Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Various clichés abound in the investing world. While many are gross oversimplifications of dynamic complexity in behavioral finance, some of them are timeless pieces of wisdom. Included in this latter half is the famous recommendation by Baron Rothschild to “buy when there is blood in the streets.”

This strategy is never cut-and-dry however. Calling bottoms can be a dangerous game—referred to among traders as trying to catch a falling knife.

Different metrics exist to quantify swings in market sentiment. Momentum indicators are one way to model this. The implications of momentum indicators are multifold.

- That both in terms of buying and selling trends, human behavior is hyperactive and tends to overshoot the mark in both directions (an expression of hive mind collectivity, and swarm behavior).

- The price of any asset tends to diverge over time, at least transiently, from these extreme market conditions.

- Counter-trend movement in price is known as a correction, or in fibonacci trading lingo, a “retracement.”

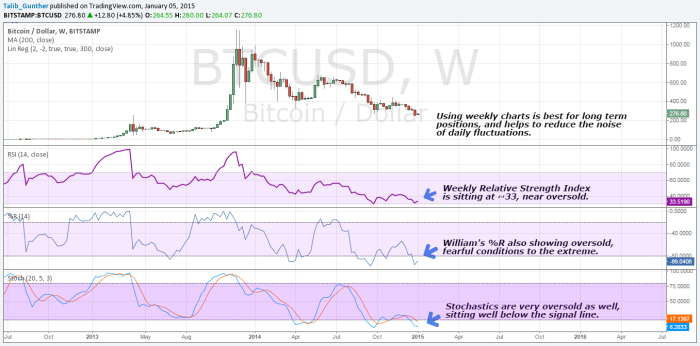

Using larger time frames in the technical analysis of these probable corrections tend to provide the best insight with the least risk for error. Three separate momentum indicators (Relative Strength Index, William’s %R, and Stochastics) currently confirm an increase in recent fear, and suggest an upswing is possibly coming soon to compensate.

Technical evidence of fear and blood (click for full size):

Chart by Brandon Chase

These insights are confirmed by all the negative chatter about bitcoin’s price drop and worries about its utility and fundamentals.

In the near future, it will be possible to data mine social media for changes in the frequency / density of such emotion-ladden keywords in real time. Certain software and scripts exist currently that attempt to model this sentiment to generate buy and sell points, but ultimately they fall short.

A quick look at last week’s news shows us where we’re at intuitively.

Evidence in the media of fear and blood:

Major bitcoin exchange suspended after price plunge (CNBC)

Bitcoin rebounds from 14-month low but remains below $300 (Nasdaq)

Bitcoin’s New Year’s price plunge (Pymnts)

There is an amusing site about this doomsday bandwagon effect, aptly named “Bitcoin Obituaries” – which observes, tongue-in-cheek, that bitcoin has died approximately 25 times. Of course, we have always had the last laugh.

Interpreting market sentiment is tricky business, and there are never any gaurentees. With that said, given the correlation between recent fearmongering in media outlets and a sharply declining price, bitcoin is flashing a buy signal for smart, long-term investors.

If historical performance is indicative of future performance (a presumption necessary for any investment) and bitcoin’s antifragility continues unabated, then this long bear market and sell-off is about to end as we see a significant rebound in price action over the coming months.

As Daniel Krawisz wrote so succinctly back in November: “Don’t Panic.”