Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

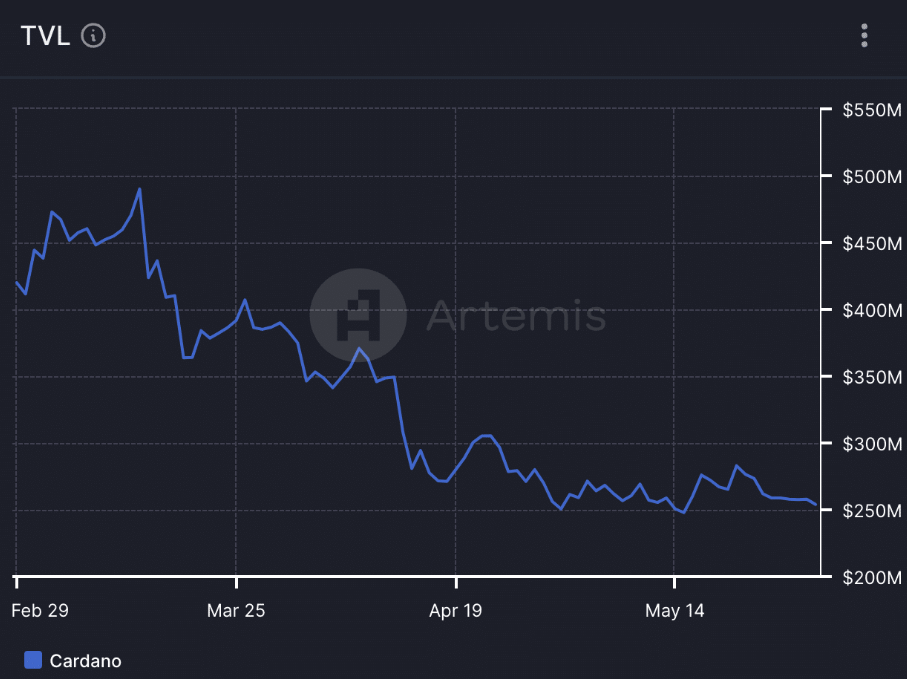

The smart contract platform Cardano (ADA) has lately been experiencing a difficult ride. Although DEX volumes have increased in the larger DeFi space, Cardano’s Total Value Locked (TVL) has dropped, casting questions over the state of its ecosystem.

DeFi Activity And NFT Market Slump

Data from Artemis, a top blockchain provider, shows that Cardano’s TVL has seen a notable dip from $430 million to $230 million despite the explosion in DEX volumes over the crypto scene. This implies a lack of interest in dApps developed on the Cardano network, therefore compromising its long-term development possibilities.

Additionally suffering is the NFT space on Cardano. Over the past month, floor pricing and general trading volume in well-known NFT collections have drastically dropped. This declining interest in Cardano NFTs could lower investor mood even more and affect the ADA price.

Cardano: Technical Indicators Flash Warning Signs

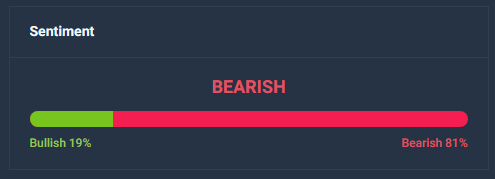

ADA’s technical picture is currently negative. Over the previous several weeks, the price has been drifting down, creating several low points and low highs. Important technical indicators include the RSI (Relative Strength Index) and CMF (Chaikin Money Flow) also show falling optimistic momentum and money flow into ADA.

Beyond the current pricing and DeFi problems, several elements cause questions regarding Cardano’s future. ADA’s velocity—which shows the frequency of token exchange—has dropped dramatically, implying less trading activity. Furthermore declining is the MVRV ratio, a gauge of profitability for token holders, suggesting that most ADA addresses are underwater right now.

Cardano Price Forecast

Even if Cardano is still a major participant in the blockchain scene, the latest developments show its difficulties. Declining price, decreasing DeFi and NFT activity, and unfavourable on-chain metrics point to a possible short-term additional downing potential.

Cardano’s price is likely to rise modestly; by June 30, 2024, it will be $0.47, a sign of over 5% increase. To evaluate the possible movement of the asset, meanwhile, one need take into account several technical indicators as well as market mood.

The negative attitude of the coin could have influence on technical analysis patterns, market trends, or news events. Furthermore displaying a Greed level among market players at 73 is the Fear & Greed Index. This suggests that investors could be more prone to take risks or engage in speculative activity, therefore affecting the price movement of Cardano.

ADA has especially undergone remarkable historical price movements. October 1, 2017 saw its lowest price of $0.017, indicating its all-time low; its highest price of $3.10 came on September 2, 2021. These historical pricing points highlight the volatility and opportunities for substantial price adjustments in the Cardano market.

Featured image from ReddSparks Crypto Blog, chart from TradingView