Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The altcoins Cardano (ADA), Solana (Solana) and Polygon (MATIC) are facing a sell-off by Robinhood and Celsius. Remarkably, the US Securities and Exchange Commission (SEC) is responsible for the former, which named ADA, SOL and MATIC among others as securities in its lawsuits against Binance and Coinbase.

“Based on our latest review, we’ve decided to end support for Cardano (ADA), Polygon (MATIC), and Solana (SOL) on June 27th, 2023 at 6:59 PM ET,” Robinhood announced in a blog post two and a half weeks ago. “No other coins are affected and your crypto is still safe on Robinhood,” the post added.

That day has now come, meaning that Robinhood could liquidate the remaining altcoins as early as tomorrow. South Korean Twitter user @nay_gmy has researched how high the selling pressure on the tokens of Cardano, Solana and Polygon will turn out to be. In a Twitter thread, the researcher explains that the situations of Robinhood and Celsius are of different nature.

While Celsius has the flexibility to sell its digital assets after July 1 (the sale will likely take several months), Robinhood has set a deadline of June 27. After that, the coins will be “sold at market value” and the proceeds will be credited to users’ accounts.

The trading firm Jump, which manages the cryptocurrencies for Robinhood, must therefore liquidate any remaining holdings after 6:59 PM ET on June 27. According to the analyst, the good news is that a large number of users have responded to the announcement in the last two and a half weeks. Still, only about half of the altcoin holdings have been withdrawn by users.

A day before the deadline, according to the analyst, about $18 million in MATIC and about $26 million in SOL had yet to be withdrawn, so the amount will be converted automatically. On the Cardano (ADA) addresses, the analyst says, “I wasn’t able to locate the ADA wallets but ~$30m is a safe estimate,” adding, “Not too bad. These numbers are significantly lower than the estimates circulating on Twitter.”

The main question will be how Jump Trading will proceed. Options include selling OTC, putting it on its own books and hedging perps, depositing it with CEXes or a combination of all. Depending, Cardano, Solana and MATIC prices will be more or less affected.

Further Selling Pressure In July For Cardano, SOL And MATIC

As for Celsius, the analyst notes that the bankrupt crypto lending company has only $2.5 million left in SOL, but also around $26 million in ADA and around $60 million in MATIC, according to their filings from the end of April. However, the analyst was only able to locate $14m of this. Regarding other altcoins, he writes: “There are other coins in the Celsius portfolio that could be more interesting for shorts.”

The big question is whether the market has already priced in the sell-off. “Certainly to some extent,” says Nay, who further elaborates that ADA, SOL and MATIC have underperformed the market and their peers since the announcement of Robinhood’s delisting.

Celsius assets, meanwhile, have received little attention. Today, however, the key will be to watch what Jump does immediately after the deadline:

If coins don’t end up on CEXes, it is likely we’ll see a rally. $SOL seems to be the cleanest play as there is no overhead from Celsius.

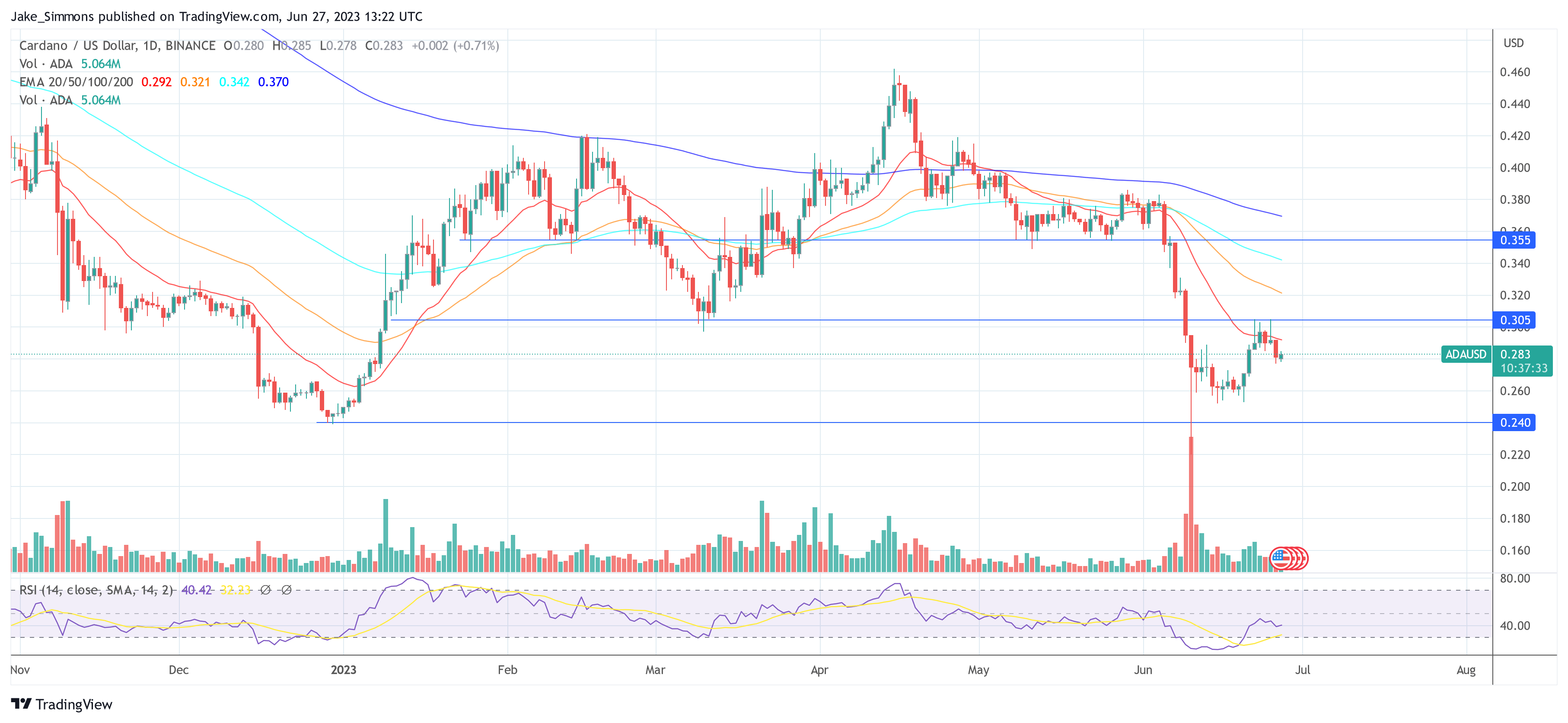

At press time, the Cardano (ADA) price was at $0.283, struggling to recapture the next resistance level at $0.30.