Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

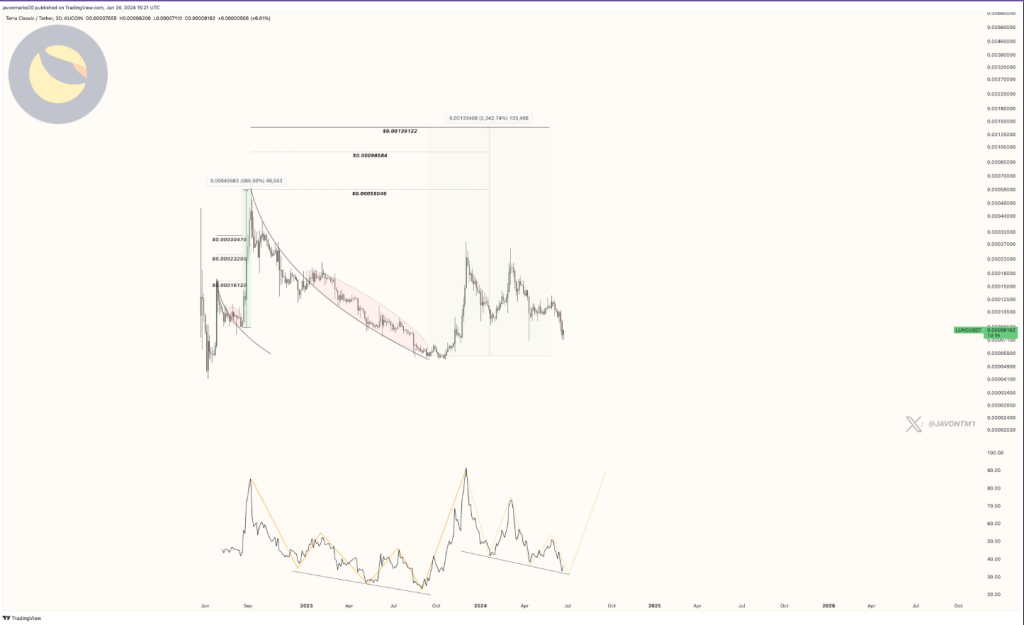

Once more drawing investor interest is Terra Classic (LUNC), the phoenix trying to emerge from the ashes of the tragic TerraUSD collapse. While well-known crypto expert Javon Marks throws a far more dramatic 1,500% leap into the ring, Coincodex analysts estimate a modest 10.7% price rise by July 25th. Is LUNC then ready for a bullish breakout, or is this yet another illusion in the erratic crypto desert?

A Token Reborn: LUNC Capitalizes On Market Volatility

Once the pillar of the collapsed TerraUSD (USTC) stablecoin ecosystem, LUNC has surprised us. LUNC has shown amazing durability as USTC lost her peg to the US dollar and sank into oblivion.

With an 82% price increase over the past 24 hours, the contentious coin shows ongoing investor curiosity. This resiliency is matched by a larger market trend whereby investors, cautious of conventional assets, are running to digital currencies thought to have great recovery potential.

Analyst Divided: Measured Optimism Vs. Moon Shot

Coincodex presents a wary but hopeful picture. Their estimate of a 10.7% increase points to LUNC perhaps climbing slowly and steadily. This fits the modest “Fear & Greed Index” that shows a wary market right now.

We remain here $LUNC (Terra Classic)’s first target at $0.00058046, implying a more than +594% upside from here to reach it in response to a long-standing breakout.

Trend-Wise, based on the previous breakout and climb, this level can be exceeded with heights of $0.00139122 being… https://t.co/rAbwsHIkqY pic.twitter.com/XOYdulvUc8

— JAVON⚡️MARKS (@JavonTM1) June 24, 2024

But analyst Javon Marks throws a wrench in the mix with a far more bold estimate. Aiming at a price of $0.00139122, Marks projects a possible 1,500% price increase. Based on historical data combined with recent price increases, LUNC is almost in a breakout phase, which shapes this optimistic view.

A Balancing Act Of Hype And Reality

Although Marks’s estimate is quite appealing, past patterns in the bitcoin market abound with failed “moon shot” forecasts. Long-term price forecasting is famously erratic in the crypto market because of its great volatility.

Technical indicators also currently point bearish, implying possible brief price declines. Investors should also take into account the continuous legal disputes around the Terra ecosystem, which can throw doubt on LUNC’s future.

Proposal 12116, which aimed to raise the validator set of the blockchain from 100 to 130, has been rejected by the Terra Luna Classic community meantime. This idea developed following a $4.5 billion settlement between US Securities and Exchange Commission member Terraform Labs founder Do Kwon. Incorporating Terra Luna v2 validators would help to improve the decentralisation of the network, hence maybe indicating a direction towards unity inside the Terra ecosystem.

Still, the plan lacked enough support in the voting on governance in the community. Important considerations in the choice were worries about including Luna v2 validators, the possible effects on network security and performance, and the wish to keep a unique identity for Terra Luna Classic.

Featured image from Pexels, chart from TradingView