 24 hours, ahead of Bitcoin and Ethereum. The volume was $10.82 billion. In the same period, Bitcoin had a transaction volume of $6.8 billion and Ethereum of $1.86 billion.

However, there is a twist to the stats. According to Messari, only 51,215 addresses were responsible for this volume, while Bitcoin (936,122 addresses) and Ethereum (518,857 addresses) had much higher user numbers. One putative reason could be whale transactions, as Martinez also acknowledged.

This would also go along with the news from Grayscale. The company announced last week that it had expanded its ADA stake in the Smart Contract Platform Ex-Ethereum Fund (GSCPxE).

As of April 5, 2023, the GSCPxE’s fund holdings consisted of a basket of six digital assets, with Cardano taking the largest share at 28.13%. It was followed by Polygon (21.30%), Solana (16.51%), Polkadot (15.38%), Avalanche (11.97%) and Cosmos (6.71%).

At EOD on April 5, 2023, the Fund Components of GSCPxE were a basket of the following assets and weightings:

Cardano $ADA, 28.13%

Polygon $MATIC, 21.30%

Solana $SOL, 16.51%

Polkadot $DOT, 15.38%

Avalanche $AVAX, 11.97%

Cosmos $ATOM, 6.71%Learn more: https://t.co/XcSylOAtaL pic.twitter.com/3wk7l5OlXc

— Grayscale (@Grayscale) April 6, 2023

Moreover, Cardano’s decentralized finance (defi) sector is also slowly gaining strength. According to data from DefiLlama, total value locked (TVL) increased by 47.5% last month. However, with a TVL of $151.98 million, Cardano remains only 18th in this ranking, led by Ethereum ($30.58 billion), Tron ($5.55 billion), and BSC ($5.1 billion).